Headlines

- 1 Trump-Style Reform Tackles the Twin Deficits: A Strong Will and Sense of Mission Driving Global Change

- 2 A Strong America, a Struggling Europe, a Reviving China: Signs of Change in the Global Economy

- 3 U.S. East Coast Port Strike Avoided, Red Sea Issues Moving Toward Stabilization

- 4 The Largest Vessel Supply in Maritime History: Future Outlook Indicated by New Record

- 5 Sixfold Profit Forecast Highlights the Future: The Rise of Three Major Shipping Companies and ONE

- 6 A New Normal for the Shipping Market? Container Freight Rates Maintain 2.4 Times Pre-COVID Levels

- 7 Growing Concerns in the Container Leasing Industry: The Sound of a Return Rush Approaching

- 8 36.87 Million Inbound Tourists, 8 Trillion Yen in Spending: Transformation Awaits Japanese Companies, an Opportunity for Global Expansion

Trump-Style Reform Tackles the Twin Deficits: A Strong Will and Sense of Mission Driving Global Change

On Friday, February 7, Prime Minister Ishiba, during a joint press conference following his meeting with U.S. President Trump, expressed his candid impressions of President Trump: “On television, he seemed intimidating with a strong personality, but in reality, he is sincere, strong-willed, and has a strong sense of mission towards his own country and the entire world.” In return, President Trump described Prime Minister Ishiba as a “very strong man,” even outside of diplomatic formalities. It seems to have been a good start to their relationship.

On Friday, February 7, Prime Minister Ishiba, during a joint press conference following his meeting with U.S. President Trump, expressed his candid impressions of President Trump: “On television, he seemed intimidating with a strong personality, but in reality, he is sincere, strong-willed, and has a strong sense of mission towards his own country and the entire world.” In return, President Trump described Prime Minister Ishiba as a “very strong man,” even outside of diplomatic formalities. It seems to have been a good start to their relationship.

President Trump has replaced Japan Steel’s previously rejected acquisition of U.S. Steel, which had been denied by former President Biden, with an investment approach, leaving room for further negotiations on this difficult issue. Although there were some apprehensions regarding Prime Minister Ishiba’s diplomatic capabilities, he has successfully leveraged the relationship that former Prime Minister Abe built with President Trump to reaffirm the pursuit of a new golden era in U.S.-Japan relations.

Is President Trump the prodigy that the times demand?

At the very least, it’s a fact that the American people elected him as president, not once, but twice! “Canada as the 51st U.S. state?”, “Acquisition of Greenland!”, “Taking back the Panama Canal!”, and “Imposing tariffs on imports!” and so on. Watching his words and negotiation methods, I find him to be a very comprehensible person. Setting aside the pros and cons of each of his policies, he seems to have reasonable justifications behind them. He is a leader that is unprecedented in the context of traditional democratic nations. Perhaps this is a phenomenon caused by the gridlock in democratic politics – politics that struggle to make decisive decisions. We must respond calmly, assessing each issue on its merits and demerits.

Having inherited his father’s real estate business, experiencing both expansion and bankruptcy several times, he is now a businessman-turned-president determined to build a stronger America for its citizens. It seems like he is striving to accomplish something that only he can achieve, and aiming to make results within his four-year term.

As the slogan “Make America Great Again (MAGA)!” suggests, he is focused on eliminating the “twin deficits” of “fiscal deficit” and “trade deficit” to strengthen America once more. Notably, the U.S. fiscal deficit for FY2024 (October 2023 – September 2024) stands at $1.833 trillion (equivalent to JPY 274.95 trillion at an exchange rate of $1 = JPY 150), while the trade deficit is $1.2117 trillion (JPY 181.75 trillion). These are unimaginably large deficits. The trade tariffs are intended to address this issue. The proposed 25% tariff on imports from Mexico and Canada, originally set to take effect on February 4, has been postponed by one month.

To tackle the fiscal deficit, the U.S. government has established the Department of Government Efficiency (DOGE), appointing entrepreneur Elon Musk as its head. However, this is a temporary organization set to be dissolved by July 4, 2026. Musk is taking measures to significantly reduce government personnel to curb expenditures. As a result, it has been reported that tens of thousands of people have applied for retirement. When a new administration takes office, such as this shift from a Democratic to a Republican administration, thousands of government employees lose their positions, which are then filled by Republican-affiliated personnel, so there is no change in the number of employees. Since government agencies are accustomed to these transitions, they are expected to adapt to the DOGE reforms. Elon Musk is expected to utilize AI (artificial intelligence) to meet President Trump’s expectations. The whole world is closely watching this small-government initiative and experiment.

A Strong America, a Struggling Europe, a Reviving China: Signs of Change in the Global Economy

According to the employment statistics for January released by the U.S. Department of Labor on February 7th, the number of non-farm payroll increased by 143,000 from the previous month. The unemployment rate improved slightly to 4.0%, down 0.1% from the previous month. Average hourly earnings rose by 0.5% month-over-month and 4.1% year-over-year. However, the average duration of unemployment has extended from 21 weeks to approx. 24 weeks over the past six months, indicating that businesses are becoming more cautious about hiring and job-seeking is becoming more difficult. Nonetheless, the U.S. economy remains robust.

The Eurozone economy is gradually recovering. However, the manufacturing sector remains sluggish, due to high energy costs. In particular, Germany’s manufacturing industry is struggling with reduced exports to China, where domestic demand remains weak. On the other hand, the service sector is performing well. With inflation rate declining and consumer spending increasing, the ECB continues to lower interest rates to support economic growth.

China is gradually returning to normal life after the Lunar New Year holiday, which started on January 29th and ended on February 4th. During this period, a total of 9 billion people traveled domestically and internationally, according to the Global Times, the leading Chinese international newspaper, January 27 edition. Given this massive movement of people, an indication of China’s enormous energy, China’s economic recovery may only be a matter of time.

U.S. East Coast Port Strike Avoided, Red Sea Issues Moving Toward Stabilization

On January 8, the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) had reached a tentative agreement on a six-year master contract. This averted a large-scale strike at U.S. East Coast ports before January 15th, preventing potential logistical disruptions at the start of the year.

Following the ceasefire agreement between Israel and the Islamic organization Hamas, the armed group Houthi in Yemen has reduced their attacks on vessels, leading to a stabilization of the Red Sea situation. The resumption of navigation through the Suez Canal appears imminent, but shipping companies are expected to continue rerouting via the Cape of Good Hope until navigational safety is fully assured. However, with the launch of new shipping alliances in February, congestion is expected at major hub ports during this transition period.

The Largest Vessel Supply in Maritime History: Future Outlook Indicated by New Record

At the end of 2024, the global order backlog for container ships reached 8.3 million TEUs, surpassing the previous record of 7.8 million TEUs at the beginning of 2023. Despite record-high new vessel deliveries of 2.9 million TEUs in 2024, an additional 4.4 million TEUs were contracted during the same year. From 2025 to 2028, approximately 1.9 million TEUs are expected to be completed annually, peaking at 2.2 million TEUs in 2027.

Sixfold Profit Forecast Highlights the Future: The Rise of Three Major Shipping Companies and ONE

Ocean Network Express (ONE), jointly owned by NYK, MOL, and K Line, raised its profit forecast for the fiscal year ending March 2025 to $4,034 billion (approximately JPY 620 billion), up from the previously projected $3,095 billion (JPY 473.5 billion). As a result, the projected consolidated ordinary profits for the parent companies are expected to increase significantly: NYK by 84% increase YoY to JPY 480 billion, MOL by 58% increase YoY to JPY 410 billion, and K Line by 121% increase YoY to JPY 300 billion.

In this earnings forecast, the profit from container shipping – specifically from ONE – are expected to reach JPY 250.2 billion for NYK (5.5 times YoY increase), JPY 203.7 billion for MOL (6.8 times YoY increase), and JPY 193.8 billion for K Line (5.7 times YoY increase). ONE continues to contribute significantly to the profitability of its three-parent companies.

A New Normal for the Shipping Market? Container Freight Rates Maintain 2.4 Times Pre-COVID Levels

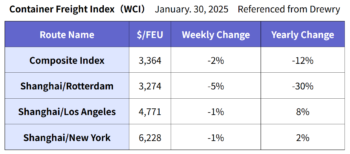

The composite index is 68% lower than its peak in September 2021 during the COVID-19 period. However, it remains approximately 2.4 times higher than the pre-COVID average in 2019. The year-to-date average composite index stands at $3,711/FEU, which is $835 higher than the average over the past 10 years. Drewry expects freight rates to decline slightly due to increased vessel capacity.

According to Drewry’s Cancelled Sailings Tracker, published on January 31, the overall cancelled sailing rate for East-West routes (Trans-Pacific, Trans-Atlantic, and Asia-Europe & Mediterranean routes) is projected to be 14% for Week 6 (February 3–9) through Week 10 (March 3–9).

Growing Concerns in the Container Leasing Industry: The Sound of a Return Rush Approaching

Container leasing companies are wary of the return of surplus containers with the resumption of navigation through the Suez Canal by shipping companies. It is anticipated that returns of leased containers from shipping companies will gradually increase from the second half of this year. This is expected to accelerate the global sales of over 10-year-old containers. At present, however, leasing companies are enjoying high utilization rates of 96–97%.

In January, the price of new containers was $1,900 per 20ft, decrease by $50 (-2.6%) from the previous month. This decline was primarily driven by falling steel and lumber prices.

The production volume of newly built containers in January was 579,829 TEUs (Dry: 550,835 TEUs, Reefer: 28,994 TEUs). Compared to the previous month, total production decreased by 312,616 TEUs (Dry: -312,499 TEUs, Reefer: -117 TEUs), representing a 35% decrease (Dry: -36%, Reefer: ±0%). Dry container production has decreased by nearly 40%, while Reefer container orders remained steady at around 30,000 TEUs per month.

36.87 Million Inbound Tourists, 8 Trillion Yen in Spending: Transformation Awaits Japanese Companies, an Opportunity for Global Expansion

Japanese people and companies are entering an era where they can no longer live or do business in isolation without interacting with foreigners, even if they do not leave Japan. I also believe that it is becoming impossible to avoid encountering foreigners in daily life. We should not be merely lamenting about the poor manners of foreigners due to overtourism. Instead, Japanese people and the government should take proactive measures to be appreciated by foreigners who experienced the virtues of orderly public conduct during the visit to Japan.

Japanese people and companies are entering an era where they can no longer live or do business in isolation without interacting with foreigners, even if they do not leave Japan. I also believe that it is becoming impossible to avoid encountering foreigners in daily life. We should not be merely lamenting about the poor manners of foreigners due to overtourism. Instead, Japanese people and the government should take proactive measures to be appreciated by foreigners who experienced the virtues of orderly public conduct during the visit to Japan.

In 2024, the number of inbound foreign tourists to Japan reached 36.87 million, with their spending hitting a record high of 8.1395 trillion yen. The number of repeat visitors to Japan is increasing. They know Japan even better than Japanese people and visit local regions beyond Tokyo, Kyoto, and Osaka, contributing to the revitalization of local areas. The Japanese government expects 60 million foreign visitors by 2030, aiming for their spending to reach 15 trillion yen.

I am confident that Japanese companies can greatly advance and succeed in their businesses by stopping inward-looking management that focuses only on the domestic market and instead reconsidering their approach from an international perspective. I particularly encourage small and medium-sized enterprises (SMEs), not just large companies, to venture abroad and do business.

The first step could be starting a joint venture with a local company, and it is best to entrust the management to local people.

The first step could be starting a joint venture with a local company. It is best to entrust the management to local partners. Once accustomed to its management, try to operate independently. Based on that successful experience, repeat the process in neighboring countries. Although there may be various obstacles, I hope that Japanese people take on the challenge of going abroad basis on their challenging-will. I believe that this will produce synergistic effects and strengthen SMEs in Japan.

The values that Japanese people cherish, such as equality, fairness, conscience, kindness, consideration for others, and the Omi merchants’ three-way satisfaction principle (benefit for the seller, benefit for the buyer, and benefit for society), will be very useful abroad. To young people: Why not take advantage of the weak yen (around $1 = JPY 150) and start a business abroad? It could be far more rewarding than working tirelessly in Japan. Furthermore, by going abroad and meeting many people originated from various countries, having them understand “the Japanese spirit” and “what it means to be Japanese”, I am convinced that this is crucial for Japanese people to play a role in contributing to international peace in the future.