Headlines

- 1 U.S. Employment Statistics Show Strong Results! Has the Fed’s Soft Landing Strategy Paid Off?

- 2 The Weight of a Spokesperson’s Words, the Market’s Sensitive Reaction

- 3 China’s Domestic Consumption and Export Strategy, Ripples in the Global Market

- 4 North American Port Strike Avoided, Strategies Behind the Scenes

- 5 Container Freight Rates Drop for 11 Consecutive Weeks! Latest Trends in the Shipping Industry

- 6 The Realignment of Shipping Alliances and the Fate of a $5 Billion M&A

- 7 Rising Inventory of New Containers, Signs of Weak Demand?

- 8 EFI Aims for Further Growth Through New Talents

U.S. Employment Statistics Show Strong Results! Has the Fed’s Soft Landing Strategy Paid Off?

On October 4, U.S. employment statistics for September were released, revealing that non-farm payrolls increased by 254,000 compared to the previous month, far exceeding the market expectation of 140,000–150,000. The unemployment rate was 4.1%, lower than the market forecast of 4.2%. The average hourly wage rose by 4.0% year-on-year, also surpassing the forecast of 3.8%. Month-on-month, wages also exceeded expectations by 0.4%.

This strong performance is largely attributed to the U.S. Federal Reserve’s (FRB) decision on September 18 to cut the policy interest rate by 0.50%, which was much more than the market anticipated rate of 0.25%, marking the first major rate cut since March 2020. The market welcomed the FRB’s strong commitment to achieving a soft landing without stifling economic growth.

The Weight of a Spokesperson’s Words, the Market’s Sensitive Reaction

On October 2, Japan’s Prime Minister Shigeru Ishiba, once a proponent of interest rate hikes, reversed his stance after meeting with Bank of Japan Governor Kazuo Ueda. Following the meeting, Ishiba stated that “the current environment does not allow additional rate hikes,” which led to a rapid depreciation of the yen and a surge in stock prices on October 3. This change of his stance is said to be a reflection for the “Ishiba Shock” that occurred on September 30, when the Nikkei Stock Average plunged by over 1,900 yen due to concerns over Ishiba’s economic policies following his victory in the LDP leadership election on September 27. In addition, following the U.S. employment statistics released on Wednesday, October 4, concerns about a slowdown in employment eased, and with the market expecting the pace of the Federal Reserve’s rate cuts to slow down, the USD/JPY exchange rate fell, leading to a weaker yen at $1.00 = 149 yen.

On October 2, Japan’s Prime Minister Shigeru Ishiba, once a proponent of interest rate hikes, reversed his stance after meeting with Bank of Japan Governor Kazuo Ueda. Following the meeting, Ishiba stated that “the current environment does not allow additional rate hikes,” which led to a rapid depreciation of the yen and a surge in stock prices on October 3. This change of his stance is said to be a reflection for the “Ishiba Shock” that occurred on September 30, when the Nikkei Stock Average plunged by over 1,900 yen due to concerns over Ishiba’s economic policies following his victory in the LDP leadership election on September 27. In addition, following the U.S. employment statistics released on Wednesday, October 4, concerns about a slowdown in employment eased, and with the market expecting the pace of the Federal Reserve’s rate cuts to slow down, the USD/JPY exchange rate fell, leading to a weaker yen at $1.00 = 149 yen.

The Prime Minister should recognize that careless remarks are causing unnecessary dollar appreciation and yen depreciation, which harm the Japanese people. Bank of Japan Governor Ueda has also made several verbal missteps, the most notable one was that on April 26, following a monetary policy meeting, which seemed to signal an acceptance of a weak yen. This led the yen to plummet down from ¥155 to ¥160 per dollar by April 29. Government officials, including the Prime Minister, the Minister of Finance, and the Governor of the Bank of Japan, should serve as reliable spokesperson for the nation, avoiding careless remarks and understanding the weight of their words. They should learn from the U.S. Federal Reserve chairs, including Jerome Powell, Janet Yellen, and Ben Bernanke, who have made exemplary statements in the best interest of the U.S.

In 2024, the USD/JPY exchange rate fluctuated between ¥140 and ¥160, with the yen weakening to ¥148 per dollar as of October 7. Import prices are rising, with around 3,000 food and beverage items seeing price increases in October, the highest items for 2024.

China’s Domestic Consumption and Export Strategy, Ripples in the Global Market

October 1 marked China’s National Day, with a seven-day Golden Week holiday that saw an estimated 1.9 billion people traveling domestically, averaging 280 million travelers per day. Over 80% of these travelers used rail or private cars. This is nearly 20% more than the pre-COVID-19 figures of 2019. In 2023, China’s personal consumption as a percentage of GDP was 39.2%, contributing significantly to domestic economic activity. Japan has been the top destination for Chinese tourists, providing a boost to Japan’s domestic economy.

October 1 marked China’s National Day, with a seven-day Golden Week holiday that saw an estimated 1.9 billion people traveling domestically, averaging 280 million travelers per day. Over 80% of these travelers used rail or private cars. This is nearly 20% more than the pre-COVID-19 figures of 2019. In 2023, China’s personal consumption as a percentage of GDP was 39.2%, contributing significantly to domestic economic activity. Japan has been the top destination for Chinese tourists, providing a boost to Japan’s domestic economy.

Meanwhile, the Chinese government is offering direct and indirect subsidies for exports, particularly in the electric vehicle (EV), solar panel, semiconductor, and solid-state battery industries. In 2023, China’s automobile production capacity reached 48.7 million units, with 30 million units sold, including exports, leaving a 38% production surplus. EV production in China is expected to surpass 10 million units in 2024, posing a major threat to European automakers shifting towards EVs. This aggressive export strategy has serious implications for national industries and economic security in other countries, leading to increased protectionist policies such as tariffs in Europe and the U.S. China may need to adopt more policies to stimulate domestic demand.

China’s cross-border e-commerce platform Temu, which rivals Amazon, has been rapidly expanding since its launch in September 2023. In August, its app usage reached 91% of Amazon’s, with projections that it will surpass Amazon by year-end. Temu dominates 60% of the market across 84 countries and regions, and has a monopoly in 28 of 30 European countries. Unlike Amazon, which operates its own warehouses, Temu ships products directly to consumers, keeping prices low. In September, the U.S. announced a review of its duty exemption for small shipments under $800, which had allowed Temu to flourish.

China’s cross-border e-commerce platform Temu, which rivals Amazon, has been rapidly expanding since its launch in September 2023. In August, its app usage reached 91% of Amazon’s, with projections that it will surpass Amazon by year-end. Temu dominates 60% of the market across 84 countries and regions, and has a monopoly in 28 of 30 European countries. Unlike Amazon, which operates its own warehouses, Temu ships products directly to consumers, keeping prices low. In September, the U.S. announced a review of its duty exemption for small shipments under $800, which had allowed Temu to flourish.

North American Port Strike Avoided, Strategies Behind the Scenes

On October 3, the United States Maritime Alliance (USMX) and the International Longshoremen’s Association (ILA) reached a tentative wage agreement, extending the current labor contract until January 15, 2025, thereby avoiding a strike. A strike would have resulted in nearly 100,000 containers piling up at ports, with 35 additional vessels potentially delayed within the next week, significantly impacting the U.S. auto industry and supply chains, and causing billions of dollars in economic damage each day. The U.S. Chamber of Commerce had urged President Biden to invoke the Taft-Hartley Act to limit labor strikes, but he refused, likely appealing to workers to support the Democratic Party for the polls on Monday, November 4 election. While USMX had to make significant concessions, avoiding a strike was ultimately beneficial for both shipping companies and shippers.

Container Freight Rates Drop for 11 Consecutive Weeks! Latest Trends in the Shipping Industry

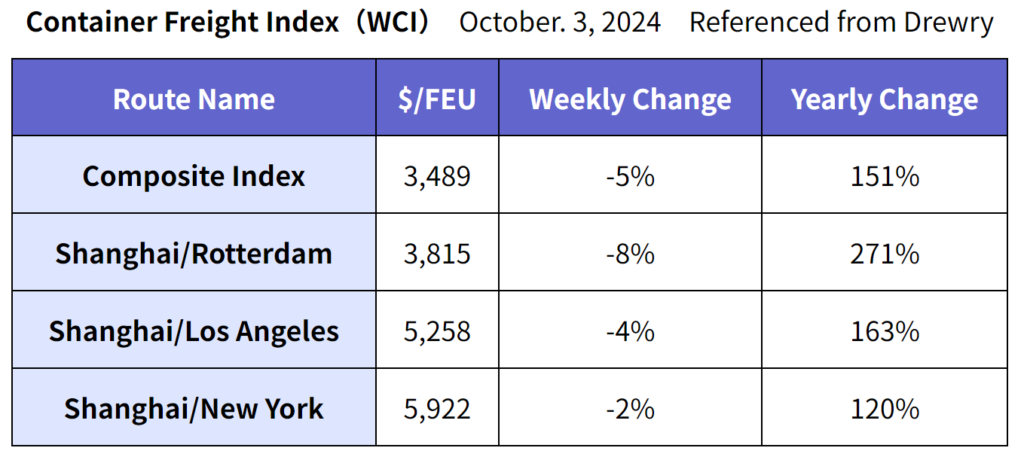

On October 3, Drewry announced that the composite World Container Index (WCI) decreased by 5% from the previous week to $3,489 per FEU, marking the 11th consecutive week of decline. This week’s composite index is 66% lower than the COVID-19 pandemic peak in September 2021 but remains approximately 2.5 times higher than the average level in 2019, before the COVID-19.

The year-to-date average of the composite index is $4,097 per FEU, which is $1,269 higher than the average level over the past 10 years.

According to Drewry’s Cancelled Sailings Tracker, from Week 41 (October 7 to 13) to Week 45 (November 4 to 10), the overall cancellation rate on East-West routes (Trans-Pacific, Trans-Atlantic, Asia/Europe, and Mediterranean routes) is projected to be 13%. The high cancellation rate is attributed to the expected decline in demand during the National Day holidays. The breakdown by route is as follows: Trans-Pacific Eastbound at 52%, Asia/Europe and Mediterranean routes at 28%, and Trans-Atlantic Westbound at 20%.

The Realignment of Shipping Alliances and the Fate of a $5 Billion M&A

The full details of the four major alliances that will start operations from February 2025 have been revealed:

Premier Alliance:

Premier Alliance:

ONE, HMM, and Yang Ming, cooperating with MSC on the Asia/Europe route to fill the gap left by Hapag Lloyd.

MSC:

Operating independently but collaborating with the Premier Alliance on the Asia/Europe route and ZIM on the Asia/North America East Coast route.

Gemini Corporation:

Comprising Maersk and Hapag Lloyd.

Ocean Alliance:

CMA-CGM, Cosco, Evergreen, and OOCL, extending their partnership until 2032.

What’s happening with the acquisition of Seaco (the world’s fifth-largest with 2.4 million TEU) by Textainer (the world’s second-largest with 4.29 million TEU)? The deal seems to be ongoing. Seaco’s parent company is China’s conglomerate, HNA Group, which filed for bankruptcy in January 2021 with a total debt of 1.1 trillion yuan (approximately 19 trillion yen), marking the largest bankruptcy in China. They are currently undergoing restructuring. The asking price for Seaco is reportedly over $5 billion (approximately 750 billion yen), but the value of Seaco’s container fleet is decreasing annually. There is skepticism about whether the value of containers will rise in the future market. On the other hand, the container leasing industry grows as companies increase in value. Without proactive investment in containers, Seaco’s corporate value will continue to decline each year. It would be a significant loss if a prestigious container leasing company were to disappear.

What’s happening with the acquisition of Seaco (the world’s fifth-largest with 2.4 million TEU) by Textainer (the world’s second-largest with 4.29 million TEU)? The deal seems to be ongoing. Seaco’s parent company is China’s conglomerate, HNA Group, which filed for bankruptcy in January 2021 with a total debt of 1.1 trillion yuan (approximately 19 trillion yen), marking the largest bankruptcy in China. They are currently undergoing restructuring. The asking price for Seaco is reportedly over $5 billion (approximately 750 billion yen), but the value of Seaco’s container fleet is decreasing annually. There is skepticism about whether the value of containers will rise in the future market. On the other hand, the container leasing industry grows as companies increase in value. Without proactive investment in containers, Seaco’s corporate value will continue to decline each year. It would be a significant loss if a prestigious container leasing company were to disappear.

Rising Inventory of New Containers, Signs of Weak Demand?

The price of newly built containers in September was $2,050 per 20-foot unit (TEU), down 6.8% ($150 per TEU) from the previous month, driven mainly by falling steel and flooring material prices. The total production of new containers was 810,861 TEU (Dry: 786,365 TEU, Reefer: 24,496 TEU), down 2.4% from the previous month (Dry: -2.2%, Reefer: -8.3%). The order volume for both Dry and Reefer containers showed no increase despite the summer peak season, and factory inventories surpassed 1 million TEU, reaching 1,014,304 TEU (Dry: 955,802 TEU, Reefer: 58,502 TEU), up 5.5% from the previous month (Dry: +6.1%, Reefer: +2.9%). In September, 757,970 TEU (Dry: 731,746 TEU, Reefer: 26,224 TEU) were shipped from factories. If orders continue at the current pace, annual production could exceed 7.5 million TEU by year-end.

EFI Aims for Further Growth Through New Talents

Since this September, six new employees have joined EFI. They are all highly talented, and we are very satisfied with their performance. The notion of a labor shortage is incorrect; in reality, there is a lack of opportunities for individuals to fully utilize their potential. It is our role as leadership to create environments where each person’s abilities can flourish. The total number of staff has now reached 36. As the company is steadily growing, we hope to join more talented people. Our aim is to create a company that employees are happy to be part of it.