1.People suffering from low wages and high prices; challenges for new Bank of Japan Governor Ueda

New Governor Kazuo Ueda announced that the Bank would continue its “massive easing” program at press conference on his appointment as Bank of Japan Governor on April 10. Former Governor Kuroda’s extra-dimensional monetary easing over the past decade has caused companies to renew their retained earnings for 10 consecutive years, reaching over ¥500 trillion by 2021. Meanwhile, according to the 2020 Labor White Paper, the average Japanese salary continues to decline, falling ¥400,000 from its peak in 2018. This is due to the increase in the number of non-permanent employees. In 1999, 29% of the total number of non-permanent workers rose, rising to 38% in 2018 and remaining at 37% in 2021 with 20.64 million workers. Japanese companies seem to have become complacent with their ¥500 trillion-plus retained earnings and have lost their appetite for investment, forgetting that human investment will bring further growth.

New Governor Kazuo Ueda announced that the Bank would continue its “massive easing” program at press conference on his appointment as Bank of Japan Governor on April 10. Former Governor Kuroda’s extra-dimensional monetary easing over the past decade has caused companies to renew their retained earnings for 10 consecutive years, reaching over ¥500 trillion by 2021. Meanwhile, according to the 2020 Labor White Paper, the average Japanese salary continues to decline, falling ¥400,000 from its peak in 2018. This is due to the increase in the number of non-permanent employees. In 1999, 29% of the total number of non-permanent workers rose, rising to 38% in 2018 and remaining at 37% in 2021 with 20.64 million workers. Japanese companies seem to have become complacent with their ¥500 trillion-plus retained earnings and have lost their appetite for investment, forgetting that human investment will bring further growth.

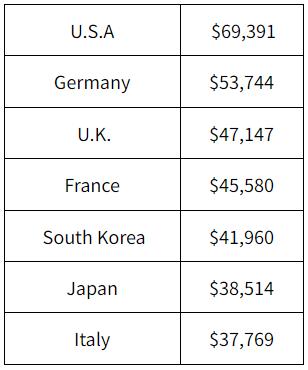

Let’s take a look at the OECD’s 2020 comparison of average wages in its member countries.

The average annual yen-dollar exchange rate in 2020 is $1.00 = 106 yen; the average annual yen-dollar exchange rate in 2022 is $1.00 = 131 yen, so the yen has weakened by 24%. Taking this into account, the current average wage in Japan is $31,164, which is the lowest of the above.

Federal Reserve Board (FRB) Chairman Jerome Powell raised the policy rate from 0.25% to 0.50% in March 2022 to combat rapid U.S. inflation. Other countries followed suit and raised interest rates to protect their currencies. Japan has maintained a zero-interest-rate policy, which has resulted in a sharp depreciation of the yen, and its citizens are now suffering from severely high domestic prices.

What was the former Bank of Japan Governor Kuroda’s decade? Hasn’t it been drowning in tricks and, in effect, weakened Japan? I hope that the new BOJ Governor, Mr. Ueda, will urgently correct the yen-dollar exchange rate, which is the symbol of the nation’s economic strength! I believe that this will have an immediate effect to protect people’s lives and is what the people, who are suffering from many tax burdens, are hoping for.

2.Market shocks from U.S. interest rate policy and disruption to the dollar economic zone

The number of nonfarm payrolls released by the U.S. Department of Labor on April 5 increased by 253,000 from the previous month, exceeding market expectations of 180,000. The unemployment rate for April was 3.4%, in line with January, when it hit a 50-year low. Average hourly earnings rose 0.5% from the previous month and 4.4% from a year earlier. Federal Reserve Board (FRB) Chairman Jerome Powell prioritized inflation control and decided to raise the policy rate by 0.25% to 5.50% since May, nipping the strength of the U.S. economy in the bud. This is the tenth rate hike in a year and two months. The rate hike was so rapid that three regional banks in the U.S. were forced into bankruptcy in less than two months: Silicon Valley Bank on March 10, Signature Bank on March 12, and First Republic Bank on May 1. It is said that social networking and financial services via the Internet accelerated the speed of deposit outflow as a factor in the bank failures. On top of that, it also affected Credit Suisse, a major Swiss financial group, which could not stop the outflow of customer funds, and its stock price plummeted on March 15, and bailed out and acquired by the Swiss financial giant USB on March 19. Under the current situation with the development of social networking sites and the Internet, Chairman Powell’s sharp interest rate policy to overcome inflation will accentuate the negative effects, only fuel anxiety, and it will not fit the reality, won’t it? I believe that the countries in the dollar economy are confused by the self-serving dictates of the United States. I think this also needs to be corrected as soon as possible. Otherwise, would it be resulted in the expansion of Chinese yuan settlements? Brazil, Argentina, and Malaysia are considering, introducing, and expanding yuan settlement, respectively.

The number of nonfarm payrolls released by the U.S. Department of Labor on April 5 increased by 253,000 from the previous month, exceeding market expectations of 180,000. The unemployment rate for April was 3.4%, in line with January, when it hit a 50-year low. Average hourly earnings rose 0.5% from the previous month and 4.4% from a year earlier. Federal Reserve Board (FRB) Chairman Jerome Powell prioritized inflation control and decided to raise the policy rate by 0.25% to 5.50% since May, nipping the strength of the U.S. economy in the bud. This is the tenth rate hike in a year and two months. The rate hike was so rapid that three regional banks in the U.S. were forced into bankruptcy in less than two months: Silicon Valley Bank on March 10, Signature Bank on March 12, and First Republic Bank on May 1. It is said that social networking and financial services via the Internet accelerated the speed of deposit outflow as a factor in the bank failures. On top of that, it also affected Credit Suisse, a major Swiss financial group, which could not stop the outflow of customer funds, and its stock price plummeted on March 15, and bailed out and acquired by the Swiss financial giant USB on March 19. Under the current situation with the development of social networking sites and the Internet, Chairman Powell’s sharp interest rate policy to overcome inflation will accentuate the negative effects, only fuel anxiety, and it will not fit the reality, won’t it? I believe that the countries in the dollar economy are confused by the self-serving dictates of the United States. I think this also needs to be corrected as soon as possible. Otherwise, would it be resulted in the expansion of Chinese yuan settlements? Brazil, Argentina, and Malaysia are considering, introducing, and expanding yuan settlement, respectively.

3.Trends in U.S. Import Cargo Volumes and the ILWU/PMA Labor-Management Negotiation Agreement

On May 8, the National Retail Federation (NRF) released its latest forecast for container import volumes at major U.S. ports. The forecast for the first half of the year (January-June) was 10.8 million TEUs, but was revised downward to 10.4 million TEUs, down 22.8% from the same period last year. The report does not see explosive demand as seen in the past two years, but says that imports will remain weak until excess inventories are resolved.

March – down 30.6% y/y to 1.62 million TEUs (up 5% from February)

April – down 23.4% y/y to 1.73 million TEUs

May – down 23.5% y/y to 1.83 million TEUs

June – down 15.9% y/y to 1.9 million TEUs

July – down 7.9% y/y to 2.01 million TEUs

August – down 9.9% y/y to 2.04 million TEUs

September – down 3.3% y/y to 1.96 million TEUs

Cumulative January-September is projected to be 178% lower than the same period last year, at approximately 16.5 million TEUs. This means that we are back to where before the COVID 19.

According to the Wall Street Journal, on April 20, the International Longshore and Warehouse Union (ILWU) announced that it had reached a tentative agreement with the Pacific Maritime Association (PMA) on the increase of workers in non-automated container terminals at the Ports of Los Angeles and Long Beach during U.S. West Coast port labor negotiations. The company reports that, through union members vote this summer, a formal new labor agreement will be issued. Cargo that had been rerouted via the U.S. East Coast and Gulf Coast in anticipation of ILWU/PMA contingencies may return to the U.S. West Coast.

4.Container freight rates stop falling?

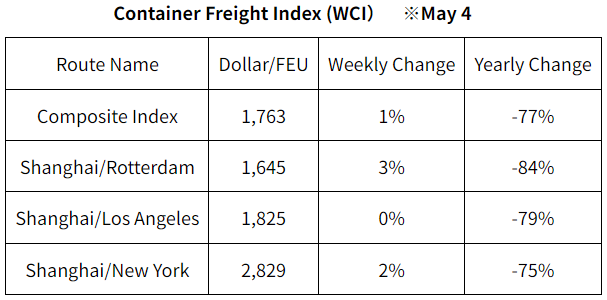

Container freight rate index was released on May 4 by Drewry, a U.K. maritime consulting firm as follows.

A sharp decline in cargo movement and freight rates occurred around the summer of 2022 on the main routes to Europe and North America. Since October, cargo movements on North American routes have declined by more than 10% year-on-year, and those on European routes have declined by more than 20% since September. You can understand how drastic the change was. The decline in consumption in Europe and the U.S., accompanied by the emergence of excess inventories at wholesalers and retailers, has led to a decrease in cargo movement, which has aggravated the recovered supply of shipping capacity. Shipping companies responded by blank sailings, but unable to halt the decline in freight rates.

5.Characteristics and Strengths of ONE’s Breakthrough

Ocean Network Express (ONE), the integrated container shipping business company of the three Japanese shipping lines, reported net sales of $29.282 billion in fiscal 2022 (April 2022-March 2023), down 3% from the previous fiscal year; after-tax income of $14.997 billion, down 10% from the previous fiscal year; and total container cargo volume of 11.081 million TEU, down 8% from the previous fiscal year. The high freight market conditions in the first half of 2022 compensated for the freight rate decline, leading to more than 2 trillion yen of profit after tax for the second consecutive year. ONE operated 209 vessels with 1,557,099 TEUs as of the end of March 2023. In addition, there are 45 newbuildings on order that will be added to the fleet in the future. ONE’s specialization in container liner shipping is characterized by its lightness of footwork: for Port to Port services, ONE is able to choose the handling agents who will provide the best service in both regions. It is free from inappropriate ties that give priority to its own affiliates. And, if they can charm shippers with the finely tuned Japanese spirit of hospitality, “OMOTENASHI”, they have a winning combination.

6.Challenges and Risks of BIPC’s Acquisition of Giant Triton

On April 12, Brookfield Infrastructure Corporation (BIPC), a subsidiary of Canada’s Brookfield Infrastructure Partners LP (BIP), announced that it will acquire Triton, the largest container leasing company. The purchase price is $85 per share (cash plus stock swap) for Triton common stock plus a 35% premium, for a total purchase price of $4.7 billion ($611 billion yen at $1.00=Yen130) and a total enterprise value of $13.3 billion (¥1,729 billion yen at $1.00=Yen130). The transaction will be completed by the end of this year and the Triton shares will be privately held. Triton is the largest container leasing company, owning and operating approximately 7.1 million TEUs. For 2022, the company achieved sales, $1.68 billion, and net income of $690 million. As for Triton management, it has gained a strong ally. But will it be a good buy for BIPC in the current situation where shipping companies are facing an overstocked container inventory problem?

On April 12, Brookfield Infrastructure Corporation (BIPC), a subsidiary of Canada’s Brookfield Infrastructure Partners LP (BIP), announced that it will acquire Triton, the largest container leasing company. The purchase price is $85 per share (cash plus stock swap) for Triton common stock plus a 35% premium, for a total purchase price of $4.7 billion ($611 billion yen at $1.00=Yen130) and a total enterprise value of $13.3 billion (¥1,729 billion yen at $1.00=Yen130). The transaction will be completed by the end of this year and the Triton shares will be privately held. Triton is the largest container leasing company, owning and operating approximately 7.1 million TEUs. For 2022, the company achieved sales, $1.68 billion, and net income of $690 million. As for Triton management, it has gained a strong ally. But will it be a good buy for BIPC in the current situation where shipping companies are facing an overstocked container inventory problem?

If the utilization rate of a leasing company that had been close to 100% were to drop by 10%, for Triton with 7.1 million TEUs, their revenue would lose 10% of its leasing revenue and, at the same time, they would have a 10% increase in unutilized depot inventory, it’s a double pain of a cost increase. That is 710,000 TEUs of depot inventory Storage Cost will be incurred worldwide. For example, if the global average daily storage cost is $0.50/TEU, the storage cost alone would be $355,000 per day, or $10.65 million for 30 days per month. If this was to continue for six months, the storage cost would be $63.9 million. You can see that this is a very risky purchase.

According to Drewry, container leasing companies own 52% of the world’s containers. The top five largest container leasing companies are as follows

7.New container prices in April 2023

New container production in April totaled 169,832 TEU (Dry: 145,119 TEU, Reefer: 24,713 TEU). Newbuild factory inventories totaled 972,048 TEU (Dry: 899,108 TEU, Reefer: 72,940 TEU), a 2% or 18,647 TEU increase over the previous month. Unfortunately, it appears that sales prices could not be finalized again this month.

Chinese steel prices have been falling since the end of 2022, hitting a five-month low in April, and with the Chinese domestic economy depression, surplus steel is finding its way into exports. From this point of view, it can be inferred that container prices have been gradually falling since March.

(Translated by Mr.Masaki Nakatsu)