According to Johns Hopkins University, more than 117 million people were infected with COVID-19 in the world, and the death toll is approaching 2.6 million. The battle against COVID-19 is not over yet. Meanwhile, the number of vaccinations in the world has increased to 306 million. As a result, the number of deaths is decreasing. According to Centers for Disease Control and Prevention (CDC), 28 million people, which is more than 8% of the population, have already been vaccinated in the United States. The average number of vaccinations in the last 7 days is about 2 million per day. It was announced that a herd immunity could be acquired by summer. It is recognized that 70-85% of the population needs to acquire immunity in order to control infection.

According to Johns Hopkins University, more than 117 million people were infected with COVID-19 in the world, and the death toll is approaching 2.6 million. The battle against COVID-19 is not over yet. Meanwhile, the number of vaccinations in the world has increased to 306 million. As a result, the number of deaths is decreasing. According to Centers for Disease Control and Prevention (CDC), 28 million people, which is more than 8% of the population, have already been vaccinated in the United States. The average number of vaccinations in the last 7 days is about 2 million per day. It was announced that a herd immunity could be acquired by summer. It is recognized that 70-85% of the population needs to acquire immunity in order to control infection.

33% of the population in the UK and about 7% in Germany have been vaccinated against COVID-19. Both countries will gradually lift the city blockade from March 8th. France banned night outs across the country in mid-December last year. Currently, about 6% of the population has completed vaccination. Vaccination will become available at pharmacies from mid-March to promote vaccination, and it is planned to lift some of the restrictions by the beginning of May. In Israel, about 60% of the population has been vaccinated. According to President Putin, about 2 million people, that is 1.3% of the Russian population, have been vaccinated twice. Also, 2 million people have been vaccinated once. In India, the number of inoculations has exceeded 20 million in total. Vaccination is progressing steadily all over the world.

The number of employees in the non-farm sector in February’s employment statistics released by the US Ministry of Labor on March 5th increased by 379,000 from the previous month. It greatly exceeded the market forecast of 170,000 people. The unemployment rate was 6.2%, an improvement of 0.1 points. However, the number of the unemployed was 9.97 million, which is 1.7 times before the COVID-19 crisis. Gross Domestic Product (GDP) recovered to 97.6% of the pre-crisis. With the additional economic measures of $1.90 trillion (about 206 trillion yen), the increase of GDP in the first quarter of 2021 is expected to be 4.8% on an annualized basis compared to the previous quarter. It is expected to increase by 5.5% in 2021 overall, the highest growth since 1984.

National Retail Federation (NRF) has announced that 2021 retail sales will exceed $4.33 trillion to $4.4 trillion. This is an increase of 6.5% to 8.2% from the previous year. It is expected to exceed the average growth rate of 4.4% in the past five years. Online sales are expected to record between $1.14 trillion and $1.19 trillion, 18-23% up from 2020. Demand that had been suppressed by the city blockade due to COVID-19 is expected to promote consumption activities by vaccination. In addition, even after things get back to normal, consumers are likely to purchase online for its convenience.

National Retail Federation (NRF) has announced January result for retail import containers and forecasts of cargo movements six months ahead.

| U.S retail import container movement | |||

| Year2021 | Forecast | Actual | Year-on-Year |

| Jan. | 2.1 M TEU | 2.06 M TEU | 13.00% |

| Feb. | 1.88 M TEU | ? | 24.40% |

| Mar. | 1.98 M TEU | ? | 44.10% |

| Apr. | 1.9 M TEU | ? | 18.20% |

| May | 1.92 M TEU | ? | 25.20% |

| Jun. | 1.92 M TEU | ? | 19.60% |

| The 1st half | 11.7 M TEU | ? | 23.30% |

According to Drewry Maritime Research, the spot Westbound freight rate for the first week of March is as follows;

To Europe

Shanghai/Rotterdam ― $8,188 per FEU, 3% or $286 down from previous week

Shanghai/Genova ― $8,505 per FEU, 1% or $106 down from previous week

To U.S.

Shanghai/Los Angeles ― $4,261 per FEU, 3% or $130 down from previous week

Shanghai/New York ― $6,651 per FEU, 0.3% or $23 up from previous week

Eastbound freight:

Rotterdam/Shanghai ― $1,402 per FEU, 1% or $16 down from previous week

Although there is a slight decline in freight, it is expected to remain stable for the time being.

Currently, long-term contract freight negotiations between shipping companies and shippers are in final stages. Considering the impacts of COVID-19, such as the long-term ship congestion due to a decrease in cargo handling capacity at major ports around the world, delays in ship schedules, port omits, cargo rollover, the difficulty to position containers to demand areas in China and Asia, continuing COVID-19 pandemic, and the serious impact the mutant virus may have on the world, it is difficult to expect that current stagnant situation of container movement may improve rapidly. Under the current situation, shippers are expected to accept the current freight level in order to stabilize the supply chain, so the freight rate is likely to remain high for a while.

Currently, long-term contract freight negotiations between shipping companies and shippers are in final stages. Considering the impacts of COVID-19, such as the long-term ship congestion due to a decrease in cargo handling capacity at major ports around the world, delays in ship schedules, port omits, cargo rollover, the difficulty to position containers to demand areas in China and Asia, continuing COVID-19 pandemic, and the serious impact the mutant virus may have on the world, it is difficult to expect that current stagnant situation of container movement may improve rapidly. Under the current situation, shippers are expected to accept the current freight level in order to stabilize the supply chain, so the freight rate is likely to remain high for a while.

Shipping lines are having a hard time about their container ships waiting offshore. Especially in port of Los Angeles, if 40 ships with the average of 14,000 TEU capacity are waiting offshore for 1 to 2 weeks, the number of containers loaded on those container ships is equivalent to the production of 1.9 months by Chinese container manufacturers. Deterioration of container turn around and non-operation period of existing container ships will put a big brake on the profits of shipping companies. On the other hand, due to the improvement of profits, shipping lines are ordering new container ships all together. 91 new vessels of 12,200 to 24,000 TEU, a total of 1,711,644 TEU slots, ordered by 12 shipping lines and investment companies will be put on the market as replacement and additional vessels in the next two to four years.

Net profit of Triton, the leader in the industry who owns 6 million TEU, was $329.78 million in 2020 (January-December), 6.7% down from the previous year. The operation ratio was 98.9%, 3.5 points up from the previous year. Textainer, which manages 3.8 million TEUs, increased its net profit by 30.3% to $73 million. The current operation ratio recorded 99.5%. Container leasing companies are generally making record high profits. However, the bad news for leasing companies is that the current container shortage and the increase in profits of shipping companies are promoting shipping lines to purchase own containers.

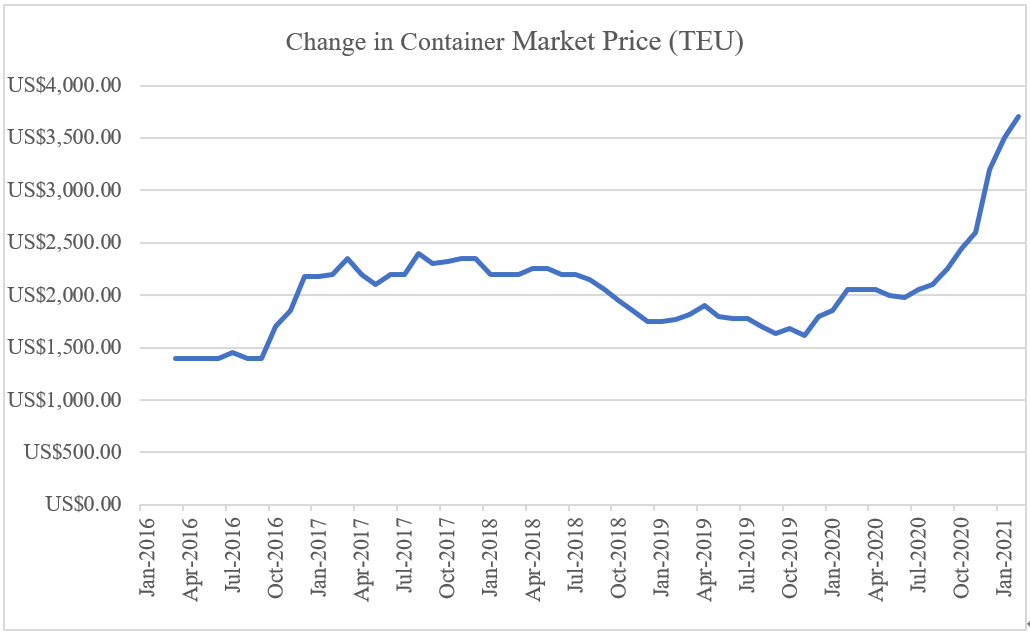

The price of new containers at the end of February was $3,700 per 20FT, 5.7% up from previous month. The factory inventory of new containers was 159,916 TEU (Dry: 112,182 TEU, Reefer: 47,734 TEU).

Chinese container manufacturers are expecting a significant increase in sales and profits in 2021. In China, container manufacturing industry as well as shipbuilding industry is an important national policy to contribute to foreign currency acquisition by exporting products using Chinese steel. While China is trying to get out of its position as the world factories, Vietnam and India announced themselves as candidate. Specifically, Vietnam’s largest steel maker, Hoa Phat Group, plans to produce 500,000 TEU annually from the second quarter of 2022 (April-June). In India, the Middle East Trans World Group plans to invest 2 billion rupees (about 2.9 billion yen) to build a container manufacturing plant in partnership with India’s state-owned Sagarmala Development Company Limited (SDCL). Its production capacity is unknown. It anticipates not only normal imports and exports but also container demand for coastal and rail transportation. Where there are export cargos, it is best to build a container factory. In the past, containers were manufactured in Japan, South Korea, Thailand, Taiwan and South Africa.

What we are concerned about the global economy is that on February 25, the yield on 10-year U.S. government bonds in the U.S. international bond market exceeded 1.5% and temporarily rose to 1.6%. The U.S. interest rates will rise as the U.S. gets on track for economic recovery. This could put a brake on stock prices and lead to a depreciation in currencies of emerging countries. There is a possibility that the prices of copper and crude oil will rise, as the demand is expected to grow.

From the aspect of economic security, the U.S. has announced that it will create a procurement system that does not depend on China. The European Union (EU) has also set a goal, aiming for a “20% share” of next-generation semiconductors to be produced in the region. In response to the U.S. semiconductor export restrictions, China will invest a total of 3,758.2 billion yuan (about 62.6 trillion yen) in research and development of AI, semiconductors, etc. by 2025, with joint efforts of public and private sectors.

One of the slogans of the Suga Cabinet is the establishment of the Digital Agency. What Japan urgently needs now is the comprehensive utilization of domestic information technology (IT), artificial intelligence (AI), and Internet of Things (IoT), which are well behind the world. The delay in digitization in government offices is noticeable. Fax was used in a part to share information on PCR test results at public health centers. In the process of receiving the special cash payments, people obtain a My Number Card and make an electronic procedure using apps in smartphones, but the local government manually matches the information with the resident’s card information in the end. The government itself does not allow the use of electronic files in parliamentary deliberation. Parliamentary debates are carried out on printed paper base in the current situation. The Suga Cabinet has just started to review the bad domestic practices of paper and seal culture, but how far has it progressed? Will the approval stamp practice in private companies still survive? It is necessary to promote the digitization in government offices and private sectors at the same time. In that respect, COVID-19 forced us to conduct Telework, and there is no doubt that we have taken a half step forward into digitization.

One of the slogans of the Suga Cabinet is the establishment of the Digital Agency. What Japan urgently needs now is the comprehensive utilization of domestic information technology (IT), artificial intelligence (AI), and Internet of Things (IoT), which are well behind the world. The delay in digitization in government offices is noticeable. Fax was used in a part to share information on PCR test results at public health centers. In the process of receiving the special cash payments, people obtain a My Number Card and make an electronic procedure using apps in smartphones, but the local government manually matches the information with the resident’s card information in the end. The government itself does not allow the use of electronic files in parliamentary deliberation. Parliamentary debates are carried out on printed paper base in the current situation. The Suga Cabinet has just started to review the bad domestic practices of paper and seal culture, but how far has it progressed? Will the approval stamp practice in private companies still survive? It is necessary to promote the digitization in government offices and private sectors at the same time. In that respect, COVID-19 forced us to conduct Telework, and there is no doubt that we have taken a half step forward into digitization.

(Translated by Ms. Chizuru Oowada)