Headlines

- 1 (1) Increase in Bankruptcies of U.S. Consumer-Related Companies, Expectations for a Significant FRB Rate Cut

- 2 (2) Increase in Container Exports to North America Due to Inventory Buildup for Risk Mitigation by Retailers

- 3 (3) European Central Bank Proposes Large-Scale Investments to compete with U.S. and China

- 4 (4) China’s Manufacturing PMI Falls Below 50 for Four Consecutive Months, Indicating Slowing Economy

- 5 (5) U.S. East Coast Port Strike, if it lasts Two Weeks, Could Cause Disruptions until Year-End

- 6 (6) East-West Route Cancellation Rate Reaches 13%, 89 Canceled Sailings, observing China’s National Day (Week 37–41)

- 7 (7) ONE, Yang Ming, and HMM Expand Direct Services Under Rebranded New Alliance

- 8 (8) New Container Information for August 2024

- 9 (9) Reefer Containers as effective Cold Storage Facilities eliminate the needs for Reconstruction

(1) Increase in Bankruptcies of U.S. Consumer-Related Companies, Expectations for a Significant FRB Rate Cut

According to the U.S. Department of Labor’s August employment report released on September 6th, the number of non-farm payroll jobs increased by 142,000 from the previous month, falling short of expectations. However, the unemployment rate improved to 4.2%, down from 4.3% in July. Average hourly earnings rose by 0.4% month-on-month, exceeding the market forecast of 0.3%. Concerns about a sharp slowdown in U.S. employment seem to have been avoided. The U.S. Federal Reserve Board (FRB) maintains the view that “the labor market is softening, but not deteriorating.” Is this truly the case?

According to the U.S. Department of Labor’s August employment report released on September 6th, the number of non-farm payroll jobs increased by 142,000 from the previous month, falling short of expectations. However, the unemployment rate improved to 4.2%, down from 4.3% in July. Average hourly earnings rose by 0.4% month-on-month, exceeding the market forecast of 0.3%. Concerns about a sharp slowdown in U.S. employment seem to have been avoided. The U.S. Federal Reserve Board (FRB) maintains the view that “the labor market is softening, but not deteriorating.” Is this truly the case?

On September 9th, Big Lots, a major U.S. discount retailer, filed for Chapter 11 bankruptcy under the U.S. Bankruptcy Code, with total liabilities amounting to approximately $3 billion (about 420 billion yen). The number of bankruptcies among U.S. consumer-related companies has been increasing recently. In April, 99 Cents Only (a dollar store chain) filed for bankruptcy, and in May, Red Lobster (a seafood restaurant chain) went bankrupt. According to S&P Global, 21 consumer-related companies filed for bankruptcy between January and mid-July this year, the highest number since 2020 for the same period. Low-income consumers are cutting back on spending to protect themselves, leading to price competition among retailers and worsening business conditions. There is hope for the FRB to implement a quick and substantial interest rate cut of 0.5% to boost the economy.

(2) Increase in Container Exports to North America Due to Inventory Buildup for Risk Mitigation by Retailers

On September 9th, the National Retail Federation (NFR) released data and forecasts for retail-related import container handling at major U.S. ports.

The August forecast shows a 20.9% year-on-year increase, with 2.37 million TEUs.

In September, a 14% increase to 2.31 million TEUs is expected, with an upward revision of 150,000 TEUs from the August forecast.

In October, a 1.3% increase to 2.08 million TEUs, a downward revision of 10,000 TEUs from the August forecast.

In November, a1.6% increase to 1.92 million TEUs, a downward revision of 60,000 TEUs from the August forecast.

In December, a 0.9% increase to 1.89 million TEUs, a downward revision of 50,000 TEUs from the August forecast.

For the full year of 2024 (January to December), the NFR expects a 12.3% increase to 24.98 million TEUs, the third-highest level on record, and a 0.3% decrease to 1.96 million TEUs in January 2025.

The increase in container exports to North America this year is likely due to inventory buildup by retailers to hedge against the following risks:

1) Extended lead times due to the Cape of Good Hope route.

2) The possibility of strikes starting in October due to failed labor negotiations at ports on the U.S. East Coast.

3) Supply chain disruptions due to tariff increases after the U.S. presidential election.

Cargo movements to North America are quite strong, but the scale and frequency of the FRB’s interest rate cuts will likely influence the speed of economic recovery after 2025.

(3) European Central Bank Proposes Large-Scale Investments to compete with U.S. and China

The European economy is also showing signs of slowing down. The Eurozone’s revised real GDP growth for Q2 (April to June) was 0.2%, down 0.1 percentage points from the preliminary estimate of 0.3%. On the morning of September 11th, the exchange rate for one euro was 155.71 yen, marking an 11% appreciation of the yen since July 10th, when the euro stood at 175.09 yen. This is due to speculation of further rate cuts by the European Central Bank (ECB). On September 9th, the European Commission proposed that an additional €800 billion (about ¥127 trillion) investment would be necessary in fields such as digital, clean technologies, and defense industries to compete with the U.S. and China. There are high hopes for Europe’s economic recovery moving forward.

The European economy is also showing signs of slowing down. The Eurozone’s revised real GDP growth for Q2 (April to June) was 0.2%, down 0.1 percentage points from the preliminary estimate of 0.3%. On the morning of September 11th, the exchange rate for one euro was 155.71 yen, marking an 11% appreciation of the yen since July 10th, when the euro stood at 175.09 yen. This is due to speculation of further rate cuts by the European Central Bank (ECB). On September 9th, the European Commission proposed that an additional €800 billion (about ¥127 trillion) investment would be necessary in fields such as digital, clean technologies, and defense industries to compete with the U.S. and China. There are high hopes for Europe’s economic recovery moving forward.

(4) China’s Manufacturing PMI Falls Below 50 for Four Consecutive Months, Indicating Slowing Economy

According to trade statistics released by China’s General Administration of Customs on September 10th, imports in August increased by 0.5% year-on-year to $217.6 billion (about ¥31 trillion), marking the second consecutive month of positive growth, although the pace of growth slowed from July. Domestic demand weakness has also slowed resource procurement from overseas. The largest import item was integrated circuits, 10% increase, largely due to a surge in demand ahead of impending import restrictions by the U.S. and Europe. Resource-related imports were down, with crude oil declining by 4% year-on-year, iron ore by 9%, and plastics by 4%, reflecting sluggish domestic demand and the urgent need to address the prolonged real estate slump. However, exports in August increased by 8.7% to $308.6 billion, with a larger growth rate compared to July. By product category, automobiles, including electric vehicles (EVs), as well as mobile phones and computers and their components, performed well.

China’s Manufacturing Purchasing Managers’ Index (PMI) in August remained below 50 for the fourth consecutive month, and the new export orders index has been below 50 for four months since May. Meanwhile, the U.S. and Canada have raised tariffs on Chinese-made EVs starting in August, and countries in Latin America, including Brazil, have also raised tariffs on Chinese steel. China’s exports are expected to slow down in the second half of 2024.

(5) U.S. East Coast Port Strike, if it lasts Two Weeks, Could Cause Disruptions until Year-End

In the shipping industry, the most talked-about topic is the ongoing labor negotiations at U.S. East Coast ports. This year marks the renewal of labor agreements that take place once every six years, with the current agreement set to expire at the end of September. The International Longshoremen’s Association (ILA), the union representing East Coast port workers, is expected to demand at least the same labor condition improvements (including wage increases) won by the International Longshore and Warehouse Union (ILWU) at West Coast ports last year, making the negotiations quite challenging.

Denmark-based shipping research firm Sea-Intelligence has estimated the potential impact if a strike occurs. They predict that East Coast ports will handle 2.3 million TEUs in October, averaging 74,000 TEUs per day, with 36,000 TEUs of imports and 38,000 TEUs of exports. Even in the case of empty containers, approximately 20,000 TEUs per day could not be loaded. A one-week strike would delay port operations until mid-November, while a two-week strike could disrupt port activities until early 2025. In response, the National Retail Federation issued a statement on September 3rd, calling on both parties to avoid a strike. In June, U.S. supply chain industry associations also submitted a joint letter to President Biden requesting government support.

(6) East-West Route Cancellation Rate Reaches 13%, 89 Canceled Sailings, observing China’s National Day (Week 37–41)

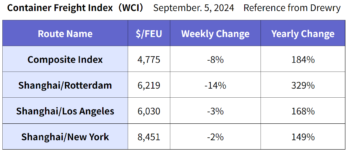

According to the Container Freight Rate Index (WCI) published by Drewry on September 5th, the overall freight rate index decreased by 8% from the previous week to $4,775 per FEU, marking the seventh consecutive week of decline. While the overall index is down 54% compared to September 2021 during the pandemic, it is still about 3.4 times higher than the average level in 2019.

According to Drewry’s Cancelled Sailings Tracker, there were 89 canceled sailings on east-west routes (Pacific, Atlantic, Asia-Europe, and Mediterranean routes) from Week 37 (September 9–15) to Week 41 (October 7–13), representing a cancellation rate of 13%, in response to the National Holiday in China. The breakdown by route shows that 66% of the cancellations were on eastbound Pacific routes, 26% on Asia-Europe/Mediterranean routes, and 8% on westbound Atlantic routes. Drewry predicts that freight rates on Asia-to-Europe routes will continue to decline in the coming weeks.

(7) ONE, Yang Ming, and HMM Expand Direct Services Under Rebranded New Alliance

On September 9th, Ocean Network Express (ONE), Yang Ming Marine Transport (YML), and the former Hyundai Merchant Marine (HMM) announced that from February next year, they would rebrand their current alliance, “The Alliance (TA),” and launch a new service under the name “Premium Alliance” for five years. On Asia-Europe routes, the lost slots by the left of Hapag-Lloyd will be filled by slot exchanges with the Swiss shipping company MSC. The new service will feature a pendulum service (FP1) connecting North America and Europe with Japan as base. The “FN2” Asia-Europe route will call at Tokyo and Kobe. For North America’s West Coast PSW services, “PS3” will call at Tokyo and “PS5” will call at Kobe. For the PNW service, “PN1” will call at Nagoya, Tokyo, and Kobe, while “FN2” will call at Tokyo and Kobe. As two (2) direct European services are added, this is good news for Japanese shippers.

(8) New Container Information for August 2024

The price of newly built containers in August was $2,200 per 20f. This represents a $50 (2.2%) drop compared to the previous month, mainly due to the decline in steel prices and floor material costs. The total number of newly built containers reached 830,905 TEUs (Dry: 804,188 TEUs, Reefer: 26,717 TEUs). Compared to the previous month, total production decreased by 2.4% (Dry: -1.4%, Reefer: -26%). Orders did not increase significantly and remained at about the same level as the previous month, but Reefer orders dropped sharply. As a result, the stock of new containers at factories increased to 961,413 TEUs (Dry: 901,183 TEUs, Reefer: 60,230 TEUs), representing a 7.2% increase (Dry: +7.5%, Reefer: +1.2%) from the previous month. In August, the number of containers shipped from factories totaled 766,480 TEUs (Dry: 741,081 TEUs, Reefer: 25,399 TEUs). At this rate, new container production in 2024 is expected to exceed 7 million TEUs, with dry containers accounting for just under 7 million TEUs and reefer containers exceeding 270,000 TEUs. This matches the production level of 2021 during the COVID-19 pandemic, making it the highest ever for new container production.

(9) Reefer Containers as effective Cold Storage Facilities eliminate the needs for Reconstruction

At the 26th Japan International Seafood Show, EFI once again exhibited at the Thermo King booth this year. The event was even more successful than last year, with 25,022 visitors, 1,628 more than the previous event, during the three days from August 21 (Wednesday) to August 23 (Friday). EFI’s booth attracted many visitors from the first day, and all employees rotated to attend visitors responding to inquiries. The effect of exhibition has been significant and we are still busy dealing with it.

At the 26th Japan International Seafood Show, EFI once again exhibited at the Thermo King booth this year. The event was even more successful than last year, with 25,022 visitors, 1,628 more than the previous event, during the three days from August 21 (Wednesday) to August 23 (Friday). EFI’s booth attracted many visitors from the first day, and all employees rotated to attend visitors responding to inquiries. The effect of exhibition has been significant and we are still busy dealing with it.

One of the major topics is the launch of the whaling mother ship Kangeimaru (LOA 112.6 meters, GT 9,299 tons) by Kyodo Senpaku, a major whaling company, after 73 years of interval. The ship was built by Asahi Shipbuilding and was completed in March of this year. A key feature of the ship is that it is equipped with 41 Thermo King Magnum Plus reefer containers, which can cool down to minus 40℃. Of these, 40 containers are used as refrigerated holds, allowing for the freezing of smaller meat portions and enabling easy temperature management, improving product quality, energy efficiency, and economic performance. Containers are loaded/unloaded onto/from the vessel on RORO (Roll on – Roll off) system. On the vessel, containers are shifted on LOLO (Lift on – Lift off) system. This innovative use of reefer containers has attracted significant attention.

As the official distributor of Thermo King, , in addition to the Magnum Plus, EFI also offers Super Freezers, which can cool down to minus 60℃. There is currently a shortage of cold storage facilities in the Tokyo metropolitan area, with a 98% occupancy rate, and nearly 50% of these facilities are over 40 to 50 years old, requiring reconstruction. Why not consider using Thermo King’s reefer containers, which can cool to minus 40℃ or minus 60℃, as an effective substitute for cold storage facilities? From the perspectives of construction cost, time efficiency, and operational efficiency, reefer containers are a viable alternative to building new cold storage facilities. EFI takes pride in working with clients to propose solutions that meet their needs and bring satisfaction.

(Translated by Tokuyama)