Headlines

- 1 (1)Farewell Historic Yen Depreciation! The Background of Exchange Rate and Stock Price Volatility

- 2 (2)Steady Recovery in U.S. Container Imports, European Struggles with EV Competition, and Continued Consumer Frugality in China

- 3 (3)Bad Weather Delayed Vessels; Container Freight Rates Remain High Even After Peaking

- 4 (4)9% of Cancelled Sailing on East-West Routes, Surplus Vessel Issue Resolved

- 5 (5)ONE’s Profit Significantly Exceeds Expectations

- 6 (6)New Container Information for July 2024

- 7 (7)Good Opportunities for Leasing Companies: Increased Container Demand due to Possible North American Port Disruptions

- 8 (8)Future Prospects from a High-Rise 18th-Floor Office: Employee-Centered Management Philosophy

(1)Farewell Historic Yen Depreciation! The Background of Exchange Rate and Stock Price Volatility

Bank of Japan Governor Ueda decided to raise the interest rate to 0.25% at the Monetary Policy Meeting held on July 30-31. At the same time, Federal Reserve Board (FRB) Chairman Powell expressed a positive stance towards a rate cut in September at the Federal Open Market Committee (FOMC) held on July 30-31. As a result, the yen-dollar exchange rate started to appreciate. On Monday, August 5, the yen-dollar exchange rate temporarily rose to 141 yen per dollar. Currently, the yen-dollar exchange rate is hovering around 145 yen per dollar. It seems that the yen-dollar exchange rate has finally normalized.

Bank of Japan Governor Ueda decided to raise the interest rate to 0.25% at the Monetary Policy Meeting held on July 30-31. At the same time, Federal Reserve Board (FRB) Chairman Powell expressed a positive stance towards a rate cut in September at the Federal Open Market Committee (FOMC) held on July 30-31. As a result, the yen-dollar exchange rate started to appreciate. On Monday, August 5, the yen-dollar exchange rate temporarily rose to 141 yen per dollar. Currently, the yen-dollar exchange rate is hovering around 145 yen per dollar. It seems that the yen-dollar exchange rate has finally normalized.

In March 2022, the FRB ended the zero-interest-rate policy it had maintained for the past two years to curb record inflation caused by the COVID-19 pandemic and raised the policy interest rate by 0.25%. Due to rapid rate hikes that followed, the yen exchange rate hit 151 yen per dollar in October 2022, marking a historic depreciation of the yen for the first time in 32 years. At that time, Bank of Japan Governor Kuroda insisted on maintaining the zero-interest-rate, saying that a rate hike would be ineffective. This was a significant mistake, as evidenced by the yen depreciation due to the widening of interest rate differentials between Japan and the US. During this period, the yen was exploited by international speculators, leading to a further depreciation to 160 yen per dollar. As a result, for two years and five months, the Japanese government, companies, and citizens had to endure unnecessary hardships. Former Bank of Japan Governor Kuroda and the Finance Ministers should reflect deeply on this.

Meanwhile, on August 2 (Friday), the Dow Jones Industrial Average fell more than 900 dollars compared to the previous day due to concerns about a worsening US economy, leading to consecutive sharp declines. Consequently, on Monday, August 5, the Nikkei Stock Average dropped by 4,451 yen compared to the previous weekend, recording the largest drop since Black Monday on October 20, 1987. On the following day, August 6 (Tuesday), the Dow Jones Industrial Average temporarily rose more than 700 dollars, ending at 38,997.66 dollars, up 294.39 dollars (0.76%) from the previous day. On the same day, the Nikkei Stock Average also rose by 3,217 yen (10.2%) compared to the previous day, ending at 34,675 yen. This was the fourth largest increase in history. It can be speculated that current stock trading is conducted based on a programmed algorithm, leading to simultaneous selling or buying when certain thresholds are met. It seems like that, this time, it made profit-fixed selling and then repurchasing.

It should not be forgotten that Japan is an exceptionally wealthy country in the world.

1) Household financial assets amount to 2,200 trillion yen, with cash and deposits comprising 1,118 trillion yen, accounting for 51% of the total.

2) Internal reserves of listed companies exceed 550 trillion yen.

3) Overseas financial assets of Japanese companies exceed 1,500 trillion yen.

4) Foreign exchange reserves amount to approximately 1.2918 trillion dollars.

Considering model calculations, purchasing power parity, and equilibrium exchange rates, an appropriate rate for the yen-dollar exchange rate is said to be around 110 yen per dollar, so even if it becomes 120 yen per dollar, it would not be surprising.

On August 2 (Tuesday), it was decided that Kamala Harris, the Vice President of the United States, would be nominated as the presidential candidate by the Democratic Party. There is a possibility that, on November 4 (Monday), at the first time, a female will be inaugurated as the 47th President of the United States, who is also an Asian-African American. I am hopeful.

(2)Steady Recovery in U.S. Container Imports, European Struggles with EV Competition, and Continued Consumer Frugality in China

The National Retail Federation (NRF) updated its forecast for retail-related import container handling volumes at major US ports on July 9.

The forecast for July is 2.21 million TEU, an increase of 15.5% year-on-year and an upward revision of 110,000 TEU from the previous forecast.

For August, it is 2.22 million TEU, an increase of 13.5% year-on-year and an upward revision of 50,000 TEU.

For September, it is 2.10 million TEU, an increase of 3.5% year-on-year and an upward revision of 40,000 TEU.

For October, it is 2.05 million TEU, a decrease of 0.5% year-on-year and an upward revision of 40,000 TEU.

For November, it is forecasted to be 1.96 million TEU, an increase of 3.5% year-on-year.

Container movement to the United States has been steady since the beginning of this year. Inventory levels related to retail have been optimized, and restocking movements are emerging again, surpassing the same month’s results from the previous year.

According to the January-June 2024 financial results of the five major European automobile companies, including Germany’s Volkswagen (VW), net profits were all negative compared to the same period last year. The reasons cited include sluggish demand for electric vehicles (EVs) in Europe, price competition with Chinese EVs, and increased research and development costs for EVs. I hope that the Olympics and Paralympics being held in Paris, France, will be a positive factor and help improve the economy.

According to the National Bureau of Statistics of China, the Consumer Price Index (CPI) for January-June 2024 rose by 0.1% year-on-year. Energy-related prices increased, while durable goods prices fell. Consumption of meat, including pork, which is essential to Chinese tables, vegetables, fruits, automobiles, motorcycles, and smartphones all decreased compared to the same period of last year. Consumers’ frugality is still strong, indicating that it will take more time for China’s domestic economic recovery.

(3)Bad Weather Delayed Vessels; Container Freight Rates Remain High Even After Peaking

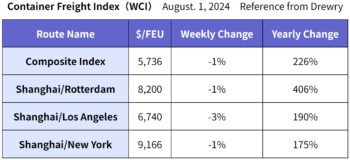

Drewry’s freight index as of August 1 is as follows:

Spot rates have peaked, but if transportation disruptions continue, freight rates are expected to remain high for the time being. Bad weather in South Africa and typhoons hitting China and Taiwan are causing delays and extended waiting times for container vessels. On the other hand, congestion at major ports in Asia is easing, which is expected to stabilize freight rates.

(4)9% of Cancelled Sailing on East-West Routes, Surplus Vessel Issue Resolved

According to Drewry’s Cancelled Sailings Tracker, between Week 32 (August 5-11) and Week 36 (September 2-8), 9% of planned sailings on East-West routes (Pacific route, Atlantic route, Asia/Europe-Mediterranean route) are scheduled to be canceled. The breakdown is 56% for eastbound Pacific routes, 15% for Asia/Europe-Mediterranean routes, and 29% for westbound Atlantic routes.

According to Drewry’s Cancelled Sailings Tracker, between Week 32 (August 5-11) and Week 36 (September 2-8), 9% of planned sailings on East-West routes (Pacific route, Atlantic route, Asia/Europe-Mediterranean route) are scheduled to be canceled. The breakdown is 56% for eastbound Pacific routes, 15% for Asia/Europe-Mediterranean routes, and 29% for westbound Atlantic routes.

The surplus vessel issue for 2024 has been resolved by rerouting via the Cape of Good Hope and adding vessels to relieve port congestion at hub ports. As a result, the financial results for the first half of 2024 (January-June) of each shipping company exceeded expectations due to high ocean freight rates. However, the second half (July-December) is expected to see a drop in cargo movement, potential freight rate declines, geopolitical issues, and other uncertainties, making the market conditions in the second half crucial.

(5)ONE’s Profit Significantly Exceeds Expectations

According to the new financial forecast by ONE, the after-tax profit for the first half (April-September 2024) is $2.245 billion, significantly exceeding the previous forecast of $800 million. The after-tax profit forecast for the second half (October 2024-March 2025) has also been revised upward from $200 million to $500 million.

(6)New Container Information for July 2024

The price of new containers in July was $2,250 per 20f. This is a $50, or 2.2%, decrease from the previous month. The total number of new containers was 851,618 TEU (Dry: 815,323 TEU, Reefer: 36,295 TEU). Compared to the previous month, the total increased by 9.7% (Dry: 9.3%, Reefer: 20.7%). The remaining number of new containers at factories was 896,988 TEU (Dry: 838,076 TEU, Reefer: 58,912 TEU). Compared to the previous month, the total increased by 17.1% (Dry: 17.6%, Reefer: 10.4%). The number of containers shipped from factories last month was 720,947 TEU (Dry: 690,209 TEU, Reefer: 30,738 TEU).

(7)Good Opportunities for Leasing Companies: Increased Container Demand due to Possible North American Port Disruptions

Container manufacturers’ production lines are fully booked through December. The price of 20f containers dropped by $50. The decrease in Chinese steel prices is the cause. It is likely that leasing companies are taking advantage of this price drop to place larger orders. This is because, with the labor contract for ports on the east coast of North America expiring at the end of September, there is a high possibility that east coast ports will go on strike from October onwards. If the east coast ports cannot be used, cargo will gather on the west coast ports, causing congestion and confusion, making it impossible for shipping companies to return empty containers to demand areas in China and Asia.

As a result, depending on the strike situation at east coast ports, shipping companies will likely hesitate to return leased containers for the time being. Consequently, leasing companies will continue to enjoy an exceptionally high container utilization rate of 98-99%.

(8)Future Prospects from a High-Rise 18th-Floor Office: Employee-Centered Management Philosophy

Starting from Monday, July 22, we have moved our office to the 18th floor of the Yokohama Creation Square, a 20-story building, approximately a 7-minute walk from Yokohama Station East Exit through the Bay Quarter. The spacious area covering half of the 18th floor, about 100 tsubo (approximately 3,300 square feet), and the view from the high floor provide a refreshing environment and improve work efficiency. We hope you will visit us when you come to this area.

As a non-listed company, we aim to be a company where employees are the main actors, sharing profits with employees if we are successful, and making them happy. We would much appreciate your continued support and patronage.

(Translated by Tokuyama)