1.Strong U.S. Economy, but Uncertain Outlook

According to the May employment report released by the U.S. Department of Labor on June 2, the number of nonfarm payrolls exceeded market expectations of 190,000, up 339,000 from the previous month. The average hourly wage is up 0.3% from the previous month, and up 4.3% compared to the same month last year. However, the Federal Reserve Board (FRB) expects the U.S. economy to enter a recessionary phase in the second half of the year, for following reasons;

1) Household savings by U.S. government cash benefits for COVID-19 will bottom out and consumer spending will decline.

2) Financial institutions will be reluctant to lend money due to the impact of bank failures.

3) Companies will become more cautious about hiring.

However, when we look at the polarization of the IT industry, where some industries are cutting jobs in anticipation of declining demand, while small and medium-sized self-employed industries are unable to attract the workers they need even if they offer high wages, we can feel that the inflation is pushing wages higher and is driving the US economy in the post-COVID-19 turmoil toward a healthier direction.

Wal-Mart, famous for its motto “Everyday low price,” reported an 8% increase in sales for the February-April period, and consumer spending, which accounts for 70% of the U.S. gross domestic product (GDP), is moving toward low prices to protect its lifestyle. On the other hand, purchases of luxury goods, dining out, and traveling by wealthy U.S. consumers are on the rise. Sales of luxury brand goods are also strong. For example, French luxury brand LVMH Moet Hennessy Louis Vuitton announced its financial results for the January-March 2023 period, and the U.S. market, which accounts for 20% of the total sales, increased 8% year-on-year.

Wal-Mart, famous for its motto “Everyday low price,” reported an 8% increase in sales for the February-April period, and consumer spending, which accounts for 70% of the U.S. gross domestic product (GDP), is moving toward low prices to protect its lifestyle. On the other hand, purchases of luxury goods, dining out, and traveling by wealthy U.S. consumers are on the rise. Sales of luxury brand goods are also strong. For example, French luxury brand LVMH Moet Hennessy Louis Vuitton announced its financial results for the January-March 2023 period, and the U.S. market, which accounts for 20% of the total sales, increased 8% year-on-year.

However, the drop in demand for existing home sales, which accounts for about 90% of the U.S. housing market, due to the sharp rise in interest rates has made the future of the U.S. economy uncertain. We believe that the FRB’s high interest rate policy (5.5%) has acted to some extent as a camphor against inflation. We would like to ask FRB Chairman Powell to change the high interest rate policy soon, as further high interest rate policy could hinder not only the U.S. economy but also the global economic recovery.

The International Air Transport Association (IATA) has announced that global air passenger demand in 2023 is expected to recover to 4.3 billion, 96% of year 2019, the pre-COVID-19 level. However, operating profit is expected to be 2.8%, which is not as high as 5.2% in 2019. The company also says that the high freight rates are largely due to high labor costs.

2.Japan’s Stock Market in Frenzy, Real Wages falling for 13 Consecutive Months, and Need for Urgent Correction of Yen Depreciation.

The total net income of Japanese listed companies for March 2023 financial results increased 1% from the previous period to 39.881 trillion yen, marking the highest profit for the second consecutive year. As a result, foreign investors have been buying up Japanese stocks in the stock market since April, and the Nikkei Stock Average reached the 31,000-yen level for the first time in 33 years on May 22. The yen-dollar exchange rate in the foreign exchange market, which was in the mid-138-yen per dollar range on June 1, dropped to the mid-140-yen per dollar range on June 5.

The total net income of Japanese listed companies for March 2023 financial results increased 1% from the previous period to 39.881 trillion yen, marking the highest profit for the second consecutive year. As a result, foreign investors have been buying up Japanese stocks in the stock market since April, and the Nikkei Stock Average reached the 31,000-yen level for the first time in 33 years on May 22. The yen-dollar exchange rate in the foreign exchange market, which was in the mid-138-yen per dollar range on June 1, dropped to the mid-140-yen per dollar range on June 5.

According to Teikoku Databank, the prices of more than 3,500 items were raised in June, and another 30,000 items are scheduled to be raised in July and afterwards. According to the April Labor Survey released by the Ministry of Health, Labor and Welfare on June 6, per capita wages fell 3.0% year-on-year in real terms after taking price fluctuations into account, marking the 13th consecutive month of decline. We hope that Governor Kazuo Ueda, who took over as head of the Bank of Japan in April, will correct this yen depreciation as soon as possible. For small and medium-sized business employers, which account for 70% of the total workforce, there is no time to lose in reforming the current situation where real income is not rising.

3.Container Freight Rates in Down Trend

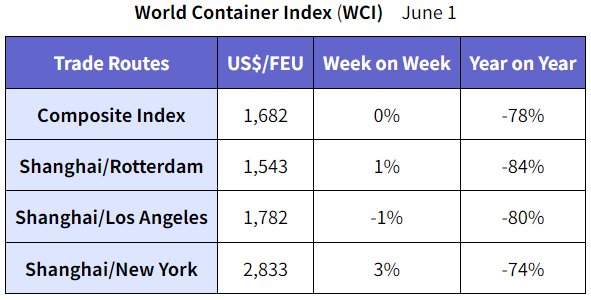

The container freight rate index published on June 1 by Drewry, a U.K. maritime consulting firm, is as follows

Drewry expects spot freight rate on East-West routes to decline further in the coming weeks.

4.Labor-Management Negotiations at U.S West Coast Ports Reached Tentative Agreement, but Wage Negotiations Struggle.

In April this year, the ILWU/PMA labor-management negotiations reached a tentative agreement, but as of June 5, several container terminals at U.S. West Coast ports continue to be closed. ILWU is requesting a $7.5 per hour wage increase each year for a contract validity period of 6 years. However, in that case, wages will be doubled in 6 years. PMA is now offering $1.56. According to them, wage increases over the past 20 years have ranged from $0.5 to $1.5 per hour. Currently, the agreement has not been reached due to the wide range in hourly wage increases. PMA fears another freight increase that occurred during COVD-19 disaster, and shipments not returning from the East Coast of North America. Shippers’ associations are calling on the Biden administration to intervene politically. We do not want to see 100+ container vessels waiting offshore at the ports of Los Angeles and Long Beach, which started in late 2020.

5.New container prices for May 2023, and questionable prices offered by container manufacturers to leasing companies.

The number of newly built containers in May was 166,372 TEU (Dry: 146,880 TEU, Reefer: 19,492 TEU), and the new container factory balance was 1,004,140 TEU (Dry: 928,671 TEU, Reefer: 75,469 TEU), up 32,092 TEU from last month. The current situation seems to be that major container manufacturers in China are forced to lay off seasonal workers due to low orders for new dry containers, and as a result, they have to stop the dry container production line and limit the number of production to make ends meet. The newbuild price has not been disclosed this month either, but it seems that container manufacturers are offering $2,300 per 20f to major leasing companies. They seem to be sending a wrong sign to leasing companies who are trying to make speculative purchases when container prices are low.

The number of newly built containers in May was 166,372 TEU (Dry: 146,880 TEU, Reefer: 19,492 TEU), and the new container factory balance was 1,004,140 TEU (Dry: 928,671 TEU, Reefer: 75,469 TEU), up 32,092 TEU from last month. The current situation seems to be that major container manufacturers in China are forced to lay off seasonal workers due to low orders for new dry containers, and as a result, they have to stop the dry container production line and limit the number of production to make ends meet. The newbuild price has not been disclosed this month either, but it seems that container manufacturers are offering $2,300 per 20f to major leasing companies. They seem to be sending a wrong sign to leasing companies who are trying to make speculative purchases when container prices are low.

6.China’s Slack Steel Market, the Change of LNG Import Might Contribute to the Global Economic Recovery.

Steel demand for construction, which accounts for more than half of China’s steel products, has been weak and the recovery in demand for real estate development has been slow. Chinese steelmakers are cutting production, but production levels remain considerably higher than domestic demand. Therefore, they are trying to stimulate demand in China, Asia, and Japan by lowering their selling prices, but the market is cooling down due to the economic slowdown caused by global monetary tightening, so their efforts would not be rewarded as expected.

China, the world’s largest importer of natural resources, has switched its LNG imports from Australia to Russia and returned to domestically produced coal, leading to lower gas prices in Asia and Europe. China’s imports have increased by more than 40% because Russian gas became cheaper as a result of sanctions that developed countries imposed on Russia. This may lead to lower global inflation and contribute to a global economic recovery.

7.Price Adjustments and Factory Inventories of Chinese Container Manufacturers

Chinese container manufacturers should follow the traditional approach of adjusting container prices based on the supply-demand balance and lower their manufacturing prices now, and offer container leasing companies the prices that match the market. In this way, we believe that some aggressive container leasing companies will surely place speculative orders in anticipation of the container market in the coming year.

It is said that 70% of the factory inventory, which currently exceeds 1 million TEU, is procured by shipping companies, with the remainder at 30%. Many of the shipping companies’ fleets are over 10 years old, and these containers are for their replacements, so when the 24,000 TEU vessels are deployed sequentially starting this year, the factory inventory will disappear in an instant and sudden demand will emerge. Shipping companies will then have no choice but to rely on speculative new containers ordered by leasing companies.

8.Expectations for Prime Minister Kishida after the G7 Hiroshima Summit

Finally, I would like to send cheers to Prime Minister Kishida. That is, he invited Ukrainian President Zelensky to the G7 Hiroshima Summit held in Hiroshima, a city that has declared the abolition of nuclear weapons, and announced a summit declaration that clearly stated the strengthening of unity to maintain an international order based on the rule of law. I am impressed that the Ministry of Foreign Affairs has hit the ground running for quite some time. I hope that Japan will contribute greatly to world peace.

Finally, I would like to send cheers to Prime Minister Kishida. That is, he invited Ukrainian President Zelensky to the G7 Hiroshima Summit held in Hiroshima, a city that has declared the abolition of nuclear weapons, and announced a summit declaration that clearly stated the strengthening of unity to maintain an international order based on the rule of law. I am impressed that the Ministry of Foreign Affairs has hit the ground running for quite some time. I hope that Japan will contribute greatly to world peace.