1.U.S. economy is driven by the service sector. Concerns for a global interest rates hike caused by Chairman Powell’s comments.

According to the June employment report released by the U.S. Department of Labor on June 7, the number of nonfarm payrolls increased by 209,000 from the previous month. The unemployment rate was 3.6%, down 0.1% from 3.7% in May. Average hourly earnings rose 0.4% from the previous month and 4.4% from a year earlier. According to the National Employment Report, employment in small and medium-sized offices and the service sector was strong. By industry, leisure and accommodation services increased by 232,000, construction by 97,000, logistics services by 90,000, natural resources and mining by 69,000, and education and health services by 74,000 respectively. On the other hand, manufacturing and information services lost 42,000 and 30,000 respectively. The U.S. economy is currently being supported by the service sector, not the manufacturing sector.

According to the June employment report released by the U.S. Department of Labor on June 7, the number of nonfarm payrolls increased by 209,000 from the previous month. The unemployment rate was 3.6%, down 0.1% from 3.7% in May. Average hourly earnings rose 0.4% from the previous month and 4.4% from a year earlier. According to the National Employment Report, employment in small and medium-sized offices and the service sector was strong. By industry, leisure and accommodation services increased by 232,000, construction by 97,000, logistics services by 90,000, natural resources and mining by 69,000, and education and health services by 74,000 respectively. On the other hand, manufacturing and information services lost 42,000 and 30,000 respectively. The U.S. economy is currently being supported by the service sector, not the manufacturing sector.

On June 28, Federal Reserve Chairman Jerome Powell stressed that he would not rule out further interest rate hikes. This has led to a race by the world’s central banks to raise interest rates. The global policy rate stood at 5.9% as of June 26. It was 5.7% during the Lehman Brothers crisis. Although the policy rate hike is intended to calm inflation, we hope that Chairman Powell will stop raising the policy rate because an excessively high interest rate will have a significant impact on the service sector.

2.Continuation of Japan’s monetary easing policy will put pressure on the lives of ordinary people.

On the other hand, the Japanese yen has depreciated against the dollar since January 2021, when it depreciated to 1 USD = 103 JPY, and is now at the 1 USD = 142 JPY level. Against the Euro, the Yen has weakened to its lowest level since May 2020 (1 EUR=115 JPY) and is currently at 1 EUR=155 JPY. This is due to the Bank of Japan Governor Kazuo Ueda’s announcement on June 16th that BOJ will maintain its massive monetary easing policy, which has been in place for 10 years under former BOJ Governor Haruhiko Kuroda, and which has not worked. How long will Japan be the only country to continue monetary easing? Such policy that has not succeeded over the past 10 years should be corrected immediately. The automobile industry, once the leader of the export industry, now imports many parts from abroad. This has increased costs, which in turn has caused the yen to depreciate, putting pressure on the lives of the common people. I believe that any policy which does not protect the lives of us common people should be corrected immediately.

3.China’s Hidden Debt Exceeds 1,100 Trillion Yen? Real estate recession worsens.

China’s economic recovery has been slow. This is because local governments are in financial difficulties. One theory says that there is a hidden debt of over 1,100 trillion yen. The real estate industry, which accounts for 30% of China’s gross domestic product (GDP), has fallen into a major slump. Excessive borrowing has been used to develop infrastructure. The huge hidden debt, which increased by 50% due to the COVID pandemic, is now dragging down China’s economic activity. The inventory level of condominiums remains high, real estate development investment is declining, demand for building materials is falling, and steel prices are falling as a result. The Chinese government is struggling to adjust crude steel production, which accounts for 50% of the world’s total. Some observers believe that crude steel production in 2023 will fall below the 1 billion tons mark for the first time in four years.

4.US Container import cargo volume forecast is expected to increase

There are some bright topics for global logistics. The National Retail Federation (NRF) has revised its outlook for import shipments since July: 1.94 million TEU in July (down 11% y/y), 2.03 million TEU in August (down 10% y/y), 1.96 million TEU in September (down 3.4% y/y), 1.97 million TEU in October (down 1.8% y/y), and 1.88 million TEU in November (up 5.9% y/y). The forecast has been revised upward since August, and November is expected to be the first month since June 2022 with a year-on-year increase.

There are some bright topics for global logistics. The National Retail Federation (NRF) has revised its outlook for import shipments since July: 1.94 million TEU in July (down 11% y/y), 2.03 million TEU in August (down 10% y/y), 1.96 million TEU in September (down 3.4% y/y), 1.97 million TEU in October (down 1.8% y/y), and 1.88 million TEU in November (up 5.9% y/y). The forecast has been revised upward since August, and November is expected to be the first month since June 2022 with a year-on-year increase.

5.Container Freight Rates Decline for Ninth Consecutive Week

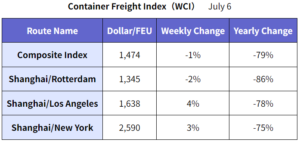

The Container Freight Index WCI, released on July 6 by Drewry, a UK-based research firm, reported that the overall index fell 1.3% week-on-week to $1,474.32/FEU, the ninth consecutive week of decline.

6.Will the slump in the shipping industry continue throughout this year?

To summarize ocean container transport, there are no signs of recovery on North American routes in July. This is probably due to the fact that inflation has cooled consumer activity and the excess inventory problem has yet to be resolved. Cargo movement on European routes has been gradually recovering since the beginning of the year, and in April, shipments from Asia to Europe increased for the second consecutive month to 1,446,000 TEU, up 12% from the previous year. Is this also related to special demand from Russia? On the other hand, cargo movement from Asian countries deeply involved with China is not strong. Shipping companies continue to return over inventory to leasing companies. Leasing companies’ depots around the world are almost fully occupied and there seems to be no room to accept additional. Both shipping lines and leasing companies are selling off old containers that are more than 10 years old at an accelerated pace. So, there is no way for shipping lines, leasing companies, container manufacturers, freight forwarders, and even freight operators in local ports but to be patient for the rest of the year.

7.Newly built Container Information for June 2023

The number of newly built containers in June was 171,795 TEU, up 3% month-over-month; Dry was 145,419 TEU, down -1% month-over-month; Reefer was 26,376 TEU, up 35% month-over-month; June production was weighted toward Reefer. Newly built container factory backlogs totaled 958,542 TEU (Dry: 875,856 TEU, Reefer: 82,686 TEU), a decrease of 45,598 TEU from last month. In all, 217,393 TEUs were shipped from the factory. The breakdown was Dry: 189,234 TEUs and Reefer: 19,159 TEUs. Dry orders showed little growth, but instead 21% of the previous month’s inventory was shipped. That is the main reason for the decrease in factory inventory this month. Unfortunately, there is no mention of newbuild prices this month.

8.What Three Remarkably Active Young Japanese Have in Common

Since there is not much bright subject about at work, I would like to offer a topic that will lighten your mood a little. It is remarkable to see Japanese young people who are active in the world. I would like to mention a few of them based on my own prejudice. First of all, there is Shohei Otani, 29 years old, who contributed to Japan’s World No. 1 victory in the World Baseball Classic (WBC) and is currently playing a major role in Major League Baseball (MLB). There has been some topics that he has equaled or surpassed MLB legend George Herman “Babe” Ruth, the original Two-way player. I look forward to seeing him in action every day. The second is 30-year-old Naoya Inoue, the former bantamweight unified champion of four boxing organizations. In June 2022, he was ranked No. 1 in Pound for Pound (PFP) by “The Ring,” the most prestigious USA boxing magazine in the world. However, in January 2023, he vacated his World Bantamweight titles of WBA Super, WBC, IBF, and WBO. Because, he has decided to move up one rank to challenge Stephen Fulton Jr. who holds two World Super Bantamweight championship belts (WBC & WBO) on July 25 at Ariake Arena, Tokyo. I believe he will surely win by KO in the early rounds. The last young man is Sota Fujii, the Japanese Chess player. At the young age of only 20, he became the second person, along with Yoshiharu Habu, to win the Seven titles this June. It is very difficult to win another title while defending the ones he holds. There are eight titles in the Japanese Chess. I think it is only a matter of time before he wins all eight titles.

Since there is not much bright subject about at work, I would like to offer a topic that will lighten your mood a little. It is remarkable to see Japanese young people who are active in the world. I would like to mention a few of them based on my own prejudice. First of all, there is Shohei Otani, 29 years old, who contributed to Japan’s World No. 1 victory in the World Baseball Classic (WBC) and is currently playing a major role in Major League Baseball (MLB). There has been some topics that he has equaled or surpassed MLB legend George Herman “Babe” Ruth, the original Two-way player. I look forward to seeing him in action every day. The second is 30-year-old Naoya Inoue, the former bantamweight unified champion of four boxing organizations. In June 2022, he was ranked No. 1 in Pound for Pound (PFP) by “The Ring,” the most prestigious USA boxing magazine in the world. However, in January 2023, he vacated his World Bantamweight titles of WBA Super, WBC, IBF, and WBO. Because, he has decided to move up one rank to challenge Stephen Fulton Jr. who holds two World Super Bantamweight championship belts (WBC & WBO) on July 25 at Ariake Arena, Tokyo. I believe he will surely win by KO in the early rounds. The last young man is Sota Fujii, the Japanese Chess player. At the young age of only 20, he became the second person, along with Yoshiharu Habu, to win the Seven titles this June. It is very difficult to win another title while defending the ones he holds. There are eight titles in the Japanese Chess. I think it is only a matter of time before he wins all eight titles.

They are all polite, respectful, not arrogant, mild-mannered, calm, and natural, and they are very friendly and considerate of others and their surroundings. They are also incredibly hardworking. And I think it is wonderful that they are stoically focused on what they do. I have never heard them speak ill of their competition. I feel great pride as a Japanese. I think they are people we can be proud of in the world. But I don’t think these three are special. Their personalities are that we Japanese have been taught to bear in mind and behave regularly.

Young people of Japan! Let’s go out into the world more and change the world into a peaceful world!