Headlines

- 1 Global Stock Market Crash and ¥510 Trillion Lost: Trump’s Tariff Policies Lead the Collapse of Economic Order

- 2 U.S. Job Growth Amid Economic Uncertainty, EU Rearmament, and Plummeting Investment to China – Unpredictable Global Affairs

- 3 Trans-Pacific Freight Rates Rebound! More Volatility Ahead from Trump’s Tariff Policies

- 4 Strategic Shift of the World’s Largest Container Leasing Company: The True Intent Behind the Partnership with Sumitomo Mitsui F&L

- 5 CIMC Group Reports 606% Surge in Net Profit: Container Manufacturing Leads the Way

- 6 New Container Information for March 2025

- 7 Behind the U.S.-China-Russia Power Game: A New Era for Japan’s National Defense

- 8 Reviving Japan Through Fundamental Reforms in English Education and the Political System

Global Stock Market Crash and ¥510 Trillion Lost: Trump’s Tariff Policies Lead the Collapse of Economic Order

On March 26, U.S. President Trump announced the implementation of an additional 25% tariff on automobiles imported from Japan. The new tariffs are set to take effect on April 3. The United States expects that this new measure will generate approximately $100 billion (about 15 trillion yen) in annual tariff revenue. Currently, passenger vehicles are subject to a 2.5% tariff, while trucks are taxed at 25%, meaning the new rates will rise to 27.5% and 50% respectively. In 2024, Japan’s automobile exports to the United States totaled approximately 6 trillion yen, accounting for 30% of Japan’s total exports to the U.S. It’s a matter of vital importance for Japan.

On March 26, U.S. President Trump announced the implementation of an additional 25% tariff on automobiles imported from Japan. The new tariffs are set to take effect on April 3. The United States expects that this new measure will generate approximately $100 billion (about 15 trillion yen) in annual tariff revenue. Currently, passenger vehicles are subject to a 2.5% tariff, while trucks are taxed at 25%, meaning the new rates will rise to 27.5% and 50% respectively. In 2024, Japan’s automobile exports to the United States totaled approximately 6 trillion yen, accounting for 30% of Japan’s total exports to the U.S. It’s a matter of vital importance for Japan.

On April 2, President Trump announced a global reciprocal tariff policy. A baseline 10% tariff will be imposed on all countries, with additional surcharges applied based on each country or region: Japan 24%, the EU 20%, the UK 10%, and China 34%. Since China is already subject to an additional 20% tariff, the total tariff on Chinese goods will reach 54%. These measures will take effect starting April 9. There is a potential for a retaliatory tariff battle between nations. However, individual negotiations to lower the rates still appear to be possible.

While the import tariffs are expected to significantly raise prices of goods coming into the U.S., the country’s trade deficit had already widened in January and February. This was driven by a last-minute surge in imports ahead of the tariff hikes announced by the Trump administration. Japanese automakers’ new vehicle sales in the U.S. from January to March 2025 rose 5% year-on-year to approximately 1.4978 million units, driven in particular by a surge in demand for hybrid vehicles (HVs). As a result, the U.S. trade deficit grew at an unprecedented rate, reaching $130.7 billion in January and $122.7 billion in February.

The global stock market downturn triggered by President Trump’s reciprocal tariff policy shows no signs of abating. On April 3, the Dow Jones Industrial Average fell by $1,679, followed by a further drop of $2,231 on April 4, closing at $38,314. This marked the third-largest single-day drop in history. It is estimated that the total market capitalization of listed companies in Japan, the U.S., and Europe decreased by approximately $3.5 trillion (around 510 trillion yen) on April 3 alone. The so-called “Trump Recession” is becoming a reality. As the trade war intensifies, participants in the U.S. market have begun to shift toward risk aversion. The high-tariff policy, originally aimed at attracting investment into the United States, is instead causing capital to flow out of U.S. stocks.

On April 4, the U.S. crude oil benchmark WTI futures temporarily fell to $60.45 per barrel, a 10% drop from the previous day. This represents the lowest price level in four years, not seen, since April 2021 during the COVID-19 pandemic. Concerns over a slowdown in the global economy due to the U.S.-China trade war have led to expectations of reduced oil demand, putting downward pressure on prices.

The Japan External Trade Organization (JETRO) estimates that the combined impact of automobile tariffs and reciprocal tariffs could lower global GDP by 0.6%. The International Monetary Fund (IMF) forecasts global GDP to reach $127 trillion by 2027, suggesting that $760 billion (approximately 114 trillion yen) could be lost as a result. These latest measures mark the collapse of the free trade framework the United States had supported since the end of World War II, marking a major turning point in the global economic order.

U.S. Job Growth Amid Economic Uncertainty, EU Rearmament, and Plummeting Investment to China – Unpredictable Global Affairs

According to the U.S. Department of Labor’s employment report released on April 4, the number of non-farm payrolls increased by 228,000 in March compared to the previous month. The unemployment rate rose slightly to 4.2%, up 0.1% from February’s 4.1%. Average hourly wages increased by 0.3% from the previous month and by 3.8% year-on-year. The non-manufacturing business activity index for March dropped to 50.8, down from 53.5 in February. With declining consumer purchasing power due to tariffs and growing uncertainty about the economic outlook, many companies are holding back on hiring.

According to the U.S. Department of Labor’s employment report released on April 4, the number of non-farm payrolls increased by 228,000 in March compared to the previous month. The unemployment rate rose slightly to 4.2%, up 0.1% from February’s 4.1%. Average hourly wages increased by 0.3% from the previous month and by 3.8% year-on-year. The non-manufacturing business activity index for March dropped to 50.8, down from 53.5 in February. With declining consumer purchasing power due to tariffs and growing uncertainty about the economic outlook, many companies are holding back on hiring.

In response to President Trump’s passive stance on European defense and his conciliatory approach toward the Putin-led Russian regime, the European Union (EU) agreed on March 6 to invest approximately EUR800 billion (around 130 trillion yen) in rearmament. On March 18, Germany moved to amend its constitution to increase defense spending and introduced provisions to support countries under attack in violation of international law. Additionally, the EU is advising citizens of member states to stockpile at least three days’ worth of essential goods such as food and water. The EU is taking a firm stance on self-defense in opposition to President Putin’s anachronistic ambitions of restoring Soviet-era territories and maintaining his authoritarian regime.

Meanwhile, the Chinese government is working to curb the trend of foreign companies withdrawing from China. According to the State Administration of Foreign Exchange of China, direct investment inflows into China in 2024 recorded a surplus of $18.6 billion (about 2.8 trillion yen). However, this represents a 95% decline from the peak in 2021 and more than a 60% decrease compared to 2023. Contributing factors include intensifying competition with Chinese firms, an economic slowdown caused by the real estate bubble collapse, and uncertainty surrounding the revised Anti-Espionage Law implemented in July 2023. The law’s ambiguity is expected to hinder free economic activity in China. Unless the Chinese government clearly defines the scope and interpretation of the Anti-Espionage Law, it is inevitable that foreign investment will continue to dwindle. How the Chinese government can once again attract foreign capital into domestic investments will be the key to the country’s economic recovery.

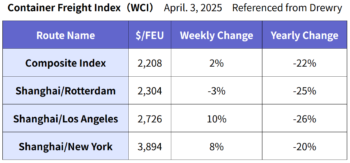

Trans-Pacific Freight Rates Rebound! More Volatility Ahead from Trump’s Tariff Policies

Spot rates on the Trans-Pacific route have begun to rise after several months of decline, due to a recent increase in blank sailings. However, following President Trump’s announcement of reciprocal tariffs, greater volatility in spot freight rates is expected going forward.

Strategic Shift of the World’s Largest Container Leasing Company: The True Intent Behind the Partnership with Sumitomo Mitsui F&L

Triton, the world’s largest container owner and operator with a fleet of 7 million TEU, announced on March 10 that it would acquire Global Container International (GCI), a company incorporated in Bermuda. Although GCI, established in 2018, owns only around 500,000 TEU—a relatively small fleet—the average age of its containers, approximately 4 to 5 years, may have made the acquisition price attractive.

Triton, the world’s largest container owner and operator with a fleet of 7 million TEU, announced on March 10 that it would acquire Global Container International (GCI), a company incorporated in Bermuda. Although GCI, established in 2018, owns only around 500,000 TEU—a relatively small fleet—the average age of its containers, approximately 4 to 5 years, may have made the acquisition price attractive.

Another noteworthy topic in the container leasing industry is that Sumitomo Mitsui Finance and Leasing (SMFL) has formed a joint venture with Triton’s parent company, Brookfield, a Canadian investment firm. The joint venture will manage 20% of Triton’s fleet, which equates to approximately 1.4 million TEU. In practice, Triton will likely continue operating the fleet, while the joint venture receives 20% of the profits generated from that share. SMFL aims to learn container leasing operations through this partnership, with the goal of eventually operating an independent container leasing company in the future.

However, looking at the current state of the container leasing market, there are some doubts as to whether a leasing company of Triton’s scale, operating 7.5 million TEU, can continue to maintain high profit margins without difficulty. That said, from the perspective of Brookfield, Triton’s parent company, the move to carve out 1.4 million TEU and downsize to 6 million TEU may be a strategy to reduce operational risk. Hopefully, SMFL will not end up drawing the short straw in this deal.

CIMC Group Reports 606% Surge in Net Profit: Container Manufacturing Leads the Way

CIMC Group, the world’s largest container manufacturer, announced its consolidated financial results for fiscal year 2024. Revenue rose 39% year-on-year to 177.7 billion RMB (approx. 3.554 trillion yen). Operating profit surged 131.4% to 7.65 billion RMB (approx. 153 billion yen), while net profit for the period skyrocketed 605.6% to 2.97 billion RMB (approx. 59.4 billion yen), marking significant growth in both revenue and profitability. In its container manufacturing business, sales of dry containers surged by 417% to 3,433,600 TEU, while reefer container sales rose by 49.8% to 138,600 TEU, both record highs. Container sales reached 62.2 billion RMB (approx. 1.244 trillion yen), accounting for 35% of total company revenue.

New Container Information for March 2025

In March, the price of newly built containers was $1,750 per 20ft unit, representing a 5.4% or $100 decrease from the previous month. The primary reason for the drop was the decline in flooring material prices. Compared to January’s price of $1,900, this represents a 7.9% or $150 decrease. Reports suggest that Chinese container manufacturers have begun to scale back their production lines. Depending on the order volume leading into the peak summer season, further price declines may continue.

In February, new container production totaled 535,105 TEU (Dry: 500,440 TEU, Reefer: 34,665 TEU). Factory inventory for newbuild containers reached 1,531,467 TEU (Dry: 1,467,632 TEU, Reefer: 63,835 TEU). Compared to the previous month, inventories increased by 95,379 TEU (Dry: 84,396 TEU, Reefer: 10,983 TEU), reflecting an overall rise of 6.6% (Dry: 6%, Reefer: 21%). Factory shipments totaled 439,726 TEU (Dry: 416,044 TEU, Reefer: 23,682 TEU), indicating that rush orders and pre-tariff shipments continued into March. Despite this, inventories still grew by 95,379 TEU compared to the previous month.

Behind the U.S.-China-Russia Power Game: A New Era for Japan’s National Defense

President Putin’s Russia, now effectively a despotic state, continues to justify its forcible occupation of Ukrainian territory by citing the presence of many ethnic Russians living there and Soviet-era territorial. Its ambitions appear to include securing rare mineral resources and further territorial expansion. Similarly, the communist state of China has drawn its so-called “Nine-Dash Line” to claim territorial rights over the South China Sea based on historical control, asserting ownership over islands and surrounding continental shelves. It has constructed artificial islands to solidify de facto control. These moves are widely seen as part of efforts to secure rich fishing grounds, undersea oil and gas resources, and strategic maritime routes.

Amid these global developments, President Trump—while advocating for democracy— appears to overlook the waning influence of the United States, instead accusing other nations of rising in power only because of past U.S. support. “If you want to do business with the U.S., invest in us! Otherwise, pay outrageous import tariffs!” This approach resembles a schoolyard bully unilaterally picking fights. Hasn’t the United States, once the object of admiration after World War II, enjoyed the greatest prosperity of all? Now, the very country that established the rules and benefited the most appears to be overturning the system it once led. It’s inevitable that such behavior will lead to a loss of trust and increasing international isolation.

Reviving Japan Through Fundamental Reforms in English Education and the Political System

Given these circumstances, it has become clear that the U.S. may not defend Japan in times of crisis. Humans are stupid. Already it seems we’ve forgotten the horrors and inhumanity of war just 85 years ago. World War II in the Pacific, which ended with the U.S. firebombing major Japanese cities including Tokyo and dropping atomic bombs on Hiroshima and Nagasaki, resulted in the deaths of millions, including those from Japan’s own invasion of China and Asian countries. War must never happen again, but history has proven that we must defend our own country by ourselves.

Given these circumstances, it has become clear that the U.S. may not defend Japan in times of crisis. Humans are stupid. Already it seems we’ve forgotten the horrors and inhumanity of war just 85 years ago. World War II in the Pacific, which ended with the U.S. firebombing major Japanese cities including Tokyo and dropping atomic bombs on Hiroshima and Nagasaki, resulted in the deaths of millions, including those from Japan’s own invasion of China and Asian countries. War must never happen again, but history has proven that we must defend our own country by ourselves.

Japan’s current state is, frankly, disappointing. Once a nation that rose to become the world’s second-largest economy through remarkable postwar recovery, Japan has become complacent, relying on its past glories and legacy, clinging to vested interests, and losing the will to drive meaningful change.

First and foremost, Japan must reform its approach to English education. The current system, which focuses heavily on reading and writing, must be urgently shifted toward listening and speaking. English is essential for communication with people overseas. The sheer amount of energy we spend on reading and writing English in junior high and high school is immense. Yet, many students lose confidence in their English abilities—particularly in reading and writing—and as a result, may lose interest in their overall studies. English, as currently taught, is of little practical use in the Japanese business world after graduation. The reality is that most people are unable to make practical use of it. So why do we continue to emphasize reading and writing when it has so little utility? If we start with listening and speaking skills from elementary school, more children may become motivated not only to study languages but also to engage with their broader education. When children learn spoken English at an early age, it stays with them for life. Reading and writing can be taught later and still be learned in time. This shift in focus would surely improve productivity among Japanese people.

The decision by the Liberal Democratic Party, Komeito, and Nippon Ishin no Kai to eliminate tuition fees, without any income restrictions, has led to a political commitment to spend 400 billion yen annually, including for private high schools. Months of precious time of the members of Parliament have been spent making this decision. I think something is wrong. Wouldn’t it be more beneficial to invest that 400 billion yen into listening and speaking-based English education in elementary and junior high schools? Such a move would better support the growth of the next generation of young people who will bear the future of Japan. Learning through web conferencing and internet-based platforms could also reduce the burden on teachers. This is an ideal method of education for the internet generation. It would likely reduce the number of students who give up study and empower young people who step confidently into the global arena, where they can interact and compete with foreigners on equal footing.

What Japan needs moving forward is to cultivate individuals with such capabilities. Japanese people and companies must stop thinking solely within the narrow confines of our island nation. It is essential to adopt a global perspective seeing Japan as a part of the world, not apart from it. We must avoid falling into a “Galápagos syndrome” of isolation and irrelevance.

To compete with global leaders, Japan must produce leaders who possess the qualities to engage at the world stage. Unfortunately, under the current political system, even the most talented individuals often have their abilities stifled, and their uniqueness is lost. Politics has become merely another career path, which is a deeply troubling development. Much like the saying that the third generation of a family business often drives it into the ground, Japan’s political system which built on inherited electoral bases, name recognition, and financial backing, needs to be dismantled. We must build a system that nurtures genuine statesmen and leaders.

The world is watching, expecting Japan to change. How will Japan’s political, bureaucratic, and business sectors respond? We must break free from vested interests and continuously strive for innovation and growth, developing talent and organizations capable of competing on a global scale. Judging by the current global situation, we may not have much time left. It is also up to us to take elections seriously and clearly express our will.