Headlines

- 1 The Reality Behind “America First”: President Trump’s Wavering Between Supporters’ Expectations and International Dynamics

- 2 FRB and Trump’s Policies: Four Key Factors Chairman Powell Considers in Decision-Making

- 3 The Background of the EU’s €1.3 Trillion Military Rearmament and ECB Rate Cut

- 4 China’s ¥24 Trillion Fiscal Stimulus: Private Enterprises Holding the Key to Economic Recovery

- 5 The Pitfalls of Forward Imports: NRF Forecasts Indicate an Inflationary Chain Reaction

- 6 A Power Map after the Realignment of Shipping Alliances, the Freight Rate Competition to be Followed

- 7 ONE’s Rapid Expansion: Achieving “A” Rating and the Full Picture of Its 3 Million TEU Strategy

- 8 Container Freight Rates Down 75% from COVID Peak, Up 85% from Pre-COVID Levels

- 9 Issues Post-Suez Reopening: Leasing Companies in Urgent Need to Sell Off Old Containers

- 10 New Container Information as of February 2025

- 11 Colby’s Demand for Increased Defense Spending: the Path to Japan’s Constitutional Reform

The Reality Behind “America First”: President Trump’s Wavering Between Supporters’ Expectations and International Dynamics

Every day, President Trump’s activities dominate newspaper headlines. His principles are essentially boiled down to two slogans: “America First!” and “Make America Great Again.” Any policy contradicting these principles is simply not part of his agenda. A clear example of this was the backlash from the American automotive industry, resulting in a one-month grace period imposed on March 5th for the 25% tariffs on imports from Mexico and Canada. Given Trump’s background as a businessman, he makes decisions on profit-loss calculations. Despite this, he is likely aware that tariffs lead to retaliatory tariffs, ultimately harming both American citizens and the U.S. economy.

Every day, President Trump’s activities dominate newspaper headlines. His principles are essentially boiled down to two slogans: “America First!” and “Make America Great Again.” Any policy contradicting these principles is simply not part of his agenda. A clear example of this was the backlash from the American automotive industry, resulting in a one-month grace period imposed on March 5th for the 25% tariffs on imports from Mexico and Canada. Given Trump’s background as a businessman, he makes decisions on profit-loss calculations. Despite this, he is likely aware that tariffs lead to retaliatory tariffs, ultimately harming both American citizens and the U.S. economy.

During the first term of the administration eight years ago, Prime Minister Abe and President Trump became well-acquainted, and it seems they built a good relationship due to their compatible personalities. There were even talks among European leaders that they should follow Abe’s ways to get along with President Trump.

On February 28th, when Trump met with President Zelensky of Ukraine in Washington, it is widely known that their discussion over Russian ceasefire negotiations escalated into an unprecedented dispute. Trump has never viewed his predecessor former Democratic President Biden favorably. In his second-term policy address on Match 4 to the joint session of Congress, Trump labeled Biden “the worst president in American history”. He also criticized Zelensky for securing $350 billion in U.S. military aid from Biden, seemingly holding a grudge over their close ties. As the Japanese proverb goes, ‘If you hate the priest, you’ll hate his robe too.’ I cannot help but feel sympathy for President Zelensky.

Afterwards, Trump froze U.S. aid to Ukraine, playing directly into Putin’s hands. Far from considering a ceasefire, Russia is now accelerating its territorial expansion. This situation underscores Putin’s strategic advantage over Trump. In this aspect, one could argue that Putin has out-maneuvered Trump. It’s critical that Trump avoids a “can’t see the forest for the trees” scenario. Given the significant expectations from his Republican supporters, especially those in poverty, the dissatisfaction stemming from tariff-induced high prices poses a threat to his administration’s stability.

FRB and Trump’s Policies: Four Key Factors Chairman Powell Considers in Decision-Making

The U.S. Department of Labor’s employment report for February, released on March 7th, showed a non-farm payroll increase by 150,000, slightly below market expectations. The unemployment rate edged up to 4.1% from 4.0% in January but remains historically low. Average wages increased by 0.3% month-over-month, suggesting a stable labor market despite potential slowdowns due to Trump’s tariff policies. Meanwhile, Federal Reserve Chairman Powell indicated in his March 8th speech that further rate cuts will be influenced by Trump’s major four policies in tariff & trade, immigration, fiscal policies, and regulations. Market watchers do not foresee a rate hike in the upcoming March 18th FOMC meeting.

The Background of the EU’s €1.3 Trillion Military Rearmament and ECB Rate Cut

On March 6th, President Trump’s declaration that the U.S. would not defend NATO members with insufficient defense spending pushed the EU to set aside up to €800 billion for defense enhancement and rearmament. Threats from outside the region, such as Russia, cannot be addressed without the involvement of the United States, that is why the EU has responded to President Trump’s request to increase defense spending. At the same time, this move is also aimed at protecting the EU independently. However, it is said that building a strong military force within the EU would take decades and require enormous funding.

On March 6th, President Trump’s declaration that the U.S. would not defend NATO members with insufficient defense spending pushed the EU to set aside up to €800 billion for defense enhancement and rearmament. Threats from outside the region, such as Russia, cannot be addressed without the involvement of the United States, that is why the EU has responded to President Trump’s request to increase defense spending. At the same time, this move is also aimed at protecting the EU independently. However, it is said that building a strong military force within the EU would take decades and require enormous funding.

This move has also led to a surge in government bond long-term rates due to expected economic growth from increased fiscal spending. In response, the ECB cut policy rates by 0.25% on March 6th, the fifth consecutive cut, aiming to strengthen the economy amid a moderate inflation outlook.

The latest real economic growth rate in the Eurozone is projected to be 0.9% for 2025 and 1.2% for 2026. The price outlook, reflecting high energy costs, is expected to be 2.3% for 2025 and 1.9% for 2026. The EU’s automobile industry accounts for 1 trillion euros (approximately 160 trillion yen) in the region’s GDP and constitutes a key industry, representing one-third of the region’s research and development investments. To recover the EV demand, which slowed down by 6% year-on-year in 2024, the EU announced on March 5th policies to expand support and subsidies, ease regulations, and rescue the automobile industry.

China’s ¥24 Trillion Fiscal Stimulus: Private Enterprises Holding the Key to Economic Recovery

The National People’s Congress of China convened on March 5th in Beijing and set the target for real economic activity for 2025 at around 5% for the third consecutive year. Additionally, the general public budget expenditure was increased by 1.2 trillion yuan (approximately 24 trillion yen) compared to the previous year, bringing it close to 30 trillion yuan. However, given the current situation where the real estate slump has not yet been overcome and to prevent deflation, it is urgent to stimulate domestic demand. As a solution to this, the utilization of private enterprises is indispensable. The contribution of private companies, as seen with DeepSeek, exceeds expectations. For this reason, further fiscal stimulus is desired.

The Pitfalls of Forward Imports: NRF Forecasts Indicate an Inflationary Chain Reaction

The National Retail Federation (NRF) announced the handling performance and the latest forecast of retail-related import containers on February 7. Despite the impact of President Trump’s additional tariffs and retaliatory tariffs from various countries, the forecast shows that retail import volumes will remain at high levels, exceeding 2 million TEU in a single month this year. The projected figures are 2.11 million TEU for January, 1.96 million TEU for February, 2.14 million TEU for March, 2.18 million TEU for April, 2.19 million TEU for May, and 2.13 million TEU for June.

However, forward and advance imports by retail companies to mitigate the impact of additional tariffs are causing inventory space shortages and increased handling costs, which lead to rising prices. President Trump’s additional tariffs could disrupt the supply chain diversification, causing confusion. Price increases may result in reduced consumer spending in the United States, potentially leading to an economic slowdown. Furthermore, a decrease in U.S. import cargo is inevitable and could significantly impact the global economy.

A Power Map after the Realignment of Shipping Alliances, the Freight Rate Competition to be Followed

As of February 1st, shipping alliances have undergone a realignment, with notable changes observed by the Danish maritime research firm Sea-Intelligence. On the North American routes, although the Ocean Alliance has slightly decreased its share, it still maintains the largest share (35%). Premier Alliance, led by ONE, has maintained the same market share even after Hapag Lloyd left. Meanwhile, the Gemini Cooperation, composed of Maersk and Hapag Lloyd, has the smallest share.

On the other hand, MSC, who provides services independently without joining to any Alliances, collaborates with Premier Alliance on the Northern Europe and Middle East routes and with ZIM on the U.S. East Coast and North Pacific North America routes. As a result, MSC is able to offer more weekly services on these four main routes than Maersk Line and Hapag Lloyd, which constitute Gemini, thus gaining a larger market share. However, it is anticipated that as each shipping company adapts to the new environment, competitive pressure could lead to a potential decline in freight rates.

ONE’s Rapid Expansion: Achieving “A” Rating and the Full Picture of Its 3 Million TEU Strategy

Ocean Network Express (ONE) was assigned an issuer credit rating of ‘A’ with a stable outlook by Rating and Investment Information, Inc. (R&I) on February 12th. As of the end of March 2024, ONE’s net assets are expected to exceed $20 billion, and with a high net asset ratio of around 70%, its robust financial foundation with virtually no debt is a key factor for the ‘A’ rating.

Ocean Network Express (ONE) was assigned an issuer credit rating of ‘A’ with a stable outlook by Rating and Investment Information, Inc. (R&I) on February 12th. As of the end of March 2024, ONE’s net assets are expected to exceed $20 billion, and with a high net asset ratio of around 70%, its robust financial foundation with virtually no debt is a key factor for the ‘A’ rating.

As of February 1st, ONE’s container fleet consists of 256 vessels, totaling 1,971,680 TEU. According to ONE’s mid- to long-term strategy ‘ONE2030,’ the company plans to invest over $25 billion in its container business to expand its operation scale to 3 million TEU and aims to achieve a profit of $3.8 billion by 2030. As of the end of January this year, ONE forecasts a net profit of $4.34 billion for the fiscal year ending March 2025.

On February 14th, ONE named a new 13,800 TEU container ship built at HD Hyundai Heavy Industries’ Ulsan Shipyard as ‘ONE SPARKLE.’ ONE plans to commission 20 of these vessels, all of which will be completed by 2026. The ship is equipped with 2,550 reefer plugs and an exhaust gas cleaning system (scrubber). It is also designed to be compatible with methanol and ammonia fuel in the future, contributing to reduced environmental impact.

As of February 2025, ONE’s intra-Europe service fleet consists of 686 vessels with a total capacity of approximately 1.19 million TEU and an average vessel size of 1,773 TEU. This represents a 3.9% increase compared to the same month of the previous year and has expanded its market ranking to ninth place in intra-Europe services. Additionally, ONE is focusing on inter-regional services.

Container Freight Rates Down 75% from COVID Peak, Up 85% from Pre-COVID Levels

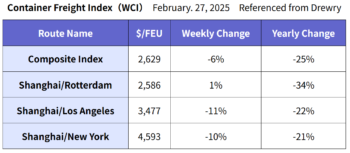

The composite index is down 75% from its peak in September 2021 amid the pandemic but up 85% from the pre-pandemic average of 2019. The average index year-to-date is $3,372/FEU, $489 above the past decade’s average. Freight rates are expected to decline further with an increase in shipping capacity. According to the Cancelled Sailings Tracker published on February 28, the overall cancellation rate from March 3 to April 6 is anticipated at 6% across major East-West trades.

Issues Post-Suez Reopening: Leasing Companies in Urgent Need to Sell Off Old Containers

Container leasing companies are currently holding off on purchasing new containers due to uncertainties surrounding President Trump’s tariff issues. In January and February 2025, container leasing companies’ orders for new containers accounted for 24% of the total, which is half of the 50% ordered by shipping companies. If the safety of the Suez Canal is confirmed and operations resume, a substantial number of surplus containers from shipping companies is expected to return to leasing firms. To address this issue, it is important to quickly sell off old containers to remain agile.

Container leasing companies are currently holding off on purchasing new containers due to uncertainties surrounding President Trump’s tariff issues. In January and February 2025, container leasing companies’ orders for new containers accounted for 24% of the total, which is half of the 50% ordered by shipping companies. If the safety of the Suez Canal is confirmed and operations resume, a substantial number of surplus containers from shipping companies is expected to return to leasing firms. To address this issue, it is important to quickly sell off old containers to remain agile.

New Container Information as of February 2025

The price of new containers in February was $1,850 per 20ft, a $50 decrease (-2.6%) from the previous month. This decline was driven by the drop in steel and lumber prices in January, as well as lower paint costs. The total production volume of new containers in February was 363,623 TEU (Dry: 334,906 TEU, Reefer: 28,717 TEU). The remaining inventory at container factories decreased by 216,206 TEU compared to the previous month (Dry: -215,929 TEU, Reefer: -277 TEU). On a month-over-month basis, this represents a 37% decline in total inventory (Dry: -39%, Reefer: -1%).

Factory shipments in February totaled 337,976 TEU (Dry: 408,471 TEU, Reefer: 29,505 TEU). The decline in new container production reflects a drop in demand following the Lunar New Year holiday. On the other hand, as shipments exceeded 300,000 TEU, the remaining factory inventory also decreased by nearly 5%.

Colby’s Demand for Increased Defense Spending: the Path to Japan’s Constitutional Reform

Elbridge Colby, whom President Trump has nominated as the Pentagon’s No. 3 official for policy, is demanding that Japan increase its defense spending to over 3% of GDP. Just like Russia’s current invasion of Ukraine, where a stronger power is occupying a weaker nation by force, expanding its own territory at Ukraine’s expense, and attempting to justify its actions. Japan must not miss this opportunity. It should reform its Constitution, officially reorganize the Self-Defense Forces into a formal military, and strengthen its national defense.

No one will protect Japan but itself. Prime Minister Ishiba, isn’t now the time to etch your name into history? If this opportunity is lost, Japan as a nation may no longer exist in 50 years.