April is an opening of the new school term of the schools in Japan and at the same time it is a start month of finding employment of the school-leaver. Therefore, the commuter train of this time comes to have more intense condition with many passengers.

It is a special feature of season in Japan that gives poetic charm that the congestion of the train by a new pupil and recruit toward the downtown area at commuter rush time of the morning. A station employee pushed the buttocks of the passenger to pack them into a train at a main station in old days. No more buttocks pusher but the hell of situation to the commuters is unchanged now. The fiscal year of approximately 70% of the listed companies in Japan start from April. April is some new challenge month for us in this sense. It is meaningful that we start in life with full of hope in a comfortable soft spring breeze when the flower of the Japanese symbol of the nation, a cherry tree are in full glory.

Ocean Network Express (ONE) formally started on April 1. Japanese 3 shipping lines operated the liner business independently and they integrated their liner business into ONE as the liner specialized company with the investment ration of

38% by NYK, 31% by MOL, 31% by K Line. ONE has 140 containerships with the operation scale of 1.46 million TEU, No. 6 ranking with 7% share of the world to cover over 200 ports in 85 service routes. 3 Japanese shipping lines had been endeavoring to sharpen their competition power and cost cut respectively so that I believe that ONE could pursue the scale merit more by integrating the liner business of 3 parent companies.

ONE anticipates the saving of 110 billion yen a year by integration effect such as the intensive number of staff and office in the world, the unification of terminal in the world and railway network in North America and so on. I really wish ONE to be the shipping line that is endowed with all good advantages of each parent company used to have.

There are 7 shipping lines including ONE, the integration company of the liner section of 3 Japanese companies who operate more than 1 million TEU in the world and hold over 90% share of the world market and the oligopoly is proceeding in the market.

The business results of the Chinese container maker have been improving.

Limiting to the container production of CIMC in 2017 in the largest in the world (CIMC produce other than container production) CIMC sales is $4,200 million, 2.2 times compared with the previous year, last profit is 4 times to $240 million comparing with the previous year, the number of dry container production is 1,308,900TEU and reefer container is 30% up to 109,100TEU. Singamas is the 2nd largest with sales amount of $1,476,670,000, 61% up compared with the last year. The black figure is $43.44 million.

Container production increase 31.6% to 715,733TEU compared with a year ago. They foresee similar demand increase this year. Chinese container maker account for more than 95% of the world container. The new container price is $2,200 per 20f as for the end of March and new container stock in the factory is 780,000TEU.

The achievements in 2017 of Textainer, No. 2nd largest is the number of operating containers is 3,280,000TEU, up 4.4% from a year ago, the sales amount is $444,900,000 falling 1.1% from a year ago. Operating income is 450% up to $143,900,000, the profit and loss changed to the black of $19,400,000 from a deficit of $52,800,000 comparing with the year ago. They expect lease demand expansion in 2018 because of strong cargo movement. Triton proud of world’s largest number of the container operation, 5 million TEU acquired 800,000TEU at single age of 2017.They seem to have supplied under L/T and as seller’s market they seem to be successful in obtaining the condition for most of containers to be returned in Asia after expired L/T. Reflecting lack of container in the 2nd hand market their selling prices have been rising to the half price of their original buying price. The income and expenditure of the major lease company is greatly improved sequentially.

Shipping Guide quotes Drewry freight index. According to it, the effectiveness of the spot rate from April 1 seemed to force the freight rate from Shanghai to New York raising $ 335 (17% up) to $2,354 per FEU and the rate from Shanghai to Los Angels largely rose $ 185 (18% up) to $ 1,230 per FEU rose. On the other hand, on account of the delivery of 2/3 of the new mega ships to concentrate on the first quarter (Jan – March) the freight rate from Shanghai to Rotterdam fell $190 (14% down) to $1,201 per FEU. The Pacific freight rate seems to become weak under the influence. Is the market still think that it is many for 7 shipping companies to dominate 90% of the market? Or does the sales team of the battle front consider it best to continue sterile freight competition, not to learn lesson from as ever? Until when you continue to pulling the cart before the horse like you waste the profit which could be originally earned and you give priority to old-fashioned business which you merely fill up the space of the huge containership to attain reducing the cost per ship. I think that a major shipping line stop solicitation of cargo less than certain level of the freight rate the freight recovery could be easily attained. Does the space come first? Profit is important? It is necessary for the major shipping lines to consider this proposition seriously.

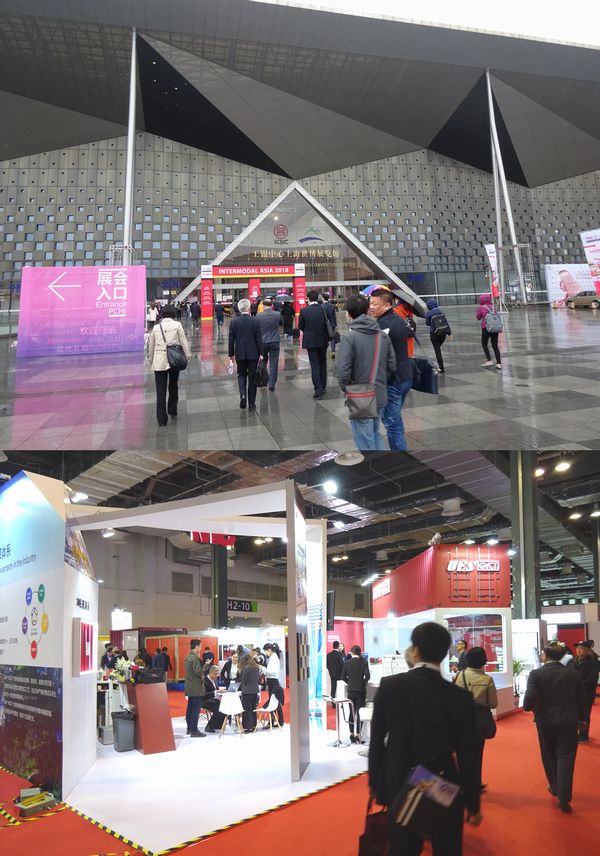

I participated in the Intermodal show held in Shanghai from March 19 (Mon) to 22(Thu). EFI sent the big delegation of total 4 people including me. It was because 4 companies we have undertaken the agency business have the own booth respectively there.

I participated in the Intermodal show held in Shanghai from March 19 (Mon) to 22(Thu). EFI sent the big delegation of total 4 people including me. It was because 4 companies we have undertaken the agency business have the own booth respectively there.

Future Box Corporation

Kukdong MES/JJ MES

Thermo King

UES International (HK) Holdings Ltd.

(alphabetical order)

Intermodal Show of this year seemed to lack vigor generally and I felt that a scale became small. Is it related with a number of shipping line and a lease company decreasing by unification and merger? However, I could realize every year that necessity, many purpose and practical use for the 2nd hand container as well as the new container have been stronger and strong. On the other hand, I want our staff to go abroad for business trip as much as possible. I want to get our excellent staff attend Intermodal show held in Asia (Shanghai) once a year as a big exhibition if possible. I want them to feel the true atmosphere of the exhibition of a supplier doing about container work. I want them to directly meet the people in charge of the container maker, a leasing company and various companies which they usually exchanges emails. Furthermore, I want them to deepen a human connection and want them to be interested in the profundity of the container. And I want them to aim at establish the higher dimensional business relationship with people. The thing which is insufficient for us now is to utilize more trendy IT and to directly meet people regardless of the domestic or foreign country same as before and then I am convinced that it is important to establish the excellent relationship with the excellent people based on friendly rivalry.