The global average temperature is the highest in recorded history. Natural factors that cannot be ignored.

We are exhausted with the extreme heat with daily highs over 35 degrees C. The temperature in Okinawa is lower than that of Sapporo, and the temperature in Singapore is lower than that of Tokyo. It is these days when we talk about recommending Okinawa and Singapore as summer place, which is not even a joke?

We are exhausted with the extreme heat with daily highs over 35 degrees C. The temperature in Okinawa is lower than that of Sapporo, and the temperature in Singapore is lower than that of Tokyo. It is these days when we talk about recommending Okinawa and Singapore as summer place, which is not even a joke?

The World Meteorological Organization (WMO) and the Copernicus Climate Change Service of the European Union (EU) are forecasting that the global average temperature for July 2023 will be the highest in recorded history. Paleoclimatologists believe that the Earth is currently in an interglacial period, between two ice ages, when the planet is at its warmest, and that this July will be the hottest in 120,000 years.

When we consider the causes of global warming, rather than CO2 emissions from fossil fuel combustion of coal and petroleum products, we cannot ignore factors that are related to nature, can we? Terrestrial and undersea volcanic activity, forest fires, coral reef bleaching phenomenon due to rising sea water temperature, decrease and death of fresh water and sea water algae, expansion of desertification, and so on. On the other hand, speaking outside of industrialization, the burps of ruminants such as cattle contain methane, a greenhouse gas produced by fermentation in the rumen, and it is said that 200 to 800 liters of methane gas are released as burps per day from one cow. Besides, there is no doubt that slash-and-burn agriculture, farmland cultivation, etc. also have an impact.

A second U.S. interest rate hike is unnecessary. A chain of corporate bankruptcies will disrupt the global economy.

According to the July employment report released by the U.S. Department of Labor on August 4, the number of nonfarm payrolls increased by 187,000 from the previous month. The unemployment rate was 3.5%, a 0.1% improvement from June. Average hourly wages rose 4.4% from the same month last year. Labor shortages are the main reason for the wage increase. Labor shortages are especially noticeable in the transportation, warehousing, and service industries, but we believe that time will solve this problem for the U.S., a country of immigrants. We believe that a second rate hike before the end of the year is unnecessary as suggested by Fed Chairman Jerome Powell. We need to stop raising interest rates as soon as possible and seriously consider lowering them. As a recent bankruptcy example, on July 31, Yellow Corporation, a long-established trucking company founded in 1929, was forced to cease operations after unsuccessfully refinancing a total of $1.3 billion in debt due in mid-2024 and other debt. U.S. real estate has 400 trillion in loans maturing in the last five years, and delinquencies and defaults on loans for office buildings are frequent in large cities across the United States. The number of properties in reserve for default is said to be increasing. I hope that Chairman Powell will not create more unnecessary bankruptcies and throw not only the U.S. economy but the world economy into turmoil.

China’s economic slump expected to linger.

China’s Manufacturing Purchasing Managers’ Index (PMI) for July 2023 has fallen below 50 for the fourth consecutive month. This is the longest since May-October 2019, when the economy slowed due to the U.S.-China trade war. The sluggish real estate market and stagnant exports appear to be weighing on the economy. On July 31, the Chinese government announced measures to stimulate consumption recovery, including easing purchase restrictions and tax incentives to boost car sales and supporting replacement with “smart appliances,” that are connected to the Internet. However, China’s economic slump is expected to be prolonged.

Japan’s YCC correction and the downgrade of US Treasuries make a strong yen adjustment a reality.

On July 28, Bank of Japan Governor Kazuo Ueda decided to implement yield curve control (YCC) and short- and long-term interest rate manipulation. The yen temporarily appreciated to less than $1.00=Yen140, but, the market saw the seriousness of the Bank of Japan, the yen weakened again, returning to $1.00=Yen143. With the Bank of Japan effectively raising the upper limit on the allowable volatility of Japan’s long-term interest rates to 1%, Japanese government bond yields are back on an upward trend, and Japanese money, the largest investor in US Treasuries outside the US, may flow out of the US to Japan, leading to a deterioration in the demand for US Treasuries. The amount of securities investments lost by Japanese investors due to the negative interest rate policy over the past 10 years amounted to 531 trillion yen at the end of 2022. Fitch Ratings, a major credit rating agency, moved to downgraded U.S. Treasuries on August 1. The rating was downgraded from “AAA” to “AA+,” one level lower than the previous rating. Although the immediate impact is unlikely, if Governor Ueda takes a serious step toward normalizing interest rates in Japan, there is no doubt that the dollar/yen exchange rate will quickly adjust to a stronger yen if Japanese investors’ investments in U.S. securities return to Japan. That is what we hope will lead to immediate policy measures to help Japan’s pensioners and vulnerable people. I would like to give a yell to Governor Ueda.

On July 28, Bank of Japan Governor Kazuo Ueda decided to implement yield curve control (YCC) and short- and long-term interest rate manipulation. The yen temporarily appreciated to less than $1.00=Yen140, but, the market saw the seriousness of the Bank of Japan, the yen weakened again, returning to $1.00=Yen143. With the Bank of Japan effectively raising the upper limit on the allowable volatility of Japan’s long-term interest rates to 1%, Japanese government bond yields are back on an upward trend, and Japanese money, the largest investor in US Treasuries outside the US, may flow out of the US to Japan, leading to a deterioration in the demand for US Treasuries. The amount of securities investments lost by Japanese investors due to the negative interest rate policy over the past 10 years amounted to 531 trillion yen at the end of 2022. Fitch Ratings, a major credit rating agency, moved to downgraded U.S. Treasuries on August 1. The rating was downgraded from “AAA” to “AA+,” one level lower than the previous rating. Although the immediate impact is unlikely, if Governor Ueda takes a serious step toward normalizing interest rates in Japan, there is no doubt that the dollar/yen exchange rate will quickly adjust to a stronger yen if Japanese investors’ investments in U.S. securities return to Japan. That is what we hope will lead to immediate policy measures to help Japan’s pensioners and vulnerable people. I would like to give a yell to Governor Ueda.

Japan Makes Great Strides in Ship Financing Market, European Banks Falling Back.

According to Petrofin Research, a Greek ship finance research firm, they report the outstanding ship financing balance at the end of 2022 for the world’s 40 largest banks engaged in ship financing declined 0.3% year-on-year to 289.39 billion dollars (about 41 trillion yen). While German and Nordic financial institutions’ balances are shrinking, Greek banks are making great strides, and Asian banks are increasing their share, and 11 Japanese banks (8 in 2021) are in the top 40, indicating that “Japan is increasing its presence in global ship finance.” The total amount of ship financing by banks worldwide is estimated at 350 billion dollars (approximately 50 trillion yen), and the total amount of ship financing including leases and the stock market is said to have reached 525 billion dollars (approximately 75 trillion yen). European banks’ share of the ship financing market fell 4.7 percentage points year-on-year to 49.5%, falling below 50% for the first time. Russia’s invasion of Ukraine has undoubtedly had an impact.

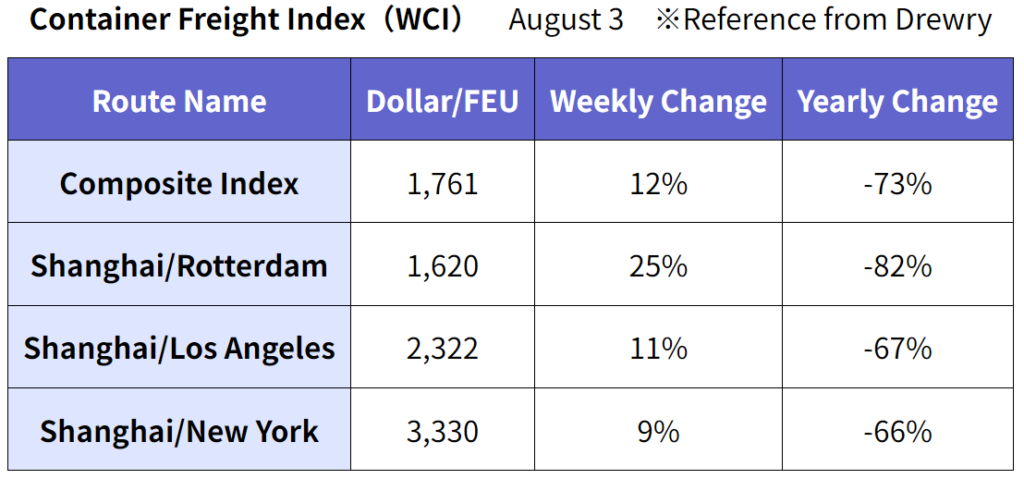

Container freight rates rise sharply from the previous week.

According to the container freight rate index WCI released by Drewry on August 3, the overall index rose sharply to $1,761.33/FEU, up 11.8% from the previous week. Freight rates from Shanghai to Rotterdam jumped sharply by 25%, marking the fifth consecutive week of increases in North American container freight rates from Shanghai and both West Coast and East Coast. This is the result of freight rate increases by major container carriers.

ONE’s performance declines, but it secures profits and its total fleet jumps to 6th place in the world.

Ocean Network Express (ONE), an integrated liner shipping company of three Japanese carriers, reported a 91% year-on-year decline in after-tax profit to $513 million (approx. 73 billion yen) for the April-June period of 2023. It is significant that ONE was able to secure a profit under the current circumstances of declining cargo demand, increasing tonnage supply, and intensifying freight rate competition. While ONE has not yet determined its full-year forecast, MOL, one of the parent companies, expects a recovery in cargo demand from the end of the year through next year, and forecasts full-year after-tax profit of $1.1 billion ($600 million in the first half and $500 million in the second half). Expectations are high for ONE, which has taken over the Liner divisions of the three Japanese carriers and is thoroughly engaged in containership business.

Alphaliner reports that as of August 7, ONE’s operating fleet totaled 213 vessels and 1,673,600 TEUs, making it the world’s sixth largest container shipping company. It also has 36 vessels with 469,768 TEUs on order. The company plans to continue to invest in new vessels at the scale of 150,000 TEUs per year every year. On the other hand, MSC’s Top position remains unchanged, occupying the number one position by far with 5,161,074 TEUs, as the company has been promoting the purchase of used vessels since 2020 and added 24,000 TEU newly built vessels in the first half of this year. It also has 117 vessels with 1,211,371 TEUs on order. As second-placed Maersk intends to maintain its ship volume for the time being, CMA-CGM, with 119 vessels and 1,220,000 TEUs on order, is expected to replace Maersk in second place in the future.

New Container Information for July 2023.

Newly-built containers in July totaled 180,546 TEU (Dry: 156421 TEU, Reefer: 24,125 TEU), up 5.1% or 8,751 TEU from the previous month (Dry: +7.6% or 11,002 TEU, Reefer: -8.5% or 2,251 TEU). Factory inventories totaled 908,645 TEU (Dry: 834,331 TEU, Reefer: 74,314 TEU), down 5.7% or 49,897 TEU from the previous month (Dry: down 4.7% or 41,525 TEU, Reefer: down 10% or 8,372 TEU). Unlike June, compared to the previous month, Dry orders increased and Reefer production decreased, and the factory inventory decreased with 5% for DRY and with 10% for Reefer by being taken out of the mills.

Reflections on war and prayers for peace. We must not allow Russia’s outrage to continue.

August is a hot month for Japan: the atomic bombings of Hiroshima and Nagasaki on August 6 and 9, respectively, and the anniversary of the end of the war on August 15. It is said that more than 240,000 people died in the atomic bombings of both cities. The Japanese people are responsible for the Pacific War and for eliminating war from the world. We cannot allow Russia, one of the five permanent members of the United Nations Security Council, to invade Ukraine by force on February 24, 2022, and still continue occupation and fighting. I believe that Russian President Vladimir Putin is highly anachronistic. He has hinted at the use of nuclear weapons, putting not only the citizens of Ukraine but also his own people in fear of death. He is a failure as a leader of Russia. World leaders are expected to eliminate war from the world and make not only their own citizens happy but also all mankind.

August is a hot month for Japan: the atomic bombings of Hiroshima and Nagasaki on August 6 and 9, respectively, and the anniversary of the end of the war on August 15. It is said that more than 240,000 people died in the atomic bombings of both cities. The Japanese people are responsible for the Pacific War and for eliminating war from the world. We cannot allow Russia, one of the five permanent members of the United Nations Security Council, to invade Ukraine by force on February 24, 2022, and still continue occupation and fighting. I believe that Russian President Vladimir Putin is highly anachronistic. He has hinted at the use of nuclear weapons, putting not only the citizens of Ukraine but also his own people in fear of death. He is a failure as a leader of Russia. World leaders are expected to eliminate war from the world and make not only their own citizens happy but also all mankind.