China’s Overreaction to the Release of Treated Water from Nuclear Power Plants and What We Can Do Now

On August 24, TEPCO Energy Partner, Incorporated began discharging treated water that had accumulated at the Fukushima No.1 Nuclear Power Plant (F1) into the sea. On the same day, China completely suspended imports of Japanese marine products. The rationale for this suspension, however, is not convincing. This is because the International Atomic Energy Agency (IAEA) has published an investigation report stating that the discharge of TEPCO’s treated water into the ocean “meets international safety standards”. TEPCO has been diluting the treated water with seawater and discharging it from the seafloor about 1 km off the plant with a tritium concentration of less than 1,500 becquerels per liter, one-fortieth the national standard.

On August 24, TEPCO Energy Partner, Incorporated began discharging treated water that had accumulated at the Fukushima No.1 Nuclear Power Plant (F1) into the sea. On the same day, China completely suspended imports of Japanese marine products. The rationale for this suspension, however, is not convincing. This is because the International Atomic Energy Agency (IAEA) has published an investigation report stating that the discharge of TEPCO’s treated water into the ocean “meets international safety standards”. TEPCO has been diluting the treated water with seawater and discharging it from the seafloor about 1 km off the plant with a tritium concentration of less than 1,500 becquerels per liter, one-fortieth the national standard.

Tritium emissions from the Fukushima No.1 Nuclear Power Plant (F1) are limited to 22 trillion becquerels per year, which is the controlled level of emissions from the F1 before the disaster. The Qinshan Nuclear Power Plant in China’s Zhejiang Province emits about 143 trillion becquerels per year, 6.5 times more than F1. South Korea’s Wolseong Nuclear Power Plant is 3.2 times 71 trillion becquerels, Canada’s Bruce A and B reactors are 54 times 1,190 trillion becquerels, and France’s ARG reprocessing plant is 455 times 10,000 trillion becquerels. China, which opposes the project, is also discharging contaminated water containing tritium and other radionuclides from its nuclear facilities into the ocean in accordance with international standards set by the IAEA, just as Japan does. It is important that this be correctly understood about China’s overreaction to the issue of TEPCO’s discharge of treated water into the ocean. We should respond calmly. On the other hand, Japan needs to patiently and solemnly appeal to the whole world about this current situation.

In 2022, the main exporting countries and regions of Japanese marine products is China in first place with 22.5%, Hong Kong in second place with 19.5%, and the United States in third place with 13.9%, with China being the largest exporter of Japanese marine products with export value reaching 87.1 billion yen. The 87.1 billion yen in damage caused by China’s misunderstanding of the import ban can be resolved if the marine products are consumed in Japan. Why don’t we review our dietary habits by consuming more marine products at this good opportunity? Wouldn’t we be able to live healthier?

I feel that we need to work on improving of freezing and refrigeration technology of marine products, improve processing technology, add value, and expand export destinations for Japan’s safe and processed marine products.

Economic Situation in Japan, U.S., and China: Concerns that China’s Slump Will Be Prolonged

According to the U.S. Labor Department’s August employment report, the number of nonfarm payrolls increased by 187,000 from the previous month, but the number of unemployed also increased, resulting in the unemployment rate increased to 3.8%. Average hourly wage growth was 0.2% month-over-month and 4.3% year over year, a pressure to raise wages is easing. The number of corporate jobs in July was 8,827,000, about 70% of the peak. The momentum of job openings is becoming less heated than it was in 2022. If the labor market continues to calm down, I believe that there will be no need for the Fed’s Federal Open Market Committee (FOMC) to raise policy rates.

On the other hand, I feel the Japanese economy is very much in danger against the current extreme depreciation of the Yen currency of $1.00 = Yen150. “What’s wrong? Kazuo Ueda, Governor of the Bank of Japan!” I would like to ask.

China’s manufacturing purchasing managers’ index (PMI) was 49.7 in August, falling below 50 for the fifth consecutive month. In addition to the sluggish domestic real estate market, the slowdown in exports has a negative impact on the country’s economy. This is the first time since the economic slowdown caused by the U.S.-China trade war that it has been below 50 for six months until October 2019. Vanadium, a rare metal, is at its lowest level in almost nine months. The Chinese economy, which accounts for the majority of the world’s crude steel production, has begun to stagnate, and demand appears to be declining. On the other hand, oversupply has also been a drag. A prolonged economic slump in China is seen as a burden on the global economy.

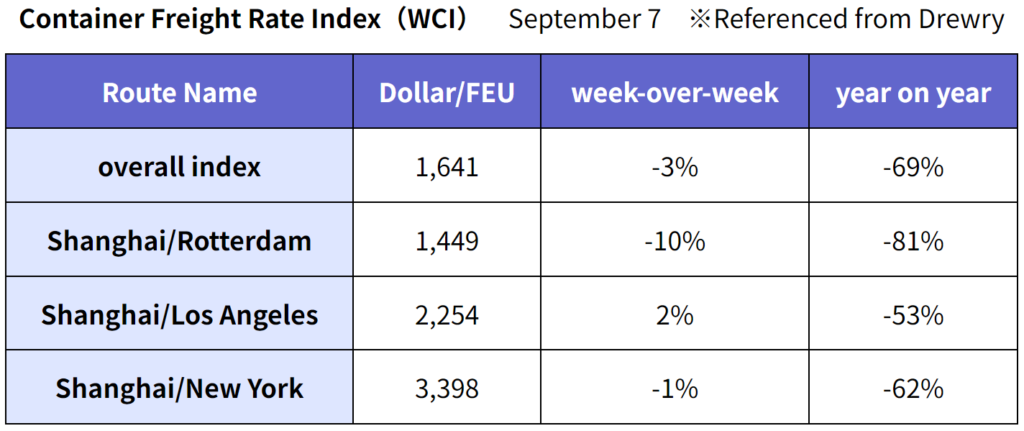

Container Freight Rates Continue to Fall but Remain Higher than before COVID-19

According to the Container Freight Index (WCI) released by Drewry on September 7, it is 84% lower than the September 2021 peak and 37% lower than the average of $2,681 over the past 10 years. However, the level is still 18% higher than the average level in 2019 before Coronavirus. Freight rate levels for each route are shown below and are expected to stabilize over the next few weeks.

ILWU Steps Up to New Agreement Amid Panama Canal Traffic Restrictions

The Panama Canal, the main artery between Asia and the east coast of North America, has been restricting vessels traffic due to water shortages caused by drought, but it does not appear to be disrupting the supply chain as feared. On August 31, the United States West Coast Longshoremen’s Union, ILWU, and the Pacific Maritime Association, PMA, entered into a new six-year agreement that will expire on July 1, 2028. The new agreement reportedly includes a 32% wage increase over six years and special bonuses totaling $70 million for all union members.

Liner Shipping Company Posts Significant Decrease in Profit; HMM Shares to be sold to one of 3 Korean Candidates

Major liner carriers’ results for the April-June period of 2023 were affected by a sharp decline in freight rates, with each company reporting a significant decrease in profits. Nevertheless, Maersk, Hapag Lloyd, COSCO, and ONE still managed to post double-digit profits in the April-June period. On the other hand, ZIM and Wan Hai fell into the red, and HMM’s profit margin was in the single digits.

Major liner carriers’ results for the April-June period of 2023 were affected by a sharp decline in freight rates, with each company reporting a significant decrease in profits. Nevertheless, Maersk, Hapag Lloyd, COSCO, and ONE still managed to post double-digit profits in the April-June period. On the other hand, ZIM and Wan Hai fell into the red, and HMM’s profit margin was in the single digits.

In response to this situation, The Korea Development Bank (KDB), the largest shareholder of Korea’s largest shipping company, HMM, and the Korea Ocean Development Corporation (KOBC) conducted a preliminary bidding for the sale of HMM shares in July. Hapag Lloyd participated in the bidding, but was ultimately eliminated as a candidate for sale. The finalists have been narrowed down to three Korean companies, and a decision is expected by the end of the year.

Shipping companies continue to carry excess inventory, and it is expected to take time for inventory adjustment. Furthermore, the recovery of cargo movement is widely anticipated to occur in the latter half of this year or next year.

ONE Celebrates 5th Anniversary and Becomes the World’s Leading Liner Shipping Company

Ocean Network Express (ONE) celebrated its 5th anniversary this April. It has been five years since they consolidated the liner divisions of three Japanese carriers and took on the mission of a specialized container liner shipping company. Influenced by the stumbling blocks of their main operating system at the start and the skyrocketing freight rates due to the logistics confusion after the COVID-19 pandemic, ONE, after experienced heavenly and hellish accomplishments, is standing itself on a different dimension from other major shipping companies who are seeking for more diversification of total logistics. I hope that ONE will demonstrate its uniqueness and aim to become the world’s leading liner shipping company among liner shipping companies. A toast to the glory of ONE with Japanese sake!

Ocean Network Express (ONE) celebrated its 5th anniversary this April. It has been five years since they consolidated the liner divisions of three Japanese carriers and took on the mission of a specialized container liner shipping company. Influenced by the stumbling blocks of their main operating system at the start and the skyrocketing freight rates due to the logistics confusion after the COVID-19 pandemic, ONE, after experienced heavenly and hellish accomplishments, is standing itself on a different dimension from other major shipping companies who are seeking for more diversification of total logistics. I hope that ONE will demonstrate its uniqueness and aim to become the world’s leading liner shipping company among liner shipping companies. A toast to the glory of ONE with Japanese sake!

New Container Information in August 2023

Newly-built containers in August totaled 203,525 TEU (Dry: 186,092 TEU, Reefer: 17,433 TEU). The number of newly built containers in factory storage was 907,820 TEU (Dry: 843,268 TEU, Reefer: 64,552 TEU), down 825 TEU from the previous month (Dry: 8,937 TEU up, Reefer: 9,762 TEU down). Newly built containers of 204,350 TEU (Dry: 177,155 TEU, Reefer: 27,195 TEU) were shipped from the factory.

Exhibited for the first time at the Seafood Show in cooperation with Thermo King, with great success

We, EFI, exhibited for the first time at the 25th Japan International Seafood & Technology EXPO held at Tokyo Big Sight from August 23 to 25 with the cooperation of Thermo King (TK). EFI is representing TK for their products in Japan. It all started one year ago when one of our staff, who is dealing with TK products, visited to the exhibition. I was a little hesitant at first, thinking that we still lack the capability, but she convinced her boss that EFI had better to exhibit next year and her enthusiasm made me decide to participate in the exhibition.

We, EFI, exhibited for the first time at the 25th Japan International Seafood & Technology EXPO held at Tokyo Big Sight from August 23 to 25 with the cooperation of Thermo King (TK). EFI is representing TK for their products in Japan. It all started one year ago when one of our staff, who is dealing with TK products, visited to the exhibition. I was a little hesitant at first, thinking that we still lack the capability, but she convinced her boss that EFI had better to exhibit next year and her enthusiasm made me decide to participate in the exhibition.

I am now glad that we did. The detailed exhibition planning by the TK staff and other related parties motivated TK and they dispatched JJ Foo, who is responsible for Sales in Asia. We sent invitation letters to our customers and the relevant parties. The preparation of the event brought all employees together, and their solidarity was a great achievement. Thanks to all parties’ support, more than 126 companies stopped by TK Booth.

According to the secretariat’s press release, the scale of the event was 600 companies and 1,300 booths, an increase of more than 30% from the previous year. Surprisingly, all exhibition spaces were sold out. Moreover, some companies from China participated, with 37 exhibitors, an increase of 13 from the previous year. The number of visitors was 23,394 over the three days, 1.24 times more than the previous year.

Thermo King Products Can Help Amid Tight Supply-Demand Conditions in Cold Storage Warehouses

Lastly, as an advertisement for Thermo King products, with China’s total ban on imports of Japanese marine products, it is obvious that there will be a shortage of freezer warehouses for storing marine products. So, the powerful Magnaum Plus, which can cool down to minus 40°C and quick-freeze, and the Super Freezer, which can cool down to minus 70°C, can be used in place of freezer warehouses. Also, Thermo King’s Generator, which can supply power where there is no power supply, remote islands, and remote areas, will be of great help.

According to Nomura Research Institute, about 90% of refrigerated warehouse businesses are small and medium-sized companies that do not have enough funds to invest in new warehouses and are using old warehouses. Approximately 34% of the nation’s refrigerated warehouses are more than 40 years old, the age at which they should be rebuilt, and have not yet been reconstructed. However, the market for refrigerated and frozen foods is growing, and supply and demand for refrigerated warehouses is expected to remain tight in the future. Why not consider using Thermo King products?

>> For more information about Thermo King