Headline

1. The Bank of Japan and the Ministry of Finance cannot protect the lives of common people

2. U.S. Labor Market Heavily Affected by Immigrant Inflows

3. Positive Signs for the Eurozone Economy

4. Steady Chinese Economy, Oversupply is a New Challenge

5. Continuous Container Freight Rate Hikes and Cancelled Sailings

6. New Container Information in April 2024

7. Active Role of Speculative Leasing Containers

1.The Bank of Japan and the Ministry of Finance cannot protect the lives of common people

At 14:00 on May 8, the yen-dollar exchange rate is currently at $1.00=Yen155. It seems that the yen is gradually depreciating. We ourselves, who usually buy our lunch at the supermarket, are painfully aware that this depreciation of the yen is putting a heavy burden on the lives of common people.

At 14:00 on May 8, the yen-dollar exchange rate is currently at $1.00=Yen155. It seems that the yen is gradually depreciating. We ourselves, who usually buy our lunch at the supermarket, are painfully aware that this depreciation of the yen is putting a heavy burden on the lives of common people.

According to the latest Teikoku Databank survey, food price hikes in May 2024 will amount to 417 items, and are expected to exceed 7,000 items for the year. As price hikes due to the high cost of raw materials have resurfaced led by the weak yen, there is no doubt that the weak yen is increasing the pressure to raise prices. Under these circumstances, what was Bank of Japan Governor Ueda thinking when he said at the press conference following the April 26 Monetary Policy Meeting, “The current depreciation of the yen has not had a significant impact on the rate of price increases so far!” The market took this as a sign that he will not do an early interest rate hike, and despite during the press conference, yen selling swelled and the yen continued to weaken until it hit the $1.00=Yen160 level on April 29. I am deeply concerned that person who do not understand the current common sense of ordinary people is running the government’s policies.

The BOJ governor’s job is to implement monetary policy, but speculators pay attention to the BOJ governor’s every move, so Governor Ueda, an academic, not only explains his theories and beliefs, but as an implementer of economic policy, even if he has no intention of raising interest rates, isn’t it also necessary for him to do such tactics saying, “I’m going to raise it!, I’m going to raise it!” We cannot overlook the fact that the Yen is being used by hedge funds and other institutional investors for investment purposes any longer. It is important for the Bank of Japan and the Ministry of Finance to prevent this and protect the lives of Japanese people.

On April 29 and May 3, when the yen reached $1.00=Yen160, the weakest in 34 years, the Ministry of Finance (MOF) intervened to buy yen in the amount of 8 trillion yen on two occasions. If the yen had been bought earlier, at $1.00=Yen130, I believe that the current yen-dollar situation would have been much different. If the BOJ and MOF had shown more seriousness in protecting the yen at that time, speculators would not have been able to prey on the yen to this extent. I think we, ordinary people, would not have been troubled by the weak yen too.

Japanese companies currently have 600 trillion yen in retained earnings after tax and shareholder dividends. They are also spending a good amount on capital investment and M&A. However, Japanese companies should understand that investing in their employees will lead to higher productivity. Investing in employees ignites their spirit of challenge. I am convinced that Japan, or Japanese companies, can derive the same benefits from investing in their employees that U.S. immigrants are making the U.S. vibrant.

2.U.S. Labor Market Heavily Affected by Immigrant Inflows

The number of nonfarm payrolls in the April employment report released by the U.S. Department of Labor on May 3 increased by 175,000 from the previous month. This was below the market forecast of 240,000. The unemployment rate was 3.9%. The labor market appears to have loosened some of its tightness and is now on a softening trend. The number of job openings, which had been overheated, was 8,488,000 in March, down 3.7% from the previous month. Average hourly earnings in April rose 0.2% from the previous month, but fell short of market expectations of 0.3%. The report attributed the easing of labor shortages to the influx of immigrants, which has been increasing rapidly since 2023. It also forecasts more than 3 million immigrant arrivals in 2024. Federal Reserve Chairman Jerome Powell has denied any additional interest rate hikes, citing the decline in job openings as evidence that the current level of interest rates is having a slowing effect on the economy, and even suggested that a rate cut may be postponed. However, by the time Mr. Powell decides to lower interest rates, the soft landing of the U.S. economy may be more difficult to achieve.

3.Positive Signs for the Eurozone Economy

According to the EU statistics authority announcement on April 30, real gross regional product (GDP) for the January-March period in the eurozone, which includes 20 of the 27 member states of the European Union, increased 0.3% from the previous quarter. This exceeded the market forecast of a 0.2% month-over-month increase. Since the two preceding quarters were consecutive negative growth, it appears that European companies are recovering from the economic slump caused by the Russia’s invasion of Ukraine. By country, Germany posted positive growth of 0.2% over the previous quarter, averting recession for the first time in two quarters. France grew 0.2%, Italy grew 0.3%, and Spain grew 0.7%. The eurozone CPI growth rate in March slowed for the third consecutive month to 2.4% y/y. April was at the same level with a 2.4% y/y increase. It seems that food prices, which had been soaring due to inflationary pressures, have calmed down, so the European Central Bank’s (ECB) June interest rate cut shift seems to be in the cards.

4.Steady Chinese Economy, Oversupply is a New Challenge

China’s National Bureau of Statistics announced on April 16 that the gross domestic product (GDP) for the January-March period increased by 5.3% over the previous year. Also, the Manufacturing Purchasing Managers’ Index (PMI) released by them on April 30 was 50.4 in April. Since the PMI was 50.8 in March, it exceeded the 50, which is the borderline between favorable and unfavorable conditions, for the second consecutive month. However, while the production-led recovery of the economy seems to be going well, there are still concerns about oversupply. Industrial production in January-March increased 6.1% y/y, exceeding the growth for the full year of 2023, an increase of 4.6%. On the other hand, a major key to economic recovery is how to solve the problem of insufficient domestic demand caused by the real estate recession. As one solution, the Chinese government has announced a measure to promote the replacement of passenger cars. It will provide a subsidy of 10,000 yuan (approx. 220,000 yen) for those who replace their old passenger cars with new energy vehicles such as electric vehicles (EVs). The program aims to promote domestic sales of new energy vehicles, solve the problem of excess production capacity, and ease the problem of economic friction with other countries.

China’s National Bureau of Statistics announced on April 16 that the gross domestic product (GDP) for the January-March period increased by 5.3% over the previous year. Also, the Manufacturing Purchasing Managers’ Index (PMI) released by them on April 30 was 50.4 in April. Since the PMI was 50.8 in March, it exceeded the 50, which is the borderline between favorable and unfavorable conditions, for the second consecutive month. However, while the production-led recovery of the economy seems to be going well, there are still concerns about oversupply. Industrial production in January-March increased 6.1% y/y, exceeding the growth for the full year of 2023, an increase of 4.6%. On the other hand, a major key to economic recovery is how to solve the problem of insufficient domestic demand caused by the real estate recession. As one solution, the Chinese government has announced a measure to promote the replacement of passenger cars. It will provide a subsidy of 10,000 yuan (approx. 220,000 yen) for those who replace their old passenger cars with new energy vehicles such as electric vehicles (EVs). The program aims to promote domestic sales of new energy vehicles, solve the problem of excess production capacity, and ease the problem of economic friction with other countries.

5.Continuous Container Freight Rate Hikes and Cancelled Sailings

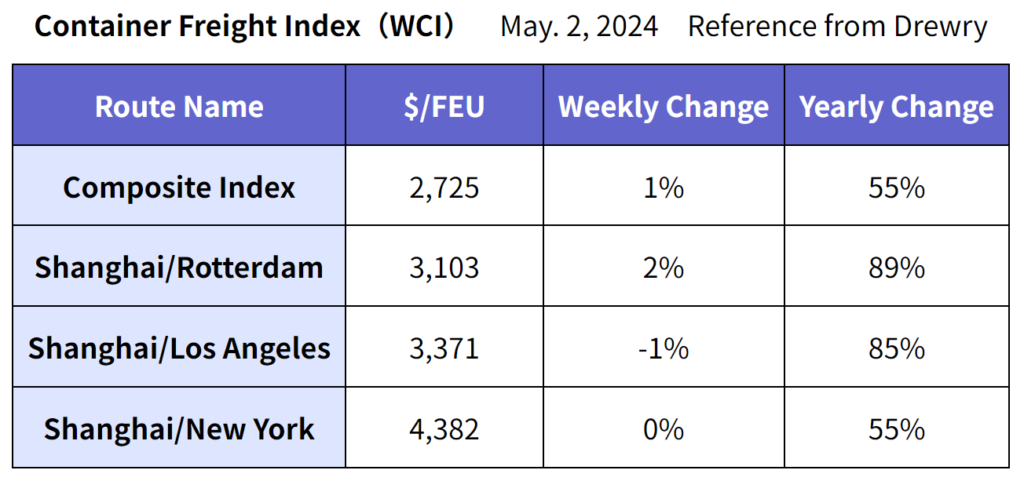

The Container Freight Index (WCI) released by Drewry on May 2 is as follows.

Drewry mentions that;

Major shipping companies are planning to raise freight rates.

(1) Asia/Europe and Mediterranean routes – FAK (Freight All Kinds) rate increase effective May 1.

2) Planning second price increase effective May 15.

Shipping companies have announced 35 cancelled sailings for the entire East-West (Pacific, Atlantic, and Asia/Europe/Mediterranean) outbound service between May 6 and June 9. The cancellation rate corresponds to 5% of the total number of cancelled sailings.

Eastbound Pacific routes account for 57%, Asia/Europe/Mediterranean routes for 29%, and westbound Atlantic routes 14%. By alliance, Ocean Alliance has 12 sailings, The Alliance has 9 sailings, 2M has 5 sailings, and Non-Alliance has 9 sailings.

The increase in exports from China and Asia toward the summer season and the shortage of empty containers on the Asian side due to reduced empty containers positioning caused by cancelled sailings and diversion of services via the Cape of Good Hope are becoming apparent.

6.New Container Information in April 2024

Newly-built container prices are $2050 per 20f, $50 or 2.5% increase. Newly-built container production was 549,270 TEU (Dry: 521,070 TEU, Reefer: 28,200 TEU).

Container factory inventories of newly-built containers at the end of April were 802,328 TEU (Dry: 747,347 TEU, Reefer: 54,981 TEU). The actual number of containers shipped from the factory was 545,636 TEU (Dry: 510,902 TEU, Reefer: 24,734 TEU). Almost the same number of Dry and more than half of Reefer were shipped from the factory during the month.

7.Active Role of Speculative Leasing Containers

In summary, ocean freight rates are expected to rise toward the summer demand season. China is trying to boost its economy by increasing manufacturing production, but it has no choice but to seek overseas markets to sell its excess inventory. On the other hand, it aligns the interest of Chinese and U.S. consumers for the U.S. Retailers Association to promote imports before the possibility of strike by the North American East Coast Longshoremen’s Association this October and the possibility of the U.S. imposing additional sanctions on Chinese goods. The situation led by the limited passages due to the water shortage in the Panama Canal and the diversions in which 95% of container vessels are forced to choose the Cape of Good Hope route due to the difficulty of passage through the Suez Canal caused by the attacks on cargo ships in the Red Sea by the Houthi rebels in Yemen may be one solution to the problem of oversupply of shipping capacity. However, it will leave shipping companies with a big problem for empty containers positioning to China and other Asian countries, where demand is high. As a result, demand for new containers may begin to increase in the second half of this year for leasing companies that have been speculatively manufacturing new containers in China. I think container utilization rates for container leasing companies will remain near 99%.

In summary, ocean freight rates are expected to rise toward the summer demand season. China is trying to boost its economy by increasing manufacturing production, but it has no choice but to seek overseas markets to sell its excess inventory. On the other hand, it aligns the interest of Chinese and U.S. consumers for the U.S. Retailers Association to promote imports before the possibility of strike by the North American East Coast Longshoremen’s Association this October and the possibility of the U.S. imposing additional sanctions on Chinese goods. The situation led by the limited passages due to the water shortage in the Panama Canal and the diversions in which 95% of container vessels are forced to choose the Cape of Good Hope route due to the difficulty of passage through the Suez Canal caused by the attacks on cargo ships in the Red Sea by the Houthi rebels in Yemen may be one solution to the problem of oversupply of shipping capacity. However, it will leave shipping companies with a big problem for empty containers positioning to China and other Asian countries, where demand is high. As a result, demand for new containers may begin to increase in the second half of this year for leasing companies that have been speculatively manufacturing new containers in China. I think container utilization rates for container leasing companies will remain near 99%.

(Translated by Mr. Masaki Nakatsu)