Headline

1. In 2023, war is slowing the recovery of global economy

1. In 2023, war is slowing the recovery of global economy

2. End of Fed rate hikes? Can the U.S. economy make a soft landing?

3. Bankruptcy of European real estate giant SIGNA causes ripples

4. Dark clouds over China’s economic recovery. Real estate recession and the huge debt problem of “Financing Platforms”.

5. Container surplus not resolved. Water drought in the Panama Canal increase operating costs.

6. Container freight rates on the rise?

7. Implications of the takeover of the two major container leasing companies

8. New Container Information in November 2023

9. 20f container manufacturing boom this year due to special demand from Russia

10. Japanese government, BOJ should aim for proper yen dollar exchange rate

11. Growth and Prospects of EFI celebrating 15th Anniversary

1. In 2023, war is slowing the recovery of global economy

With only a few weeks left in 2023, what happened in 2023?

I would say it was a year that each country in the world overcame the COVID-19 pandemic that lasted for three years from 2020 to 2022, worked to rebuild their slump industries, and strove to revive their supply chains. However, the global economy still has been some way to go. The reality is that still wars are continuing around the world.

The Russian invasion of Ukraine that began in February 2022 and the mopping-up operation by the Israeli military against the Palestinian armed group Hamas in the Middle East due to the attack by the Hamas against Israeli in October of this year are still ongoing. It has divided the world into two, and on top of that, it is causing chaos such as energy crisis, grain shortages, etc.

2. End of Fed rate hikes? Can the U.S. economy make a soft landing?

According to the November employment statistics released by the U.S. Department of Labor on December 8, the number of nonfarm payrolls increased by 199,000 from the previous month. The unemployment rate was 3.7%. The job growth was supported by the leisure and services sector, which accounts for 30% of total employment. On the other hand, the November Federal Reserve Bank economic report indicated that some firms are shrugging off the drop in demand for their products by laying off. The Federal Reserve Board (FRB) is believed to have already finished raising interest rates, and all eyes are on how the U.S. economy will make a soft landing.

The Fed lifted its zero-interest rate policy in March 2022 to combat inflation, and then raised rates for the 10 times in a year and two months, setting the rate at 5.50% in May 2023. The major countries have also followed the U.S. and responded by raising interest rates. As a result, a trend of rising prices, strikes, and wage increases followed. On the other hand, the sudden rise in interest rates has affected the cash flow of banks and other companies around the world, driving many companies into bankruptcy and causing corporate management to suffer.

3. Bankruptcy of European real estate giant SIGNA causes ripples

Real gross domestic product (GDP) in the euro area for the July-September period showed a revised quarterly growth rate of ▲0.1%, the first negative growth in three quarters. Inflation and rising interest rates are making businesses and households more economical saving. Signa Holding, which operates real estate businesses in Europe, filed for bankruptcy proceedings in an Austrian court on November 29. The company owns the Chrysler Building in New York, operates the Galeria Kaufhof, a long-established department store in Germany, and has total real estate assets reportedly in excess of 20 billion euros (approximately 3.2 trillion yen). The impact of the bankruptcy has caused ripples that may cause considerable losses to banks and insurance companies in European countries.

4. Dark clouds over China’s economic recovery. Real estate recession and the huge debt problem of “Financing Platforms”.

Global logistics is supported by supply chains. China, once known as the “world’s factory,” has not been doing so well since the end of “zero-COVID policy”. The country, that has controlled the COVID-19 pandemic more severely than any other country over the past three years, may be suffered great pain. In May 2023, the youth unemployment rate (16-24 years old) is at a record high of 20.8%, affecting about 6 million people. On top of that, the real estate-related industry, which accounts for about 30% of GNP, is in serious recession. As of June of this year, Evergrande Real Estate’s 2.2882 trillion yuan (45.764 trillion yen) and Country Garden’s 1.3642 trillion yuan (about 27.9 trillion yen), which are currently undergoing restructuring, stand out as huge debts. Meanwhile, hidden assets issued by local governments that are not included in official government statistics, or “financing platform”, have become a problem.

Global logistics is supported by supply chains. China, once known as the “world’s factory,” has not been doing so well since the end of “zero-COVID policy”. The country, that has controlled the COVID-19 pandemic more severely than any other country over the past three years, may be suffered great pain. In May 2023, the youth unemployment rate (16-24 years old) is at a record high of 20.8%, affecting about 6 million people. On top of that, the real estate-related industry, which accounts for about 30% of GNP, is in serious recession. As of June of this year, Evergrande Real Estate’s 2.2882 trillion yuan (45.764 trillion yen) and Country Garden’s 1.3642 trillion yuan (about 27.9 trillion yen), which are currently undergoing restructuring, stand out as huge debts. Meanwhile, hidden assets issued by local governments that are not included in official government statistics, or “financing platform”, have become a problem.

The IMF estimates that the official debt of local governments is 35 trillion yuan (about 700 trillion yen) and the hidden debt of “financing platform” is 56 trillion yuan (about 1,100 trillion yen), totaling 1,800 trillion yen. Therefore, it will take some time for the Chinese economy to revive.

5. Container surplus not resolved. Water drought in the Panama Canal increase operating costs.

Shipping companies were said to have 4.3 million surplus containers in North America at the end of last year. They have been returning those that can be returned to leasing companies and disposing of older containers that can be sold, but after more than a year, the surplus still remains.

Container shipping companies are considering the introduction of a surcharge in response to rising operating costs due to restrictions on the number of vessels passing through the Panama Canal due to water drought. They are switching via the Suez Canal to avoid congestion in the Panama Canal, however the Suez Canal Authority introduced a 14% value-added tax (VAT) on mooring services, etc., effective November 19. On the other hand, for return voyages from the east coast of the U.S., to avoid congestion at the destination in Asia, the alternate route via the Cape of Good Hope is also being used, although the voyage will take extra days.

6. Container freight rates on the rise?

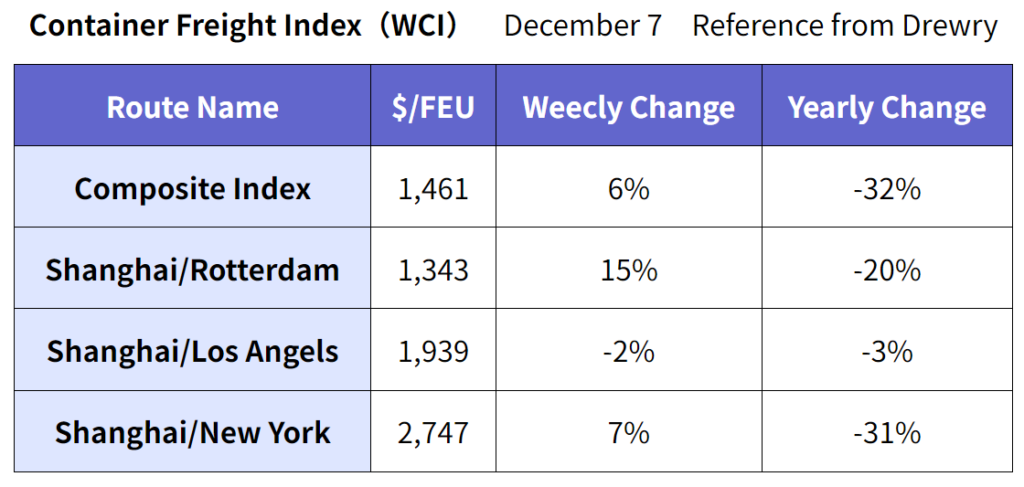

According to the Container Freight Index (WCI) released by Drewry, a UK-based shipping consultancy, on December 7, spot freight rates for vessels from Shanghai to Rotterdam and other destinations continued to increase. The increase was week-on-week in response to the freight rate hikes by container carriers as of December 1. Also, some shipping companies plan to raise rates again on December 15. As counter measures against the restriction of the number of vessels passing through the Panama Canal, there has been moves to change routes such as via the Suez Canal and via the Cape of Good Hope on routes from the east coast of North America, and impose surcharges, suggesting the possibility of higher fares in the future.

7. Implications of the takeover of the two major container leasing companies

Leasing companies are aggressively putting old containers up for sale. Perhaps as a result of this, the container utilization rate has remained high at 95-97% under the current severe conditions. This shows the strong tenacity of the leasing companies. What surprised me this year was the acquisition of two major leasing companies. In April, Triton, which boasts the world’s largest container holding (7.1 million TEUs), was acquired by Canadian investment firm Brookfield Infrastructure Corporation (BIPC), in October, Textainer, the world’s No. 2 container operator (4.4 million TEUs), was acquired by Stonepeak, a U.S. investment company. I think that this is the fact that the container leasing business is now recognized as an investment target by global investment firms.

8. New Container Information in November 2023

Newly-built container prices in November were $1,800 per 20f, down 10% or $200 from the previous month. Newly-built container production totaled 243,919 TEU (Dry: 227,684 TEU, Reefer: 16,235 TEU), up 32% or 59,800 TEU from the previous month (Dry: up 32% or 55,607 TEU, Reefer: up 35% or 4,193 TEU). Newly-built container factory inventories, 854,701 TEU (Dry: 798,438 TEU, 56,263 TEU), up 2.2% overall, or 18,790 TEU (Dry: up 1.7%, or 13,323 TEU, Reefer: up 11%, or 5,467 TEU). Overall November deliveries totaled 225,129 TEU (Dry: 214,361 TEU, Reefer: 10,768 TEU).

Annual new container production for 2023 is expected to be around 1.9 million TEUs. This is about half the size of last year’s 3.7 million TEUs.

9. 20f container manufacturing boom this year due to special demand from Russia

Around March of this year, there was an increase in exports from China to Russia, known as “special demand from Russia,” and demand for 20f containers in particular peaked in June. It is thought that 20f containers were suitable for transporting heavy cargoes. In addition, the percentage of 20f containers used worldwide is basically smaller than that of 40fHC. This is because 40fHCs are in high demand because they can carry large volumes of items at a time and are cost-effective. However, there are some weight cargoes that are suitable for 20f, and overall demand for 20f is reasonably strong. For this reason, I think it may be said that the replacement demand for 20f, which has relatively decreased this year, is strong. This year, twice as many new 20f containers are being manufactured as 40fHCs.

10. Japanese government, BOJ should aim for proper yen-dollar exchange rate

Speculation of the Bank of Japan’s lifting of negative interest rates temporarily increased the rate to the $1.00=141 yen level in the New York market on December 7. Currency exchange rates are a country’s status. In order to protect the lives of Japanese citizens and to make Japan an attractive country, we would like to request the Japanese government and the Bank of Japan to maintain the yen-dollar exchange rate at an appropriate level (target $1.00=100-120 yen).

11. Growth and Prospects of EFI celebrating 15th Anniversary

It feels like a year goes by quickly these days. We, EFI, will celebrate our 15th anniversary next March. With sales steadily increasing each year and the number of employees now exceeding 27, our current office space has become too small and we need to secure a larger space for our next leap forward. We are now in a situation that we have to consider relocation in the near future. We are deeply grateful for the warm support rendered from you all including our valuable customers and partners. We hope that we will be able to meet your expectations next year by working together as a team to provide you with even better services, prove worthy of your trust even more strongly, and make pleased you all. We do look forward to your continued guidance and encouragement.

It feels like a year goes by quickly these days. We, EFI, will celebrate our 15th anniversary next March. With sales steadily increasing each year and the number of employees now exceeding 27, our current office space has become too small and we need to secure a larger space for our next leap forward. We are now in a situation that we have to consider relocation in the near future. We are deeply grateful for the warm support rendered from you all including our valuable customers and partners. We hope that we will be able to meet your expectations next year by working together as a team to provide you with even better services, prove worthy of your trust even more strongly, and make pleased you all. We do look forward to your continued guidance and encouragement.

(Translated by Mr. Masaki Nakatsu)