Headlines

- 1 Expectations and Concerns Over Trump’s Re-election: Worries About a Dividing World

- 2 Will the Fed Cut Rates Due to the Sluggish U.S. Employment Situation?

- 3 Europe’s Household Savings Trend as a Result of the prolonged Negative Interest Rate Policy Aftermath

- 4 Will China’s Large-Scale Fiscal Spending Be Effective as an Economic Stimulus?

- 5 Container Freight Rates from Shanghai Soar! A Comparison and Analysis of Pre- and Post-COVID-19 Levels

- 6 ONE’s Tenfold Profit Surge! Large Dividends to Parent Companies, Including NYK

- 7 Declining Profit Margins and Speculative Orders: Challenges Facing the Container Leasing Industry

- 8 New Container Information for October 2024

- 9 Starting a Business After Retirement: A Mission Confirmed After 15 Years

Expectations and Concerns Over Trump’s Re-election: Worries About a Dividing World

On the evening of the 6th at 7:00 p.m. JST, it was reported that former U.S. President Donald Trump secured 272 electoral votes, surpassing the majority needed to reclaim the presidency. The U.S. presidential election is always a captivating event, as the U.S. president is regarded as a world’s leader. This election, determining the leader of a nation that represents democracy and the free world, is of great significance to us as well. The world is currently divided between authoritarian and liberal countries, with shifts in power distribution by population and GDP. This election marked the return of Mr. Trump, who champions “America First,” as the 47th president. Although Mr. Trump positions himself as a leader of liberal countries, his divisive policies and unpredictable nature leave many, including myself who is a non-USA citizen, with concerns about the future of U.S. politics. In the election, Mr. Trump disparaged and demeaned his opponent, the Democratic Vice President Kamala Harris, which raises questions about the appropriateness of such behavior in a leader of a democratic nation. Can the people of the United States truly accept someone with such a personality as their president?

On the evening of the 6th at 7:00 p.m. JST, it was reported that former U.S. President Donald Trump secured 272 electoral votes, surpassing the majority needed to reclaim the presidency. The U.S. presidential election is always a captivating event, as the U.S. president is regarded as a world’s leader. This election, determining the leader of a nation that represents democracy and the free world, is of great significance to us as well. The world is currently divided between authoritarian and liberal countries, with shifts in power distribution by population and GDP. This election marked the return of Mr. Trump, who champions “America First,” as the 47th president. Although Mr. Trump positions himself as a leader of liberal countries, his divisive policies and unpredictable nature leave many, including myself who is a non-USA citizen, with concerns about the future of U.S. politics. In the election, Mr. Trump disparaged and demeaned his opponent, the Democratic Vice President Kamala Harris, which raises questions about the appropriateness of such behavior in a leader of a democratic nation. Can the people of the United States truly accept someone with such a personality as their president?

Now, at a time when the world faces a division between two global powers, the ability of the U.S., as a representative of liberal countries, to navigate these complex issues remains uncertain. While it looks like that Mr. Trump have got a support from the lower socioeconomic segments of the U.S., this support may stem not from his qualities but from a hope that he will improve difficult living conditions. Many Americans are said to have never left the U.S., making it hard to believe they fully understand the situation that the world faces a division before casting their votes. However, the US peoples’ choice of Mr. Trump as president seems to a desire who will change the world’s stagnant political situation. I hope that President Trump will work towards a more united, livable world rather than further dividing it.

Will the Fed Cut Rates Due to the Sluggish U.S. Employment Situation?

According to the U.S. Department of Labor’s October employment statistics, the number of non-farm jobs increased by 12,000 from the previous month. The market had expected an increase of 113,000. This smaller-than-expected gain is largely attributed to the impact of the hurricane that hit Florida at the end of September and early October, as well as the strike of Boeing, major U.S. aircraft manufacturer. It marked the smallest increase since December 2020. The unemployment rate remained at 4.1%, the same as in September. Average hourly earnings in October rose by 0.4% from the previous month. Due to factors such as prolonged monetary tightening, the number of job openings in September fell to 7.44 million, dropping below the pre-COVID-19 bottom of 7.59 million in November 2018 for the first time.

The U.S. Federal Reserve will hold the FOMC meeting on November 6 and 7. Given the slowdown in non-farm employment growth, industry sources speculate that the Fed may opt for a 0.25% rate cut to counter potential further deceleration in employment.

Europe’s Household Savings Trend as a Result of the prolonged Negative Interest Rate Policy Aftermath

The European economy’s real GDP for the Eurozone, comprising 20 of the 27 EU countries, grew by 0.4% from the previous quarter for the July-September period, with an annualized growth rate of 1.5%, according to preliminary figures. By country, Germany saw a 0.2% increase from the previous quarter, France rose by 0.4%, and Italy remained flat at 0%. The aftermath of the negative interest rate policy, which lasted for about eight years until 2022, along with high interest rates and economic uncertainty, has discouraged consumer spending. Although there was a temporary boost in demand from the Paris Summer Olympics, concerns about the economy have led to a marked shift toward savings. Consequently, there is speculation that the European Central Bank (ECB) may implement a significant 0.5% rate cut, marking the third consecutive cut, at its next meeting in December as part of an economic stimulus effort.

The European economy’s real GDP for the Eurozone, comprising 20 of the 27 EU countries, grew by 0.4% from the previous quarter for the July-September period, with an annualized growth rate of 1.5%, according to preliminary figures. By country, Germany saw a 0.2% increase from the previous quarter, France rose by 0.4%, and Italy remained flat at 0%. The aftermath of the negative interest rate policy, which lasted for about eight years until 2022, along with high interest rates and economic uncertainty, has discouraged consumer spending. Although there was a temporary boost in demand from the Paris Summer Olympics, concerns about the economy have led to a marked shift toward savings. Consequently, there is speculation that the European Central Bank (ECB) may implement a significant 0.5% rate cut, marking the third consecutive cut, at its next meeting in December as part of an economic stimulus effort.

Will China’s Large-Scale Fiscal Spending Be Effective as an Economic Stimulus?

There is growing speculation that China’s leadership will announce a large-scale fiscal spending plan. It is expected that an additional 10 trillion yuan (approximately 210 trillion yen) in national and local government bonds will be issued. However, the scale may be an issue, as 10 trillion yuan amounts to slightly less than 8% of GDP, which is below the 13% of GDP in the “4 trillion yuan policy” implemented during the 2008 Lehman Shock. If the funds are used to cover the debt of local government financing platforms (investment companies set up by local governments in China), this would merely address accumulated debt without creating new demand or promoting growth, increasing the likelihood that the fiscal spending may fall short of its intended impact.

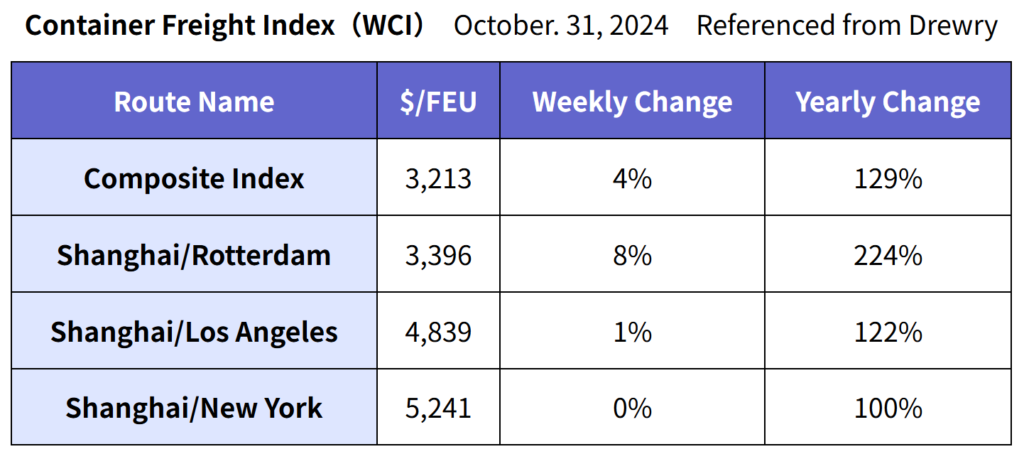

Container Freight Rates from Shanghai Soar! A Comparison and Analysis of Pre- and Post-COVID-19 Levels

Drewry’s container freight index (WCI) released on October 31 indicates that rate hikes by major container carriers have supported the surge in freight rates from Shanghai to Europe. While the composite index is down 69% compared to its peak in September 2021 during the COVID-19 period, it remains approximately 2.3 times higher than the average level in 2019 before the pandemic. The year-to-date average for the composite index is $4,017 per FEU, which is $1,178 per FEU higher than the average level over the past ten years. Spot rates from China are expected to continue their upward trend due to the shipping rush for Christmas demand.

According to Drewry’s Cancelled Sailings Tracker released on November 1, the overall cancellation rate across east-west routes (transpacific, transatlantic, Asia-Europe/Mediterranean routes) is expected to be 10% for Week 45 (November 4-10) through Week 48 (December 2-8). Cancellations by route include 59% on eastbound transpacific, 24% on Asia-Europe/Mediterranean, and 18% on westbound transpacific.

Drewry anticipates more cancellations on Asia-Europe/Mediterranean routes, though it warns that rate hikes may be difficult without stricter capacity management.

ONE’s Tenfold Profit Surge! Large Dividends to Parent Companies, Including NYK

Ocean Network Express (ONE)’s the 2nd quarter (July-September 2024) results reported a net profit after tax of $1.999 billion, 10.7 times the year-ago level. The company attributes this to favorable spot rates due to diversion via the Cape of Good Hope, solid U.S. consumer demand, and strong pre-emptive demand ahead of additional tariffs and potential strikes on the U.S. East Coast. For the first half (April-September), revenue rose 38% to $10.075 billion, EBITDA tripled to $3.63 billion, EBIT rose 6.1 times to $2.532 billion, and net profit quadrupled to $2.778 billion. ONE raised its full-year net profit forecast by $350 million to $3.095 billion on July 31. Consequently, ONE will pay dividends of $527 million (approx. 75.3 billion yen) to its parent companies, Nippon Yusen Kaisha, $431 million (approx. 61.2 billion yen) to Mitsui O.S.K. Lines, and $430 million (approx. 61.4 billion yen) to Kawasaki Kisen Kaisha on November 15. Each parent company may be grateful for ONE’s performance, viewing it as a dutiful “son.”

Ocean Network Express (ONE)’s the 2nd quarter (July-September 2024) results reported a net profit after tax of $1.999 billion, 10.7 times the year-ago level. The company attributes this to favorable spot rates due to diversion via the Cape of Good Hope, solid U.S. consumer demand, and strong pre-emptive demand ahead of additional tariffs and potential strikes on the U.S. East Coast. For the first half (April-September), revenue rose 38% to $10.075 billion, EBITDA tripled to $3.63 billion, EBIT rose 6.1 times to $2.532 billion, and net profit quadrupled to $2.778 billion. ONE raised its full-year net profit forecast by $350 million to $3.095 billion on July 31. Consequently, ONE will pay dividends of $527 million (approx. 75.3 billion yen) to its parent companies, Nippon Yusen Kaisha, $431 million (approx. 61.2 billion yen) to Mitsui O.S.K. Lines, and $430 million (approx. 61.4 billion yen) to Kawasaki Kisen Kaisha on November 15. Each parent company may be grateful for ONE’s performance, viewing it as a dutiful “son.”

Declining Profit Margins and Speculative Orders: Challenges Facing the Container Leasing Industry

Container leasing companies are maintaining a utilization rate of around 99%, but this year’s market is highly competitive, and profitability is expected to decline. CAI, supported by its parent Mitsubishi HC Capital, plans to invest 200 billion yen this year to secure 700,000 TEU, over 90% of which will be dry containers, with the remainder in reefer and special type containers. As of the end of October, CAI held 600,000 TEU, Triton 510,000 TEU, Textainer 340,000 TEU, Florence 300,000 TEU, and UES 290,000 TEU. Shipping companies are also securing containers aggressively. MSC holds 960,000 TEU, Hapag-Lloyd 460,000 TEU, ONE 370,000 TEU, Evergreen 180,000 TEU, and CMA CGM 150,000 TEU. In contrast, Maersk’s 60,000 TEU order shows limited investment capacity in containers, possibly due to their strategies as an Integrator.

New Container Information for October 2024

New container prices rose by $50, up 2.4%, to $2,100 per 20ft, driven mainly by rising steel prices. As a result, orders may ease slightly after November. October’s new container production volume reached 824,951 TEU (803,722 TEU dry and 21,229 TEU reefer), the highest production month this year. Production volume increased by 14,090 TEU (dry +7,357 TEU, reefer -3,267 TEU), representing a 1.7% increase month-over-month (dry +2.2%, reefer -13.3%). Inventory at new container factories stood at 1,080,840 TEU (dry: 1,030,684 TEU, reefer: 50,516 TEU), with dry containers exceeding 1 million TEU and reefer inventories declining. New inventory increased by 66,556 TEU (dry +74,882 TEU, reefer -8,346 TEU), a 6.6% month-on-month increase (dry +7.8%, reefer -14.3%), reflecting increased dry container production and decreased reefer output. October shipments from factories totaled 758,415 TEU (dry: 728,840 TEU, reefer: 29,575 TEU).

Starting a Business After Retirement: A Mission Confirmed After 15 Years

Recently, I was reminded of a question asked by the owner of the container leasing company I worked for upon my retirement: “What do you plan to do next?” At the time, after having worked for 26 years in one of the world’s top container leasing companies and learning American-style management, I replied, “I want to help young people in Japan find hope and dreams through what I’ve learned from my experiences.” I didn’t say this with the intention of starting my own business or running my own company. However, as I observe the natural energy that emerges and the situation that I can naturally foresee the flow and outcomes based on my experiences, I am convinced more and more that my response to the owner was not misplaced, particularly now, as I reflect on the 15 years of achievements since founding EF International Ltd. in 2010.

Recently, I was reminded of a question asked by the owner of the container leasing company I worked for upon my retirement: “What do you plan to do next?” At the time, after having worked for 26 years in one of the world’s top container leasing companies and learning American-style management, I replied, “I want to help young people in Japan find hope and dreams through what I’ve learned from my experiences.” I didn’t say this with the intention of starting my own business or running my own company. However, as I observe the natural energy that emerges and the situation that I can naturally foresee the flow and outcomes based on my experiences, I am convinced more and more that my response to the owner was not misplaced, particularly now, as I reflect on the 15 years of achievements since founding EF International Ltd. in 2010.

It is undoubtedly a significant loss to society when a person’s skills and experience go unused simply because of the word ‘retirement.’ In my case, I feel that, for the past 15 years, I have been encouraged by others to keep moving forward in my work. However, now I find myself consciously leading the company toward a bright future that I envision. Of course, I cannot run the company alone. I am supported by staff who, like me, continue to demonstrate their abilities even after reaching retirement age. There is also a place where young people can thrive and actively contribute. As the company grows, I have come to believe that my role is to provide each new team member with the work they need and an environment suited to them.”