“Too much is as bad as little.” Shipping lines and container leasing companies have run into a lot of flak from the logistics industry. The shortage of containers for export and the lack of vessel space are hot topics these days. Customers can’t export because of the lack of containers. Even if they manage to procure containers, they still can’t export because there is no space on the ships. This situation is now happening in China and Asia. Japan is no exception. Since its ocean freight is low in the first place, shipping companies have only a small allocation for Japan, and the number of shipping lines calling at Japanese ports is also limited. The reality is that export is being hampered by this limited allocation, even if freight rates are raised. On the other hand, there are few ships from Japan that go directly to Europe and North America, so cargo is transshipped once in Busan, a hub port, and then transported to Europe and the United States. It incurs extra freight and extra days compared to direct service. Maybe this situation can’t be changed, taking into consideration of the current Japan’s share of around 5%, while, in the 1970s and 1980s, exports from Japan to Europe and the U.S. accounted for 50-60% of Asia’s total.

“Too much is as bad as little.” Shipping lines and container leasing companies have run into a lot of flak from the logistics industry. The shortage of containers for export and the lack of vessel space are hot topics these days. Customers can’t export because of the lack of containers. Even if they manage to procure containers, they still can’t export because there is no space on the ships. This situation is now happening in China and Asia. Japan is no exception. Since its ocean freight is low in the first place, shipping companies have only a small allocation for Japan, and the number of shipping lines calling at Japanese ports is also limited. The reality is that export is being hampered by this limited allocation, even if freight rates are raised. On the other hand, there are few ships from Japan that go directly to Europe and North America, so cargo is transshipped once in Busan, a hub port, and then transported to Europe and the United States. It incurs extra freight and extra days compared to direct service. Maybe this situation can’t be changed, taking into consideration of the current Japan’s share of around 5%, while, in the 1970s and 1980s, exports from Japan to Europe and the U.S. accounted for 50-60% of Asia’s total.

The current shortage of containers for export would be resolved if shipping companies could return containers from export destinations to their ports of origin, i.e., demand areas. The problem is that they have not been able to do so, and there is no doubt that the COVID-19 pandemic has had a great impact. Shipping companies have SCs with shippers and provide containers (COCs) to them for the transportation of a certain amount of cargo. For this purpose, containers need to be supplied at export origin side. If containers cannot be positioned back to the demand areas, containers need to be leased in from leasing companies at the demand area. As the world’s factory, many products are exported from China. So, it makes sense to procure new containers in China. As a result, more than 95% of new containers are manufactured in China.

The shipping companies operate the containers they need (leased or owned) and provide those containers to shippers as COCs at the demand areas. Under such circumstances where the container positioning does not go well as expected, leasing companies speculatively place orders with container factories in China and start to lease out new containers that are stocked in yard to meet the demand. The leasing terms depend on the supply-demand balance. There is a big difference depending on whether it’s seller’s market and buyer’s market. In seller’s market, leasing companies try to make up for the losses they have incurred. On the other hand, if one leasing company anticipates future demand and places a large number of speculative orders, increasing the inventory on hand, and other leasing companies come up with similar ideas, and then, leasing terms will get worse due to the severe competition. Even if the shipping lines do not demand anything to leasing companies, the lease terms presented will be quite favorable to them because the leasing companies compete with each other.

Usually, Shipping companies do not bring back the same numbers of containers from the destinations to their ports of origin with cargo. This is because there is no enough cargo from the destinations. For example, if 100 containers are exported to Europe or North America, only 35 to 45 containers are returned in laden with cargo. The remaining 55 to 65 containers will have to be brought back in empty. This is why shipping companies need to set their export ocean freight factoring in the empty positioning costs from Europe and the United States to the demand area in China. However, as in the Europe trade, if shipping lines were to deploy 23,000 TEU Ultra Large Containerships and compete with each other to fill the space, freight rates would drop to the unprofitable level. This really was the situation until early spring this year. But freight rates have changed dramatically since this summer. The current freight rates of shipping companies are $4,581 per FEU from Shanghai to Rotterdam and $4,081 per FEU from Shanghai to Los Angeles. Exports from China and Asia will continue to be strong, and the shortage of space on ships is expected to continue, so the current high freight level is expected to continue. By the way, the average freight rate for the past five years is $1,503 per FEU.

In addition to a rebound from sluggish demand due to the COVID-19 pandemic, exports of consumer goods for Christmas and year-end vacation in the U.S. and Europe have increased since July. Housing in the U.S. have exceeded 1 million units since August and increased for six consecutive months to 1.53 million units in October as demand for single-family homes increased due to an increase in teleworking. As a result, demand for home furnishings also increased. Low mortgage interest rates are helping to stimulate the demand among the generations who own their homes for the first time.

As of the end of November, China’s container factories had 274,485 TEUs (Dry: 229,195 TEUs, Reefer: 45,290 TEUs) of newbuild container inventory, with a newbuild price of $2,600 per 20f. The total production by the end of 2020 is expected to exceed 2.6 million TEUs. All the remaining containers at the factories seem to have been booked by shipping companies, and the manufacturing factories have increased their production capacity to meet the demand, and the production line will be in full operation until the Chinese New Year that begins on February 12 next year. If an order is placed now, it will be manufactured after March. The price of new containers is also expected to rise to $2,700 per 20f.

The virus outbreak in the U.S. is unstoppable, with more than 200,000 people being infected per day. As a result, the state of California has issued the stay-at-home order since December 6, prohibiting commuting to work, and eating or drinking outdoors. Eighty percent of California’s population of 40 million will be affected. The economic damage is huge.

On the other hand, COVID-19 Pandemic in Europe is on its way out. The UK lifted the lockdown on Dec. 2, and started vaccination on Dec. 8. This is a messenger RNA (mRNA) vaccine manufactured by Pfizer, a major U.S. pharmaceutical company, which has an efficacy rate of over 90% in clinical trials, and it must be stored at temperatures below minus 70 degrees Celsius (℃).

Thermo King’s Super Freezer, that has over 30 years of experience, can provide such ultra-low temperatures. It has a cooling capacity down to minus 60℃, and has been used for transportation of high-grade tuna and other cargoes that require ultra-low temperatures, and traditionally has been used by major European shipping lines. Thermo King has slightly modified the current program of Super Freezer to enhance the cooling capacity to -70℃, to meet the demand for COVID-19 vaccine transportation and storage. Of course, not only the refrigeration unit but also the quality of the box was improved accordingly.

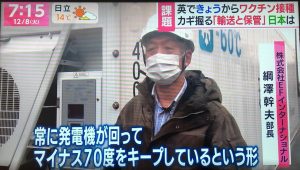

We passed this information on to various parties concerned, and TBS TV (Tokyo Broadcasting System Television, Inc.) became interested in and offered to cover the story, showing the actual Super Freezer. Luckily, Ryukyu Kaiun is operating the Super Freezer, that we sold to them, on the Tokyo/Okinawa route, so we asked them for support about the TBS’s interview, and they were very cooperative for the arrangement. On December 8 at 7:00 a.m., in the program “Asa Chan!”, in the news about the start of coronary vaccination in the U.K., a message was given to Japanese viewers that COVID-19 vaccines need to be transported and stored in frozen at ultra-low temperatures, and that Thermo King’s Super Freezer is suitable for this purpose. Until then, most of the programs I watched said that ultra-low temperature freezers at minus 70℃ were limited and that transportation and storage would be difficult, and many people wondered if the vaccine could come to Japan and be given to the people without any problems.

We passed this information on to various parties concerned, and TBS TV (Tokyo Broadcasting System Television, Inc.) became interested in and offered to cover the story, showing the actual Super Freezer. Luckily, Ryukyu Kaiun is operating the Super Freezer, that we sold to them, on the Tokyo/Okinawa route, so we asked them for support about the TBS’s interview, and they were very cooperative for the arrangement. On December 8 at 7:00 a.m., in the program “Asa Chan!”, in the news about the start of coronary vaccination in the U.K., a message was given to Japanese viewers that COVID-19 vaccines need to be transported and stored in frozen at ultra-low temperatures, and that Thermo King’s Super Freezer is suitable for this purpose. Until then, most of the programs I watched said that ultra-low temperature freezers at minus 70℃ were limited and that transportation and storage would be difficult, and many people wondered if the vaccine could come to Japan and be given to the people without any problems.

In that program, our general manager Mr. Tsunazawa made the following comment in a concise and calm manner. “Thermo King also sells a generator, so if you use it together with the Super Freezer, vaccination in places without power supply, remote areas and islands will not be a problem.” Needless to say, after the broadcast, we received more and more inquiries from various companies about Super Freezer. It is a product that can provide the same minus 60℃ as the freezer equipped on tuna fishing boats. The minimum temperature provided by ordinary freezer warehouses is minus 60℃. Super Freezer can provide that temperature anywhere as long as there is a power supply. When it is no longer needed in that place, it can be easily moved to wherever it is needed. There is nothing more convenient. Another big advantage is that it can be delivered in about three months after receiving the order. How many years does it take to build a cold storage warehouse? When the freezer warehouse is full, Super Freezer can be used as an extra storage warehouse. The fresh seafood landed by the fishery can be stored to maintain its freshness. If you do not need ultra-low temperatures down to minus 60℃, Thermo King can provide Magnum Plus, a reefer container that can maintain a temperature of minus 40℃. Its strong freezing capacity allows for rapid freezing. It is especially useful for maintaining freezing in high temperature areas just below the equator. Magnum Plus is the best choice for transporting ice cream. It not only has a high freezing capacity, but also it can realize extremely delicate control of temperatures in chilled mode. It was released in market in 2009 and has just passed 10 years, so it is not in the used market yet, and unfortunately it is still not so popular. It has a simple structure with few malfunctions, and we are confident that its cost effectiveness will be sufficient to convince you to buy it for use over 10 years.

I would like to thank TBS TV for providing us with the opportunity to promote our Super Freezer-70℃, which is suitable for transporting and storing COVID-19 vaccines, Ryukyu Kaiun and its affiliates for generously providing Super Freezer under their operation, and the depot operator for providing the filming location and equipment.

(Translated by Ms. Chizuru Oowada)