Headlines

- 1 A 21% Yen Depreciation Sparks Surging Prices! A Deepening Crisis of Daily Life with No Government Solutions in Sight

- 2 Global Affairs Strike a Blow to Shipping Industry! Mounting Challenges and Japan’s Course Forward

- 3 [The Potential of 1.46 Million People] Diverse Talent Paving the Way for Japan’s Future

- 4 The Impact of Trump’s Upcoming Inauguration: Port Strikes & Tariff Hikes Threaten Chaos in the Shipping Market

- 5 ONE-Led New Alliance Takes Off! Strategic Routes of the Big Four Shipping Alliances

- 6 Record-Breaking Container Production: Highest Volume in a Decade!

- 7 Morning Glow in Yokohama Inspires Hope: A Renewed Commitment Toward 2025

A 21% Yen Depreciation Sparks Surging Prices! A Deepening Crisis of Daily Life with No Government Solutions in Sight

A New Year’s Resolution Begins New Year’s Day!

A New Year’s Resolution Begins New Year’s Day!

Every year, I visit a shrine on New Year’s Day to pray for good health, family harmony, business success, and world peace. However, last year began on a somber note as an earthquake struck the Noto Peninsula on January 1, affecting many lives. Recovery is still incomplete, and when I think about the struggles of those impacted, I cannot help but wish for swift restoration and relief.

What Kind of Year Lies Ahead?

As for myself, I aim to take full responsibility for the things I can control and deliver results. For issues beyond individual capacity, I hope the government will take decisive action.

According to Teikoku Databank, food prices are expected to rise for 15,000 to 20,000 items starting this January. A major factor is the yen-dollar exchange rate. Back in January 2022, the exchange rate stood at US$ 1.00 = JPY 130. However, in March 2022, the U.S. Federal Reserve (FRB) raised interest rates by 0.5% to curb inflation pressures exacerbated by the COVID-19 pandemic. Additional rate hikes followed, reaching 5.5% by July 2023. While European nations and Canada raised rates to protect their currencies, Japan maintained its zero-interest-rate policy, which led to speculative selling of the yen. As a result, the yen has depreciated to US$ 1.00 = JPY 157, a 21% drop since January 2022.

Japan’s food self-sufficiency rate is 38% in calorie terms, meaning the country relies on imports for 62% of its food supply. Additionally, nearly 100% of the oil that accounts for around 40% of the country’s energy supply is imported. A weaker yen not only increases import costs but also reduces Japan’s purchasing power, making it harder to secure essential resources. This situation poses a direct threat to livelihoods.

Adding to this, Japan has faced stagnant wage growth since the economic bubble burst in the early 1990s, often referred to as “the lost 30 years.” In light of this reality, a 21% depreciation of the yen cannot be ignored. Pensioners are already struggling as their benefits erode year by year. This is fundamentally a governmental issue, and it remains unclear what kind of future the government envisions for Japan.

Global Affairs Strike a Blow to Shipping Industry! Mounting Challenges and Japan’s Course Forward

The shipping industry faces a year filled with uncertainties in 2025.

The future of ocean freight rates due to the balance between surplus and shortage of container vessels and containers

1. What Will Happen with the U.S. East Coast Strike on January 15?

In October last year, the first strike in 77 years was held on the U.S. East Coast, lasting three days. A temporary agreement was reached to increase wages by more than 60% over six years. However, unresolved issues surrounding automation and semi-automation have extended negotiations until January 15. With both the current President and the President-elect supporting port workers, the likelihood of a strike is increasing.

2. The Inauguration of U.S. President Donald Trump on January 20

Will “Taxman” Trump’s “America First” agenda of the high tariffs be implemented?

3. Is there a shift for the Asia-Europe Shipping Route via the Cape of Good Hope?

When will the Suez Canal be safe for transit again?

From a Geopolitical Perspective:

4. When will the Russia-Ukraine war come to an end?

5. What will happen with the ongoing conflict between Israel and Hamas?

6. What lies ahead for Syria following the collapse of the Assad regime?

7. The issue of the rightward shift in European politics.

8. Immigration challenges faced by the U.S. and Europe.

From the Perspective of Major Economies’ Issues:

9. What will become of China’s economy after the bursting of its real estate bubble?

9. What will become of China’s economy after the bursting of its real estate bubble?

10. How will China’s worldwide export offensive, driven by subsidies, unfold?

11. What is the future of China’s retaliatory tariff competition with the U.S.?

12. With the booming U.S. economy, will inflation resurface, and will the FRB raise interest rates again?

13. Has Germany’s energy policy – the shift from nuclear power to renewable energy – failed?

Climate Change Countermeasures:

14. What will happen regarding Germany and the U.S.’s failure to transition effectively to electric vehicles (EVs)?

15. How will the climate change agenda be affected by President Trump’s withdrawal from decarbonization efforts?

The list of issues seems endless. However, Japan must focus on what it can do their best by leveraging its strengths, highlighting the importance of community, fostering mutual respect, and helping one another to build a better nation. Japan should aspire to be a role model for other countries and contribute to world peace.

[The Potential of 1.46 Million People] Diverse Talent Paving the Way for Japan’s Future

Labor shortages remain a pressing issue in Japan, however, the nation has yet to fully utilize the potential of its youth, women, and elderly people. The core problem lies in inadequate compensation for essential societal roles. If small and medium-sized enterprises (SMEs) could offer more attractive salaries to their employees, productivity could significantly improve. With reduced tax burdens, government support for these SMEs could, in turn, boost overall tax revenues. Young people could gain confidence and pride in their work, potentially resolving societal issues like the current problem of shady part-time jobs.

According to a 2022 survey by the Cabinet Office, 2.05% of young people aged 15–39 and 2.2% of middle-aged and older individuals aged 40–64 are socially withdrawn, equating to an estimated 1.46 million people across Japan. We cannot afford to overlook this untapped human resource.

The Impact of Trump’s Upcoming Inauguration: Port Strikes & Tariff Hikes Threaten Chaos in the Shipping Market

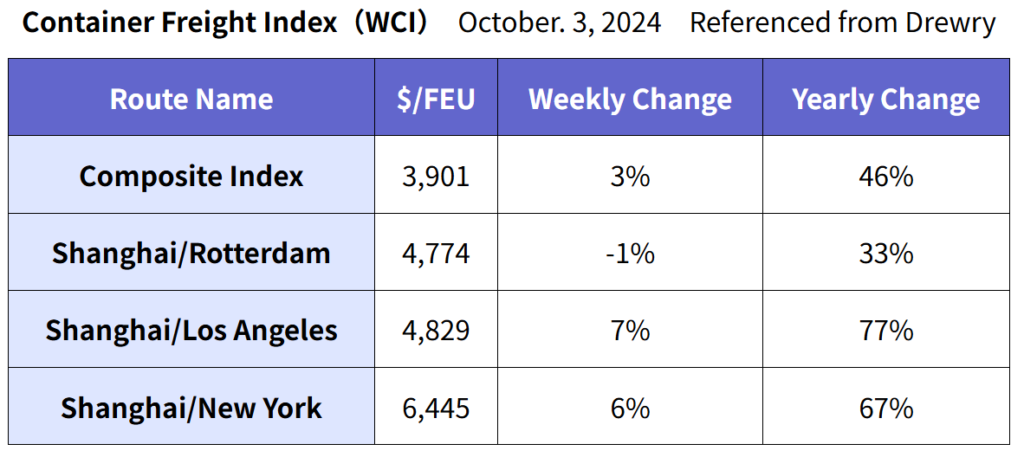

Freight rates have been rising amid concerns over potential strikes at U.S. East Coast ports and anticipatory demand ahead of tariff increases expected under the President-elect, Donald Trump. According to Drewry’s “Cancelled Sailings Tracker” released on January 3, the overall cancelled sailing rate for east-west trade routes (Trans-Pacific, Trans-Atlantic, and Asia/Europe-Mediterranean routes) is projected to reach 12% between Week 1 (December 30–January 5) and Week 5 (January 27–February 2). A breakdown by route shows that 56% of eastbound Trans-Pacific sailings and 21% of westbound Trans-Atlantic sailings are expected to be cancelled.

ONE-Led New Alliance Takes Off! Strategic Routes of the Big Four Shipping Alliances

In February this year, a restructuring of shipping alliances will take place, expanding the current three alliances into four:

1. MSC – Operating independently.

1. MSC – Operating independently.

2. Gemini – Maersk and Hapag-Lloyd.

3. Ocean Alliance – CMA CGM, COSCO, Evergreen, and OOCL.

4. Premier Alliance – ONE, HMM, and Yang Ming.

However, partial joint operations are emerging within these alliances. Notably, 1. MSC and 4. Premier Alliance will exchange slots on European routes.4. Premier Alliance and 3. Ocean Alliance will establish vessel-sharing agreements on Trans-Atlantic routes. These cooperative measures suggest that ONE, taking a leadership role, coordinated with other alliances to fill the gap left by Hapag-Lloyd’s withdrawal, maintaining competitiveness across various routes. Additionally, ONE will continue its partnership with Wan Hai on North American routes.

Record-Breaking Container Production: Highest Volume in a Decade!

In December, the price of newly built containers was at $1,950 per 20f, reflecting a $150 or 7% decrease from the previous month. This decline was primarily attributed to falling steel prices. During the same month, the production of new containers reached 892,445 TEU (Dry: 863,334 TEU, Reefer: 29,111 TEU). Compared to the previous month, total production increased by 137,399 TEU (Dry: +130,542 TEU, Reefer: +6,857 TEU), representing an 18% month-on-month rise overall (Dry: +18%, Reefer: +31%). This surge in production exceeded expectations and was likely driven by pre-emptive exports ahead of tariff hikes, stockpiling imports, and a rush to export goods before the Chinese New Year beginning on January 29.

For the entirety of 2024, China’s container production reached a record-breaking total of 8,141,386 TEU (Dry: 7,854,534 TEU, Reefer: 286,852 TEU), the highest level in the past decade. Dry container production alone also marked a decade-high, while Reefer container production ranked third during the same period. European shipping routes via the Cape of Good Hope led shipping companies to pull surplus depot inventory from leasing companies in 2023, contributing to this exceptional production volume. Among shipping lines, MSC placed a remarkable order exceeding 1 million TEU of new Dry containers in 2024. This is a figure that is truly astonishing. The second largest order came from Hapag-Lloyd, which procured 640,000 TEU of Dry containers, followed by ONE with 370,000 TEU and Maersk with 230,000 TEU. Among leasing companies, CAI led the market with an order of 640,000 TEU, followed by Triton with 510,000 TEU, and Textainer with 430,000 TEU.

Morning Glow in Yokohama Inspires Hope: A Renewed Commitment Toward 2025

Half a year ago, we moved to our new office at Yokohama Creation Square, and this marks our first New Year in the new location. The view from our 18th-floor office, overlooking the Yokohama cityscape, the distant skyscrapers of Tokyo, and the faint silhouette of the Sky Tree in Asakusa, is something I never tire of. It has a soothing effect, providing comfort for a weary heart.

Half a year ago, we moved to our new office at Yokohama Creation Square, and this marks our first New Year in the new location. The view from our 18th-floor office, overlooking the Yokohama cityscape, the distant skyscrapers of Tokyo, and the faint silhouette of the Sky Tree in Asakusa, is something I never tire of. It has a soothing effect, providing comfort for a weary heart.

On the first working day of the year, around 6:30 a.m., before the sun had risen, I gazed out at the dimly lit, silent cityscape of Yokohama. As I contemplated the year ahead, the rising sun began to reflect off the skyscraper windows, making the buildings appear as if they were ablaze. The sight was indescribable, filling me with a sense of energy and determination. It inspired me to take on the challenges of the coming year with renewed commitment, striving to deliver products and services that bring satisfaction and joy to our customers.

As we embark on a new year, I would humbly ask for your continued guidance and encouragement. Thank you very much for your support, and I look forward to another year of progress and success together.