Headlines

(1) Investing in Employees Can Change a Company’s Future: It’s Time for Wage Increases!

(2) Is Achieving a Soft Landing for the US Economy Difficult? Concerns about Economic Slowdown

(3) Eurozone Economy is Recovering! Economic Impact of Paris Olympics Estimated at more than 2.56 Trillion Yen of the estimated economic effect to Japan.

(4) China Invests 64 Billion Yuan in Local Governments to Boost Economy by Encouraging EV Purchases

(5) Concerns Rise as Congestion at Singapore and Port Klang Causes Freight Rates to Soar

(6) Record Number of Newly Built Container Ships Deployment; Solution to Overcapacity Issue Lies in Cape of Good Hope

(7) Surge in Cargo Movement Due to US Retaliatory Tariffs; Container Shortage Worsens Amid Congestion at Hub Ports?

(8) Behind Subsidy Policies in China; Surplus Steel and Automobile Exports

(9) New Container Information for May 2024

(1) Investing in Employees Can Change a Company’s Future: It’s Time for Wage Increases!

Thanks to the government’s policies to strengthen corporate governance, corporate reforms have been carried out, leading to management conscious of capital costs and shareholder-first principles, attracting foreign investors. As a result, the Nikkei Stock Average surpassed the bubble era’s highest value of 38,957 yen on February 22, and, for the first time in history, exceeded 40,000 yen, closing at 40,109.23 yen on March 4.

Thanks to the government’s policies to strengthen corporate governance, corporate reforms have been carried out, leading to management conscious of capital costs and shareholder-first principles, attracting foreign investors. As a result, the Nikkei Stock Average surpassed the bubble era’s highest value of 38,957 yen on February 22, and, for the first time in history, exceeded 40,000 yen, closing at 40,109.23 yen on March 4.

The net profit of listed companies for the fiscal year ending March 2024 was 43.5 trillion yen, up 13% from the previous year, marking the highest record for the third consecutive term. The internal reserves for the fiscal year ending March 2024 were 555 trillion yen, increasing for the 11th consecutive year. This almost matches Japan’s nominal GDP of 591 trillion yen in 2023.

The total dividends of companies constituting the Tokyo Stock Price Index (TOPIX) for the fiscal year 2023 were 19 trillion yen, more than double the 8 trillion yen of ten years ago, and the dividend payout ratio rose from 26% to 36%. Additionally, share buybacks amounted to about 10 trillion yen, a fivefold increase from ten years ago. The total shareholder return ratio for the fiscal year 2023, combining dividends and share buybacks, reached 53%, with more than half of the net profit returned to shareholders. Ten years ago, in fiscal 2013, the total shareholder return ratio was around 35%.

On the other hand, the labor distribution ratio of large companies with capital of 1 billion yen or more was 38.1%, down 2.1 points from the previous year, the lowest ever recorded. The labor distribution ratio of small and medium-sized enterprises with capital of less than 100 million yen was 70.1% in the fiscal year 2023, down 1.2 points from the previous year, the lowest level since fiscal 1991. According to the industry-specific labor distribution ratio trend table created by the Ministry of Health, Labor and Welfare, since 2000, with the exception of the COVID-19 pandemic year of 2020, most industries (excluding information and communication) have been on a downward trend. The trend for all industries (excluding finance and insurance) also shows a downward trend.

The next step which Japanese companies should take is to invest in people and employees.

Here is a proposal: large companies should take the lead in raising employee salaries. Raise them to the point where employees in other countries would be envious. Not only should the overall base salary be raised, but salaries for outstanding employees should also be increased without hesitation. How about implementing an income doubling plan in the future? Motivated employees will undoubtedly strive to bring even greater profits to the company.

Remember the “National Income Doubling Plan” proposed by Prime Minister Hayato Ikeda in 1960, aiming to double the national income in ten years, achieving an average annual growth rate of 7.2% from fiscal 1961 to fiscal 1970. Subsequently, Japan’s economy achieved economic growth that exceeded the income doubling plan, becoming the world’s second-largest economy after the United States in 1968.

Of course, this cannot be done by private companies alone, so the government must also make investments to improve the working environment, creating a workplace that encourages new enthusiasm among employees, thus enhancing the company’s competitiveness and differentiation. Subcontracting companies and small and medium-sized enterprises surrounding large companies would follow this example, leading to a chain reaction of wage increases. Reflecting wage increases in prices, Japan can create a proper growth spiral.

(2) Is Achieving a Soft Landing for the US Economy Difficult? Concerns about Economic Slowdown

According to the employment statistics for May announced by the U.S. Department of Labor on the 7th, the number of non-farm payrolls increased by 272,000 from the previous month, exceeding prior expectations. The average hourly wage increased by 0.4% from the previous month. The market sees the timing of the U.S. Federal Reserve’s (FRB) interest rate cut being further delayed. The U.S. ISM Manufacturing Purchasing Managers’ Index was 48.7 in May, worsening from 49.2 in April. According to the New York Fed’s announcement on the 14th, the percentage of new credit card delinquencies in the first quarter of 2024 was 8.93%, the highest in 13 years. Mortgage rates have also exceeded 7% for 30-year fixed rates, and the sales of existing homes are declining. There is a growing sense of deceleration in personal consumption, which accounts for 70% of GDP. It is questionable whether a soft landing avoiding a recession can be achieved.

(3) Eurozone Economy is Recovering! Economic Impact of Paris Olympics Estimated at more than 2.56 Trillion Yen of the estimated economic effect to Japan.

The European Central Bank (ECB), responsible for the monetary policy of the 20 Eurozone countries, decided on June 6 to start a 0.25% interest rate cut, the first in 4 years and 9 months since September 2019, responding to slowing inflation. Switzerland in March, Sweden in May, and Canada on June 5 have already implemented interest rate cuts. Adjustments of historically high policy interest rates are emerging in countries around the world.

The real GDP of the Eurozone for the first quarter increased by 0.3% from the previous quarter, an annualized increase of 1.3%. The composite Purchasing Managers’ Index (PMI) of the Eurozone in May reached a one-year high of 52.3. The EU region is steadily gaining momentum in economic recovery.

On July 26, the Olympic and Paralympic Games will be held in Paris, France. The economic effect of the Olympics is expected to be 256 billion yen, comparable to the 2016 Rio Olympics, surpassing the 247.6 billion yen of the Tokyo Olympics. As an economic ripple effect of Japan is expected to be 256 billion yen which is the same level as Rio Olympics held in 2016 and is considered to exceed 247.6 billion yen of Tokyo Olympics. The influence is to be given significant to Europe economy.

(4) China Invests 64 Billion Yuan in Local Governments to Boost Economy by Encouraging EV Purchases

According to trade statistics released by China Customs on June 7, exports to emerging countries (ASEAN, Russia, South America, Africa) from January to May increased by 6.7% year-on-year to 45.4 billion dollars. Exports to the EU decreased by 4% year-on-year, Japan by 8%, South Korea by 5%, Australia by 6%, while the United States increased by 0.2%. Due to the strengthening of US and EU regulations against China, China is expanding its exports to emerging countries to avoid trade conflicts with the US and EU.

According to trade statistics released by China Customs on June 7, exports to emerging countries (ASEAN, Russia, South America, Africa) from January to May increased by 6.7% year-on-year to 45.4 billion dollars. Exports to the EU decreased by 4% year-on-year, Japan by 8%, South Korea by 5%, Australia by 6%, while the United States increased by 0.2%. Due to the strengthening of US and EU regulations against China, China is expanding its exports to emerging countries to avoid trade conflicts with the US and EU.

According to the manufacturing PMI for May announced by the National Bureau of Statistics of China on May 31, it was 49.5, falling below 50 for the first time in three months. Amidst the real estate recession, the Chinese government announced on June 3 that it would provide 6.44 billion yuan to local governments as funds for promoting the replacement of new energy vehicles, aiming to replace 3.78 million new energy vehicles annually. The government targets revitalizing the domestic economy, especially local economies, job measures, adjusting the oversupply of EVs, and easing trade frictions, that is a “killing two or more birds with one stone.”

(5) Concerns Rise as Congestion at Singapore and Port Klang Causes Freight Rates to Soar

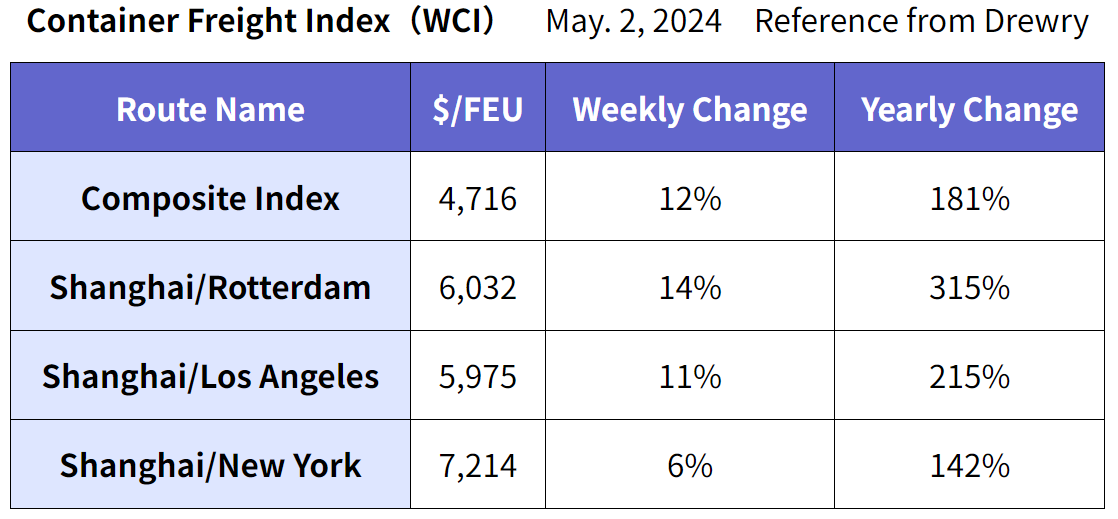

Drewry announced the Container Shipping Freight Index (WCI) on June 6.

Compared to the average level before the COVID-19 pandemic in 2019, it is about 3.3 times higher. In addition to the congestion at Singapore Port, the situation at Malaysia’s Port Klang is also deteriorating, suggesting that freight rates may remain high in the coming weeks. According to the company’s Cancelled Sailings Tracker announced on the 7th, 49 sailings were canceled on east-west routes (Pacific routes, Atlantic routes, Asia-Europe/Mediterranean routes) between week 24 (June 10-16) and week 28 (July 8-14). This corresponds to a cancellation rate of 7%.

(6) Record Number of Newly Built Container Ships Deployment; Solution to Overcapacity Issue Lies in Cape of Good Hope

Since mid-November last year, most regular shipping companies have chosen to route around the Cape of Good Hope by early 2024 due to attacks on commercial ships navigating the Red Sea and the Suez Canal by Yemen’s armed Houthi group, an important route through which 12% of world trade passes. Due to the diversion, the transportation time between Asia and Europe has increased by an average of 17 days. Meanwhile, the UK market research company Maritime Strategies (MSI) estimated that an additional 200 container ships would be needed to maintain weekly service via the Cape of Good Hope.

Since mid-November last year, most regular shipping companies have chosen to route around the Cape of Good Hope by early 2024 due to attacks on commercial ships navigating the Red Sea and the Suez Canal by Yemen’s armed Houthi group, an important route through which 12% of world trade passes. Due to the diversion, the transportation time between Asia and Europe has increased by an average of 17 days. Meanwhile, the UK market research company Maritime Strategies (MSI) estimated that an additional 200 container ships would be needed to maintain weekly service via the Cape of Good Hope.

According to European maritime research company Alphaliner, the container ship capacity deployed on Asia/Europe routes was 6.33 million TEU as of February, up 19% from the same period last year. The largest increase among shipping companies was MSC, the world’s largest container shipping company, with a 54% increase year-on-year, approximately 1.4 million TEU. The issue of excess vessels due to the record-high completion of new container ships in 2024, with 83 large ships of 15,000 TEU or more and over 1.4 million TEU completed, seems to be well resolved by the demand for container ships via the Cape of Good Hope.

(7) Surge in Cargo Movement Due to US Retaliatory Tariffs; Container Shortage Worsens Amid Congestion at Hub Ports?

Container freight rates on European routes settled around April as shipping schedules stabilized. Due to stable US consumption, shippers & consignees’ concern is North American routes which will be affected by the labor negotiations at ports on the East Coast of North America. While the Panama Canal has recovered to about 90% of its pre-August 2023 traffic levels when restrictions began, it remains a continued source of uncertainty. On May 14th, the Biden administration invoked Section 301 of the Trade Act, allowing for retaliatory tariffs against a country, China, whose behavior seen as unfair. This has spurred US cargo owners to increase pre-tax shipments. This is evident from forecasts by the National Retail Federation (NRF), predicting consistent growth in cargo volumes: a 10.7% increase to 203TEU in June, a 5.5% increase to 202TEU in July, a 7.1% increase to 210TEU in August, and a 0.5% increase to 204TEU in September, with volumes consistently exceeding 2 million TEUs.

However, congestion at hub ports has become a global issue, especially notable at the Port of Singapore. Waiting times of about three days have become usual. Port of Singapore Authority (PSA) has reactivated terminals close to urban areas in line with this issue. This congestion has led to Vessels Bunching as core route vessels have been operated at full capacity due to skipped ports and canceled sailings. The high load on hub ports is expected to further exacerbate container shortages and space constraints on container ships in the future unless this issue is resolved.

(8) Behind Subsidy Policies in China; Surplus Steel and Automobile Exports

China, which produces over half of the world’s steel demand of 8.8 billion tons, has been exporting surplus steel. Shipbuilding, containers, and chassis exports are all part of national policy, and automotive exports are no exception. China has an automotive production capacity of 40 million units, with domestic sales of 22 million units and an export capacity of 18 million units. By 2025, production of 11 million electric vehicles is expected, with the majority likely to be exported. With over 100 automotive manufacturers in China, only those that have succeeded in competition survive in overseas markets. This applies to other industries with Chinese manufacturers as well. While unfair competition with cheap products through subsidies should be restricted, we believe that competition to produce quality products is necessary.

(9) New Container Information for May 2024

The price of new container prices in May increased by about 10% from the previous month to $2,250 per 20 feet equivalent unit (FEU). The total number of new containers was 727,181 TEU (Dry: 698,412 TEU, Reefer: 28,869 TEU). Compared to the previous month, this represents an increase of 32% (Dry: +34%, Reefer: +20%). The remaining new containers at container factories was 761,451 TEU (Dry: 499,874 TEU, Reefer: 61,577 TEU), a decrease of 5% from the previous month (Dry: -6.4%, Reefer: +4%). The number of units shipped from factories in May was 768,058 TEU (Dry: 745,885 TEU, Reefer: 22,173 TEU).

The reason of the sharp increase (10% UP) in container prices is that ex-factory shipments from factories in May is very vibrant so that numbers of containers was insufficient and it needs inventory from previous months. Chinese container manufacturers have been ready to ramp up production to meet the massive demand for dry containers which will be ordered by leasing companies and/or shipping companies who have anticipated the future rise in container prices.

(Translated by Tokuyama)