Headlines

- 1 (1)Historical Yen Depreciation! Proposals to Save the Japanese Economy

- 2 (2)Political Trends in Europe & the U.S. and the Future of the Chinese Economy

- 3 (3)Continued Maritime Disruption due to Diversion via Cape of Good Hope! Impact Likely Until Early Next Year

- 4 (4)Port Congestion Leads to Ocean Freight Rate Increase! Cancellation Rate at 7%

- 5 (5)Emergence of the World’s Largest Container Leasing Company?

- 6 (6)New Container Information for June 2024

- 7 (7)Visit us at Our New Office! Relocation to the 18th Floor of YCS Near Yokohama Station

(1)Historical Yen Depreciation! Proposals to Save the Japanese Economy

On June 28, the qyen fell to the range of $1.00=Yen 161 against the dollar, marking the first time in 37 and a half years since December 1986. On April 29 ($1.00 = Yen 156.33) and May 2 ($1.00 = Yen 153.63), despite the interventions of Ministry of Finance spending a total of 9.7 trillion yen on yen-buying and dollar-selling, they were unable to halt the yen’s depreciation. How much further the yen needs to fall?

On June 28, the qyen fell to the range of $1.00=Yen 161 against the dollar, marking the first time in 37 and a half years since December 1986. On April 29 ($1.00 = Yen 156.33) and May 2 ($1.00 = Yen 153.63), despite the interventions of Ministry of Finance spending a total of 9.7 trillion yen on yen-buying and dollar-selling, they were unable to halt the yen’s depreciation. How much further the yen needs to fall?

As of the end of March, Japanese household financial assets increased by 7.1% year-on-year, reaching 2,199 trillion yen. Listed companies’ retained earnings exceed 550 trillion yen. As of July 5, the total market capitalization of the Tokyo Stock Exchange’s Prime Market, which includes many global companies, exceeded 1,000 trillion yen. As of the end of January 2024, Japan’s foreign exchange reserves were approximately $1.2918 trillion. Japanese companies’ overseas financial assets exceeded 1,500 trillion yen at the end of last year. Clearly, an exchange rate of $1.00 = 161 yen is abnormal.

Many people acknowledge the excessive yen depreciation. Every time Finance Minister Shunichi Suzuki repeats, “We will take resolute action without excluding any options against excessive movements.” it sounds hollow. The government, Bank of Japan, and Ministry of Finance’s inaction, avoiding responsibility and leaving things to chance, is frustrating. Perhaps it would be better to say they do not know how to stop it.

a) Request the U.S. Federal Reserve (FRB) to cut rates?

b) Decide on a temporary suspension of yen carry trades through special legislation, at least to halt yen depreciation?

c) Introduce a “repatriation tax reduction”?

In other words, if corporate taxes for Japanese companies remitting a part of over 1,500 trillion yen in overseas financial assets back home are reduced, the government can protect the public from excessive yen depreciation.

(2)Political Trends in Europe & the U.S. and the Future of the Chinese Economy

According to the U.S. Department of Labor’s employment statistics for June, released on July 5, non-farm payrolls increased by 206,000 from the previous month. The unemployment rate rose to 4.1% from 4.0% in May. Market expectations for a rate cut in September are rising due to the perceived slowdown in employment. In France, political uncertainty has receded as the possibility of far-right forces becoming the ruling party on the July 7 National Assembly elections has disappeared. In the UK, the Labour Party won more than 60% of the seats in the general election on July 4, resulting in a change of government for the first time in 14 years. In Iran, a new reformist president has been elected, raising expectations for a shift in diplomatic policy towards improving relations with the U.S. and Europe.

Meanwhile, China’s real GDP for April-June increased by 5.1% year-on-year. The Chinese government, aiming to revive its economy from the real estate slump, is implementing subsidy policies for the EV and high-tech industries, launching an export offensive with cheap mass-produced products. However, European countries and the U.S. are countering with additional tariffs for economic security reasons, raising doubts about the future development of global trade.

This year’s container movements are said to have entered the “Peak Season” earlier than usual. This is because, based on past COVID-19 experiences, European and American importers moved to import early to avoid supply chain disruptions caused by strikes and port congestion, or before additional tariffs were imposed.

(3)Continued Maritime Disruption due to Diversion via Cape of Good Hope! Impact Likely Until Early Next Year

Currently, due to the extended sailing days of the diversion via the Cape of Good Hope on European routes, strikes by port workers, truckers, and railroads in Europe and North America, bad weather, and the omission and cancelled sailing of major routes by shipping companies, the world’s major hub ports are congested, with transshipment containers stuck, disrupting the flow of the supply chain. Is this a recurrence of the COVID-19 crisis? This has led to a shortage of container ship space and containers, causing freight rates to soar. While shipping companies are ordering new containers themselves, considering the timing and location of production and container types/sizes, speculative new containers from container leasing companies are indeed a significant support for shipping companies.

Currently, due to the extended sailing days of the diversion via the Cape of Good Hope on European routes, strikes by port workers, truckers, and railroads in Europe and North America, bad weather, and the omission and cancelled sailing of major routes by shipping companies, the world’s major hub ports are congested, with transshipment containers stuck, disrupting the flow of the supply chain. Is this a recurrence of the COVID-19 crisis? This has led to a shortage of container ship space and containers, causing freight rates to soar. While shipping companies are ordering new containers themselves, considering the timing and location of production and container types/sizes, speculative new containers from container leasing companies are indeed a significant support for shipping companies.

Even if the “If Trump becomes the next president” scenario becomes a reality in the U.S. presidential election this year and the Suez Canal passage becomes possible in January 2025, restoring normalcy to European routes, it is expected that the disruption at the world’s major hub ports will continue for several months, and the impact is likely to remain until the first half of next year.

(4)Port Congestion Leads to Ocean Freight Rate Increase! Cancellation Rate at 7%

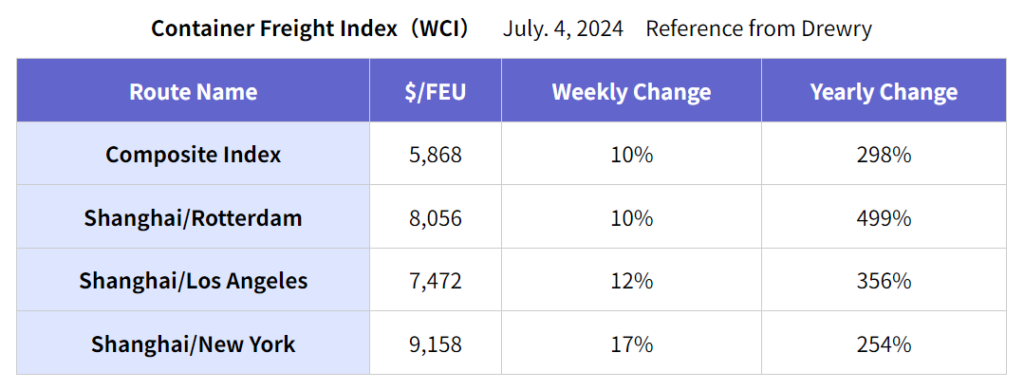

Drewry expects the freight index to rise dramatically this weekend due to port congestion at major ports in Asia. According to the company’s Cancelled Sailings Tracker, 51 voyages were canceled on east-west routes (Pacific route, Atlantic route, Asia/Europe-Mediterranean route) between week 28 (July 8-14) and week 31 (August 5-11), with a cancellation rate of 7%. The breakdown is 55% on eastbound Pacific routes, 25% on Asia/Europe-Mediterranean routes, and 20% on westbound Atlantic routes.

(5)Emergence of the World’s Largest Container Leasing Company?

In mid-June, news broke that Textainer, the world’s second-largest container leasing company, was negotiating the acquisition of Seaco, the world’s fifth-largest, with the right of first refusal. If Textainer (4.29 million TEU) acquires Seaco (2.4 million TEU), its scale will reach 6.7 million TEU, approaching Triton, the world’s largest, with 7 million TEU. If this happens, Triton and Textainer will hold over 50% of the market share, provided it does not violate any antitrust laws in each country. However, considering that the merger of Triton (2.4 million TEU) and TAL (2.4 million TEU) was approved in 2015, creating a leasing company with a scale of 4.8 million TEU, it should not be an issue. It is deemed healthier to have another company of similar scale rather than having Triton alone stand out with 7 million TEU. The selling price of Seaco is said to be over $5 billion (approximately 800 billion yen).

Remembering the time in mid-2018 when Seaco’s parent company, HNA Group, was struggling with heavy debt and Seaco was put up for sale, the Sumitomo Mitsui Group was the last company left in the acquisition race. The purchase price at that time was heard to be about 200 billion yen, but unfortunately, they abandoned the acquisition. Had the Sumitomo Mitsui Group acquired Seaco then, along with Mitsubishi HC Capital (which acquired Beacon with 1.51 million TEU in 2014 and CAI with 1.74 million TEU in 2021, managing a total of 3.26 million TEU), Japan’s two major financial capital companies might have become owners of two of the world’s largest container leasing companies.

(6)New Container Information for June 2024

In June, the price of new containers was $2,300 per 20f, up $50 or 2% from the previous month. The total number of new containers was 776,016 TEU (Dry: 745,942 TEU, Reefer: 30,074 TEU). The change from the previous month was +6.7% overall (Dry: +2.6%, Reefer: +4.5%). The remaining new containers in factories were 766,317 TEU (Dry: 712,962 TEU, Reefer: 53,355 TEU), a 1% decrease overall (Dry: +19%, Reefer: -13%).

The newly built container price seems to have stabilized, but it may still rise depending on the cargo movements from China towards the summer. The number of dry containers manufactured in the first half of the year exceeded 3 million TEU. If orders continue at this pace, it may exceed 6 million TEU. In 2021, during the COVID-19 pandemic, production exceeded 6.6 million TEU. This year could see production volumes second only to 2021 in the past decade. Container manufacturers are currently expanding production lines in their factories to meet increased production volumes.

(7)Visit us at Our New Office! Relocation to the 18th Floor of YCS Near Yokohama Station

On July 22 (Monday), we will relocate to the Yokohama Creation Square (YCS), a 20-story building, a 7-minute walk from the East North Exit of Yokohama Station, passing through the Bay Quarter. Our new office occupies half of the 18th floor, approximately 100 tsubo (330 m2) in size. With improved transportation access, we hope you will visit us when you come to Yokohama Station.

On July 22 (Monday), we will relocate to the Yokohama Creation Square (YCS), a 20-story building, a 7-minute walk from the East North Exit of Yokohama Station, passing through the Bay Quarter. Our new office occupies half of the 18th floor, approximately 100 tsubo (330 m2) in size. With improved transportation access, we hope you will visit us when you come to Yokohama Station.

(Translated by Tokuyama)